As it prepares to announce a partial shrinkage of its balance sheet this week, the question is how firmly the Fed signals the next rate hike.The Fed is widely expected to announce a partial shrinkage of its balance sheet at its 20 September meeting, in line with the guidance it provided in June.We also expect Yellen to point to the possibility of another rate hike soon (while remaining vague about the exact timing), dependent on further improvements in inflation. This should be backed by the...

Read More »Scenarios for QExit

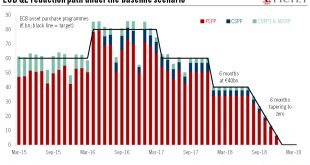

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

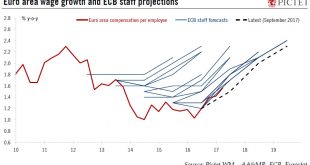

Read More »Euro area wage growth suggests the Phillips curve is not dead

The latest signs that wages are picking up together with drops in unemployment should help push the ECB along the road of policy normalisation.Wage growth is an important input in the ECB’s reaction function, and so far it has failed to respond to the narrowing of the output gap. It could be the normal behaviour of a lagging indicator, especially as labour market slack is likely to be larger than what the drop in headline unemployment would suggest. Or, it could be that “the slope of the...

Read More »US core CPI inflation stable at 1.7% in August

The inflation rate remains tepid, but we still think there is a greater probability that the Fed hikes rates in December than the market is currently pricing.CPI inflation was 0.4% m-o-m, boosted by gasoline prices, pushing the y-o-y print to a still-tepid 1.9%. Core CPI inflation was up 0.25% m-o-m; the y-o-y reading was stable at 1.7%.While improving from recent lows, there is no sign of a ‘regime shift’ in US inflation, despite the tight labour market. Globalisation and technology...

Read More »Hopes of US fiscal easing are evaporating

In spite of disappointment on the fiscal policy front and even though we expect a slowdown in growth next year, the US economy remains in fine fettle.Chaotic developments in the White House and ongoing gridlock in Congress have significantly reduced our expectations that the Trump Administration will bring a major fiscal boost to the US economy, particularly in 2018. In other words, we no longer expect a growth- and sentiment-boosting fiscal reform, nor a large-scale infrastructure spending...

Read More »ECB, a forced taper

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks...

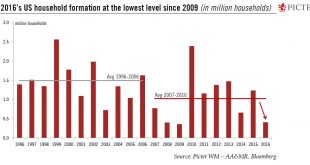

Read More »Soft household formation to curb US housing

Household formation trends mean the housing sector is unlikely to make a meaningful contribution to US GDP.The recently released Census Bureau’s Annual Social and Economic Supplement (ASEC) brought sobering news for the US housing market: new household formation slowed significantly, to 405,000 in 2016, the lowest level since 2009 (+357,000), compared with 1,232,000 in 2015. In other terms, the number of households grew only 0.3% last year, compared with +1.0% in 2015.In general, household...

Read More »House View, September 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationThere are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.Low correlations...

Read More »ISB Varsity Girls Volleyball vs. Dong Chen Highlights

International School of Beijing Girls Varsity Volleyball game vs. Dong Chen team Highlights, in ISB Gym. Vicky - 3 Aileen - 4 Julie - 5 Leah- 6 Sonia - 8 Isa - 9 Anson - 10 Kara - 11 Angela - 12 Kristen - 14 Catherine - 16 Grace - 17 0:00 - 0:40 Serving 0:41 - 1:44 Hitting/Offense 1:45 - 2:46 Defense

Read More »ISB Varsity Girls Volleyball vs. Dong Chen Highlights

International School of Beijing Girls Varsity Volleyball game vs. Dong Chen team Highlights, in ISB Gym. Vicky - 3 Aileen - 4 Julie - 5 Leah- 6 Sonia - 8 Isa - 9 Anson - 10 Kara - 11 Angela - 12 Kristen - 14 Catherine - 16 Grace - 17 0:00 - 0:40 Serving 0:41 - 1:44 Hitting/Offense 1:45 - 2:46 Defense

Read More » Perspectives Pictet

Perspectives Pictet