The energy sector in the US climbs back onto the high-yield issuance podium.As 2017 draws to a close, it is worth taking stock of this year’s highlights. On US financial markets, this year will probably be remembered as ‘Goldilocks’ time. Financial conditions have been very accommodative. Initial fears about the impact of the Federal Reserve’s monetary tightening have faded, since the Fed has hiked rates very gradually amid modest inflation. There has been a noticeable uptick in activity on the US high-yield (‘junk’) bond market, with a sharp increase in debt issuance. According to Bloomberg data (as of 28 November), high-yield issuance is up a robust 25.5% so far this year, to USD 306bn. Issuance is above levels for the whole of 2015 (USD 286bn) and 2016 (USD 244bn), although it remains

Topics:

Thomas Costerg considers the following as important: high yield issuance, Macroview, US energy sector, US financial markets, US high yield

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The energy sector in the US climbs back onto the high-yield issuance podium.

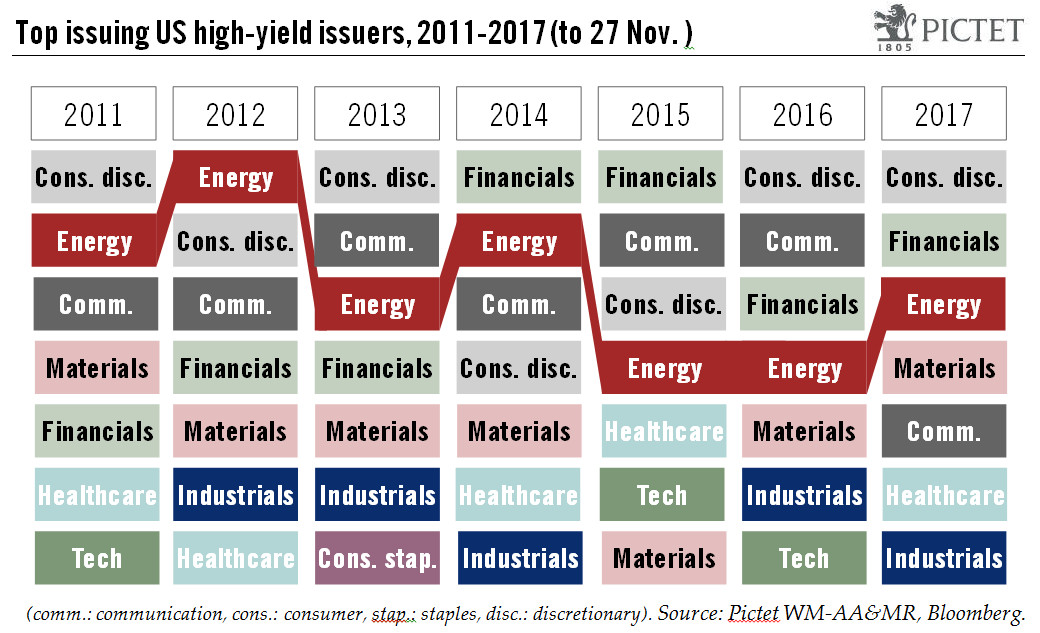

As 2017 draws to a close, it is worth taking stock of this year’s highlights. On US financial markets, this year will probably be remembered as ‘Goldilocks’ time. Financial conditions have been very accommodative. Initial fears about the impact of the Federal Reserve’s monetary tightening have faded, since the Fed has hiked rates very gradually amid modest inflation. There has been a noticeable uptick in activity on the US high-yield (‘junk’) bond market, with a sharp increase in debt issuance. According to Bloomberg data (as of 28 November), high-yield issuance is up a robust 25.5% so far this year, to USD 306bn. Issuance is above levels for the whole of 2015 (USD 286bn) and 2016 (USD 244bn), although it remains below the 2013 peak of USD 378bn.

In particular, the energy sector has posted a solid increase in debt issuance, itself helped by the rise in global oil prices: issuance is already up 80% (to USD 47bn) versus full-year 2016. While below the 2012 peak of USD 61bn (when energy was the top high-yield issuer in the US), this sector has moved from fourth to third place in terms of issuance, running neck and neck with financials (see chart). Consumer discretionary has been the top high-yield issuer this year, with USD 58bn so far (up 32% y-o-y).

From a macro standpoint, the question is whether well-lubricated debt markets for energy firms mean increased oil drilling next year. Oil investment is pivotal for the US growth outlook. Shale oil players have recently vowed to be more disciplined with capex. Will they follow through on this new mantra, resisting the appeal of raising even more debt?