After facing serious challenges, banks in Europe and the US show signs of recovering. Earnings have been decent this year as a number of headwinds fade.Although third-quarter 2017 earnings results were mixed in Europe, compared with a better season in the US, 2017 is still set to be the first year of consistently decent earnings for banks after several years of disappointing results, especially in Europe. The market has noticed the improvement, and the sector has outperformed in recent months.Headwinds are vanishing in Europe. In Europe, where the environment has remained challenging for a long time since the financial crisis, important headwinds have vanished. Economic growth has risen, existential threats to the euro area have dissipated, and balance sheets have improved. The refinement

Topics:

Yann Goffinet considers the following as important: Bank earnings, Banking sector forecast, European banks, Macroview, US banks

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After facing serious challenges, banks in Europe and the US show signs of recovering. Earnings have been decent this year as a number of headwinds fade.

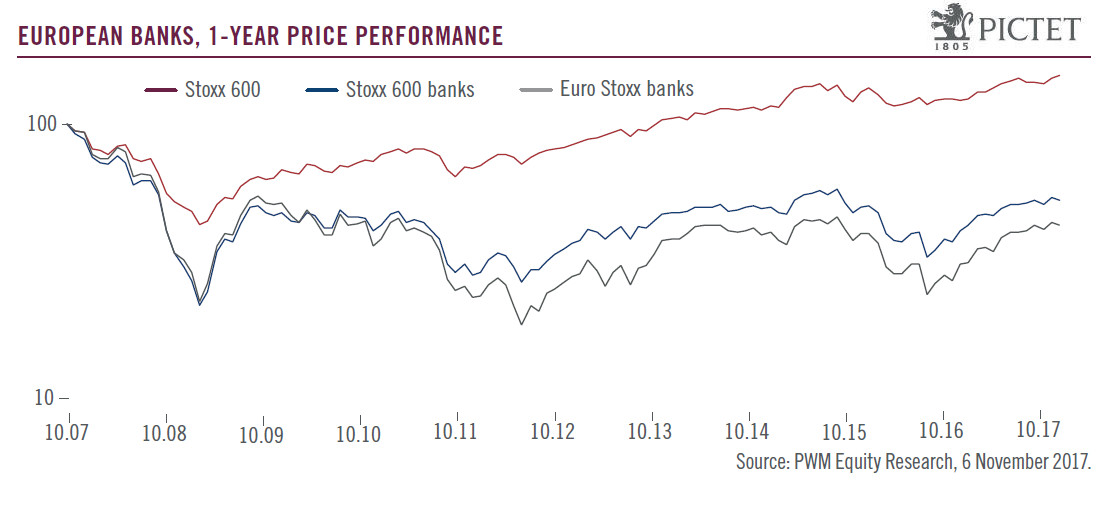

Although third-quarter 2017 earnings results were mixed in Europe, compared with a better season in the US, 2017 is still set to be the first year of consistently decent earnings for banks after several years of disappointing results, especially in Europe. The market has noticed the improvement, and the sector has outperformed in recent months.

Headwinds are vanishing in Europe. In Europe, where the environment has remained challenging for a long time since the financial crisis, important headwinds have vanished. Economic growth has risen, existential threats to the euro area have dissipated, and balance sheets have improved. The refinement of Basel III (sometimes called Basel IV) by year-end may end regulatory uncertainty, and the interest rate outlook has become a topic of debate. Loan volumes, asset quality and capital returns are improving.

Tailwinds are supportive in the US. In the US, which is more advanced in the cycle, a number of tailwinds continue to support the sector, notably rising interest rates (the third hike this year is expected in December) and capital returns (around 7% yield on average). New positives for US banks are also emerging: banking deregulation is gaining momentum, and tax reform, if it is enacted and not overly diluted, would boost earnings. Asset quality poses minor concerns thus far.

Macro variables are favourable, valuation is neutral. Rising bond yields also point to a period of outperformance by banks, on both sides of the Atlantic. Valuation is rather neutral. In both the US and Europe, the relative multiple to the wider market for P/E is around 0.75x, which is close to the 10-year average, but below the long-term average of 0.8-0.85x.

Investment conclusions. We are positive on the outlook for bank stocks, in both the US and Europe. Through the end of the year and into the full-year earnings season, the outlook may be slightly better for US than European banks. Beyond that, macro and micro trends generally look supportive on both sides of the Atlantic. In the US, aside from tax reform, regulation is a key wild card with the potential to provide a further boost. In Europe, an agreement on Basel by year-end would be the last piece of re-regulation post crisis, allowing new investors to take positions in banks.