We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the impact of changes in oil prices and the currency on ECB staff projections for inflation over a two-year horizon.In all, we expect the roughly 20% rise in oil prices over the past three months to push ECB staff forecasts for inflation higher by about 20bp in 2018 (from 1.2% to 1.4%), and by 10bp in 2019

Topics:

Frederik Ducrozet considers the following as important: 2018 staff projections, ECB staff forecasts, ECB staff projections, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.

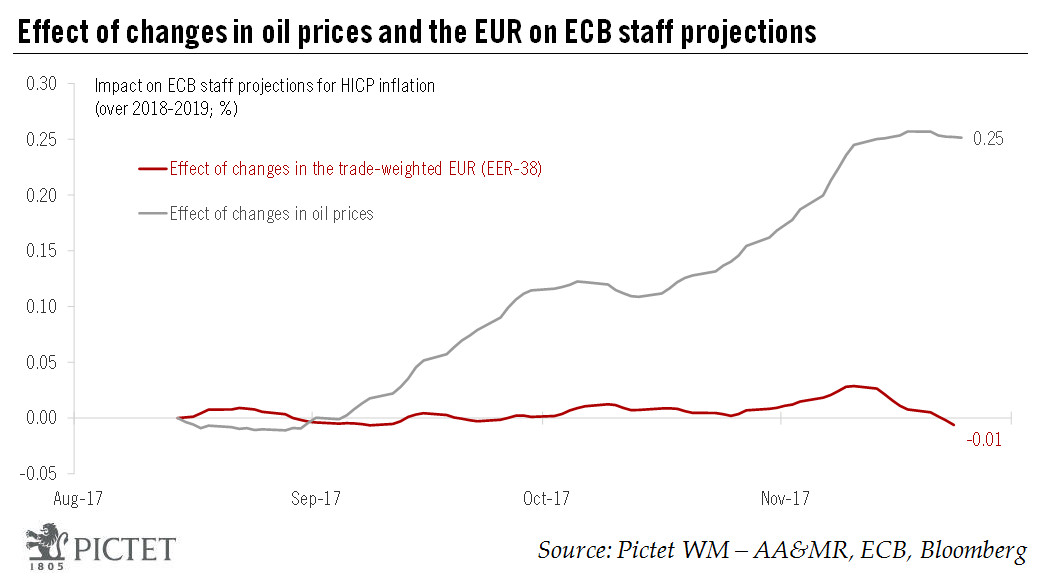

This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the impact of changes in oil prices and the currency on ECB staff projections for inflation over a two-year horizon.

In all, we expect the roughly 20% rise in oil prices over the past three months to push ECB staff forecasts for inflation higher by about 20bp in 2018 (from 1.2% to 1.4%), and by 10bp in 2019 (from 1.5% to 1.6%). Other factors should offset each other, including a slightly lower starting point for core inflation (1.0% in 2017) and a faster closing of the output gap, led by stronger growth. Indeed, we also expect the ECB staff to revise GDP growth higher again, to 2.1% in 2018 (up from 1.8%) and 1.8% in 2019 (up from 1.7%). The broader trade-weighted EUR has remained remarkably stable in the past three months, ending up only a touch higher than the level assumed by the ECB staff in September. As a result, the impact of currency changes is likely to be minimal.

Last but not least, we expect 2020 projections, which the staff will publish for the first time in December, to show further improvement in inflation to around 1.8% while GDP growth should ease to around 1.7%. We will discuss the ECB’s assumptions in more detail in a later note, including the all-important core inflation forecasts and the underlying Phillips curve framework which the ECB still views as valid, and rightly so in our opinion.