After posting its fastest growth rate in almost three years in the third quarter, the Swiss economy is set to accelerate in 2018.According to the State Secretariat for Economic Affairs (SECO), Swiss real GDP expanded by 0.6% quarter-on-quarter (q-o-q) in Q3 2017, in line with consensus expectations and our own forecasts. This comes after several quarters of poor performance. As we mentioned in our previous Flash Note, the downturn in previous GDP figures was exacerbated by special...

Read More »Debt energised

The energy sector in the US climbs back onto the high-yield issuance podium.As 2017 draws to a close, it is worth taking stock of this year’s highlights. On US financial markets, this year will probably be remembered as ‘Goldilocks’ time. Financial conditions have been very accommodative. Initial fears about the impact of the Federal Reserve’s monetary tightening have faded, since the Fed has hiked rates very gradually amid modest inflation. There has been a noticeable uptick in activity on...

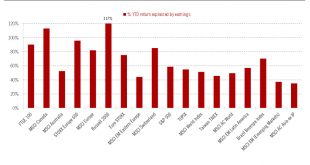

Read More »Developed-market equities continue to price hard data

Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI...

Read More »Good things come to those who wait

Scandinavian currencies have lost ground lately against the euro, but a favourable economic and policy backdrop point to strengthening of the Swedish krona.Recent months have not been kind to Scandinavian currencies: the Swedish krona and the Norwegian krone lost, respectively, 4.3% and 4.7% against the euro from the start of September to 24 November.The weakness of the Swedish krona could be explained by some disappointment at the re-election of the very dovish Stefan Ingves as Riksbank...

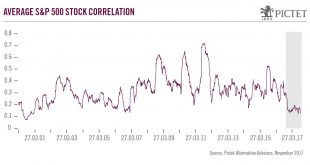

Read More »Hedge funds: alpha at the end of the QE tunnel

The performance of hedge funds has been bolstered in 2017 by the reversal of the tight market correlations of recent years. The gradual reversal of quantitative easing offers further opportunities to shine.A few years back, news that the Fed was reducing its balance sheet and considering rate rises would have prompted a severe market reaction. Today, as the ECB sets out plans for shrinking its own quantitative easing (QE) programme, the calm on financial markets is striking, affording, we...

Read More »Doing nicely

Published: 24th November 2017Download issue:English /Français /Deutsch /Español /ItalianoThe upturn in economic growth, benign central banks and improving corporate fundamentals have all ensured that most asset classes are set to finish 2017 in positive territory. But will the good times last?In the view of Pictet Wealth Management’s (PWM) chief investment manager, Cesar Perez Ruiz, next year “currently looks set to be a case of more of the same, at least in the first half”. After nine...

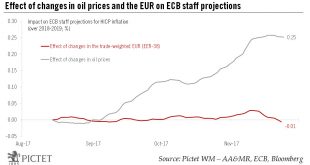

Read More »Oil prices to push ECB staff projections for inflation slightly higher

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the...

Read More »Banks: the outlook improves on both sides of the Atlantic

After facing serious challenges, banks in Europe and the US show signs of recovering. Earnings have been decent this year as a number of headwinds fade.Although third-quarter 2017 earnings results were mixed in Europe, compared with a better season in the US, 2017 is still set to be the first year of consistently decent earnings for banks after several years of disappointing results, especially in Europe. The market has noticed the improvement, and the sector has outperformed in recent...

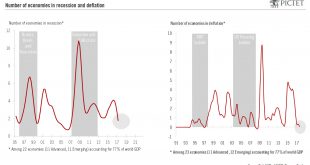

Read More »Increasing growth visibility would reassure investors

The world economy goes into 2018 with strong momentum, but policy makers could do more to improve visibility and risk asset valuations leave no room for disappointment.The current growth phase of the economic cycle started almost nine years ago in the U.S. and some emerging countries, making it the second-longest period of expansion in modern American history after the 1960s. But, increasingly, the question of whether a new recession is imminent or not has been coming up in discussions about...

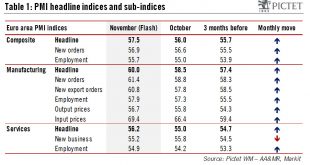

Read More »Another broad-based rise in PMI… a headache for the ECB?

The so-called ‘Euroboom’ is showing no sign of abating as euro area PMI indices rise to new highs, making it increasingly difficult for the ECB to justify its accommodative monetary stance.The euro area composite purchasing managers index (PMI) index surged well above expectations in November amid broad-based improvements across sectors and countries and the strongest pace of job creation in 17 years.At face value, November PMIs look consistent with real GDP growth accelerating further in...

Read More » Perspectives Pictet

Perspectives Pictet