Our updated core scenario for global equities foresees earnings growth as the primary driver of returns over the next 18 months. We expect current high valuations to persist.Our core scenario for global equities for the next 18 months is built on three active risk factors (drivers): earnings growth, valuations and currency fluctuations. Of the three, earnings growth will be the most significant for return generation.After two strong quarterly reporting seasons, the positive base effect that boosted earnings growth in Europe in the first half of 2017 is fading. In 2018, earnings growth in developed equity markets will be capped at around 10%, with an even split between sector groups. This trend contrasts with the annual growth rates of over 20% that investors got used to in the immediate

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: Equity market forecast, Equity scenario, equity valuations, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Our updated core scenario for global equities foresees earnings growth as the primary driver of returns over the next 18 months. We expect current high valuations to persist.

Our core scenario for global equities for the next 18 months is built on three active risk factors (drivers): earnings growth, valuations and currency fluctuations. Of the three, earnings growth will be the most significant for return generation.

After two strong quarterly reporting seasons, the positive base effect that boosted earnings growth in Europe in the first half of 2017 is fading. In 2018, earnings growth in developed equity markets will be capped at around 10%, with an even split between sector groups. This trend contrasts with the annual growth rates of over 20% that investors got used to in the immediate aftermath of the Great Recession.

Base effects will still be evident in full-year 2017 European earnings growth which is anticipated to be around 20%, mainly due to the strong recovery in European peripheral banks’ earnings after heavy losses in 2016. But growth expectations for next year currently stand at 8.0% for the Stoxx Europe 600, compared with 11.5% for the S&P 500.

Like Europe, Asia ex-Japan is likely to see 2017 earnings growth of more than 20%. Unlike Europe, this will not be linked to a massive base effect but to a recovery in corporate earnings. For full-year 2018, earnings growth in Asia ex-Japan is expected to drop to 11.6%.

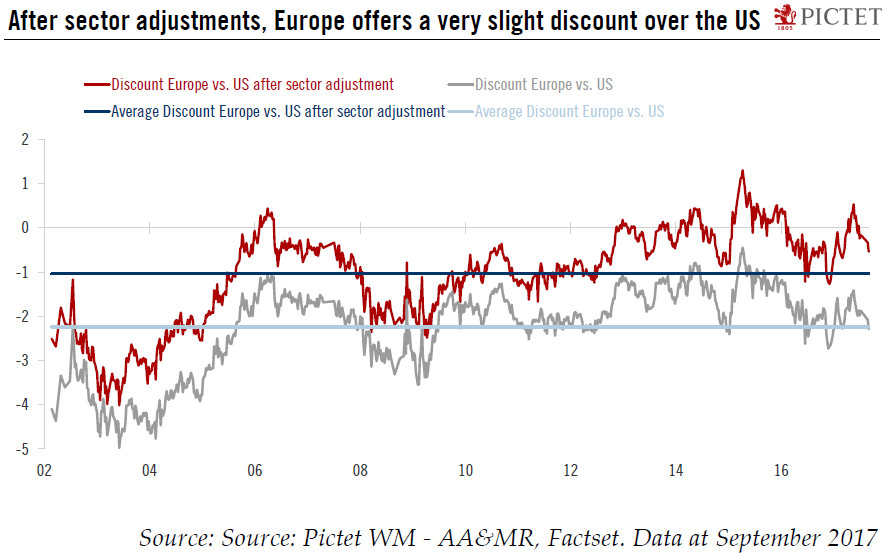

Nominal total returns should match expected earnings growth. We anticipate low levels of volatility, with occasional spikes linked to exogenous shocks. Nevertheless, in the US and Europe, stretched 12-month forward PE ratios, at close to 17x and 15x respectively, leave no room for disappointment.

Our base case has upside if the Trump Administration succeeds in passing meaningful tax reform, including a corporate tax cut from the current headline rate of 35%. Strong earnings growth momentum would result.

A negative alternative scenario involves earnings growth disappointments stemming from a loss of momentum in the US economy in 2H 2018 or 2019. However, given the current favourable macro environment, we remain confident in our central scenario for global equity markets and expect total returns to match earnings growth next year.