[embedded content] Published: Wednesday October 11 2017The 4th Pictet Entrepreneurs Summit held in Geneva in September 2017 brought together an exclusive group of 60 entrepreneurs and investors with a passion for innovation. On day one the focus was on the future of cities, food, agriculture, health and living in a secure world, while on day two the discussions centred on the topics of success, personal wealth and responsibility.

Read More »Pictet – The Entrepreneurs, Geneva (Abridged version)

The 4th edition of the Pictet Entrepreneurs held in Geneva in September 2017 brought together an exclusive group of 60 entrepreneurs and investors with a passion for innovation. On day one the focus was on the future of cities, food, agriculture, health and living in a secure world. On day two, the discussions centered around success, personal wealth and responsibility. http://perspectives.pictet.com/

Read More »Pictet – The Entrepreneurs, Geneva (Full version)

The 4th Pictet Entrepreneurs Summit held in Geneva in September 2017 brought together an exclusive group of 60 entrepreneurs and investors with a passion for innovation. On day one the focus was on the future of cities, food, agriculture, health and living in a secure world, while on day two the discussions centred on the topics of success, personal wealth and responsibility. http://perspectives.pictet.com

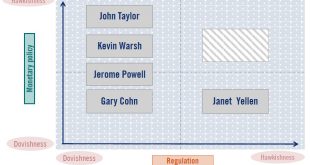

Read More »New Fed Chair—Change or Continuity?

Markets are speculating about the potential hawkishness of the Fed’s next chairperson, but we doubt there will be any ‘regime change’ in monetary policy.The Trump White House has reportedly narrowed the list of candidates for the role of Fed Chair to five people, and a decision could be announced in the coming days.The initial market reaction could be guided by the perceived hawkishness of any nominee compared with Janet Yellen. John Taylor and Kevin Warsh are perhaps the most hawkish of the...

Read More »House View, October 2017

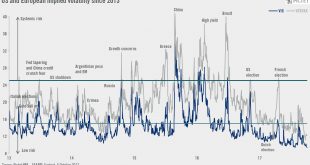

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains...

Read More »"行車糾紛"計程車突然變換車道!差點導致後方騎士煞車不及!(汽車駕駛神回覆)

昨日行經南港路 後方計程車因不滿我停在機車停等區後方 所以故意靠靠很近的從我右側鑽車過去 之後又剪我線導致我急煞 汽車違規部分我已剪舉!!

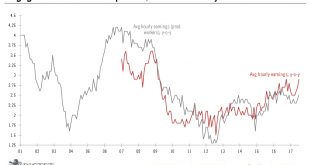

Read More »Underlying momentum in US employment remains intact

After a jobs report seriously distorted by extreme weather, the Fed remains on track to raise rates again in December.Nonfarm payrolls fell 33,000 in September, with data affected by hurricanes in the southern US. These aside, labour market signals – especially when looking at the household survey – remain solid. After a drop of 74,000 in August, employment rose 906,000 in the household survey, leading to a sharp fall in unemployment to 4.2%, the lowest rate since February 2001.The bottom...

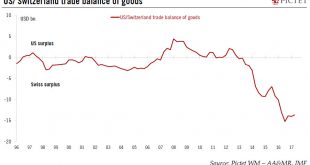

Read More »Switzerland not far from being deemed a ‘currency manipulator’ by the US

Switzerland fulfils two of the three criteria required to be considered a currency manipulator by the US, but it is unlikely to affect the SNB’s monetary policy stance.In the next few days, the U.S Department of Treasury will publish its semi-annual report on International Economic and Exchange Rate Policies. Switzerland is one of six countries on the department’s monitoring list, as it meets two of the three conditions established by the US Treasury to be deemed a ‘currency manipulator’....

Read More »Nine years on, the bull has some room to run

[embedded content] Published: Friday October 06 2017Christophe Donay, Chief Strategist at Pictet Wealth Management, discusses the synchronised global recovery and chances that equity bull market will continue for a while longer.

Read More »Pictet Perspectives – Nine years on, the bull has some room to run

The economic expansion of the global economic cycle is not over yet and it is temporarily in-sync. We don’t anticipate a recession. While the real growth recently reached a peak, it should moderately decelerate or stabilize in the US, Eurozone, UK, China and Japan. Inflation is likely to moderately pick up. We should remain in a low interest rate environment and the interest rate curve should flatten. High single digit earnings growth should continue to drive the pursue of the equity bull...

Read More » Perspectives Pictet

Perspectives Pictet