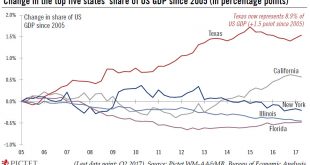

The US economy is increasingly reliant on activity in Texas, itself very dependent to oil.Texas, the second state by GDP after California, but better endowed than the latter with oil resources, has become a major driver of US growth, especially since the energy boom of the 2010s. What we’ve learned with the ups and downs of oil prices over the past few years is that high oil prices are great for Texas and therefore positive for the US economy, in spite of the hit to the individual US...

Read More »Watch out for a rebound in euro area core HICP in November

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the...

Read More »China government may tolerate lower growth

The authorities are growing more tolerant of lower headline growth, which is already showing early signs of declining.The latest Chinese economic data for October indicate the moderate deceleration in growth already seen in Q3 is extending into Q4. Both exports and domestic demand have slowed, particularly in terms of fixed-asset investment. National fiscal spending has shown signs of slowing, and central government has cut off support for some regional infrastructure projects on concerns of...

Read More »Latest Japan GDP data point to moderate deceleration

The latest GDP data confirm the economy is expanding steadily. While we have slightly lowered our growth forecast for this year, our 2018 forecast remains unchanged.Japanese GDP for Q3 came in at JPY545.8 trillion annualised, rising 1.4% q-o-q and 1.7% y-o-y in real terms.The data are broadly consistent with our view of a moderate deceleration of the Japanese economy in H2 after a strong Q2. The positive growth in Q3 marks the seventh consecutive quarter of economic expansion in Japan, the...

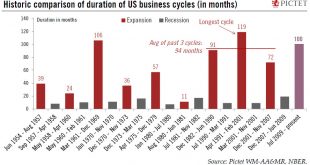

Read More »US business cycle celebrates its 100-month anniversary

The US expansion has crossed the 100-month mark. But while it has aged, the economy still has legs.The US expansion, which started in July 2009, just crossed its 100-month mark, making it – for now – the third longest in the National Bureau of Economic Research database, which stretches back to 1854. The longest growth was 119 months between April 1991 and February 2001.The exceptional length of this expansion, already well above the 94-month average for the three previous growth cycles,...

Read More »The euro area recovery is continuing to broaden out

Latest growth data indicate continuation of a strong and stable recovery. Our GDP forecasts remain unchanged.Euro area headline GDP growth was confirmed at 0.6% q-o-q in Q3.At the country level, Germany surprised to the upside, posting GDP growth of 0.8% q-o-q in Q3 and beating consensus expectations. The impressive performance was driven by exports and investment in equipment and machinery. Turning to Italy, economic activity strengthened in Q3. After a rise of 0.3% q-o-q in Q2, real GDP...

Read More »House View, November 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain constructive on equities, which are being underpinned in particular by robust earnings growth.However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.US tax cuts could...

Read More »Su Dong Chen Bible of Kungfu

Baguazhang

Read More »Su Dong Chen Bible of Kungfu

Baguazhang

Read More »US growth forecast raised

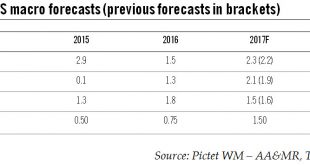

Global growth, post-hurricane reconstruction and higher oil prices are all provided a boost to the US growth outlook. But uncertainty still hangs over tax cuts and the Fed.We are raising our US GDP forecast for 2017 (+0.1 percentage point to 2.3%) and 2018 (+0.3 point to 2.0%) on the back of stronger momentum in Q4 2017. Accelerating global growth is a tailwind for the US economy – as seen in the recent sharp pick up in exports, particularly to emerging markets. Reconstruction efforts in the...

Read More » Perspectives Pictet

Perspectives Pictet