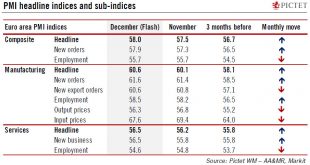

The latest flash purchasing managers index surveys showed robust momentum for the euro area. We maintain our GDP growth forecast of 2.3% for 2017.Flash purchasing managers’ indices (PMIs) for the euro area ended the year on a strong note. The composite PMI increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2).The robust momentum was led by a booming manufacturing sector, while services sentiment also improved.The breakdown by sub-indices was pretty strong,...

Read More »Increasingly optimistic on Swiss outlook

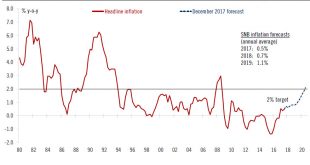

The SNB left its monetary policy unchanged, and sees the Swiss franc as highly valued. However, we expect a first rate hike to open in Q4 2018.At its December meeting, the SNB left its accommodative monetary policy unchanged. The interest rate on sight deposits was maintained at a record low of -0.75% and the SNB reiterated its willingness to intervene in the foreign exchange market if needed.The SNB’s monetary policy assessment reflected an improvement in the outlook since its September...

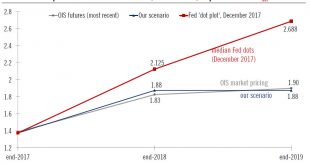

Read More »Fed’s enthusiasm on tax cut plans remains limited

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about...

Read More »Back to normal in markets in 2018

[embedded content] 2017 was a remarkable year, with positive returns for a wide array of risk assets. The environment will likely remain supportive as well, but Cesar Perez Ruiz, CIO at Pictet Wealth Management, says he expects more normal market conditions in 2018, with spikes in volatility that offer greater opportunities for active management.

Read More »Perspectives Pictet – Back to normal in markets in 2018

2017 was a remarkable year, with positive returns for a wide array of risk assets. The environment will likely remain supportive as well, but Cesar Perez Ruiz, CIO at Pictet Wealth Management, says he expects more normal market conditions in 2018, with spikes in volatility that offer greater opportunities for active management. http://perspectives.pictet.com https://www.group.pictet/wealth-management

Read More »House View, December 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth...

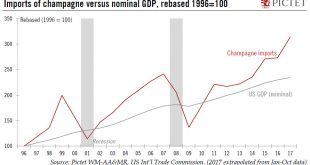

Read More »Effervescence, not exuberance

Despite the length of the current expansion, we believe US growth still has some way to go. But there are signs the economy is becoming bubbly.The key debate right now among economists revolves around how further will the expansionary phase of the US business cycle go. We are already over 100 months into the current phase (it started in July 2009), making it the third-longest period of post-World War II expansion. The longest was 119 months, between April 1991 and February 2001. Our view is...

Read More »Oil market tilted towards oversupply

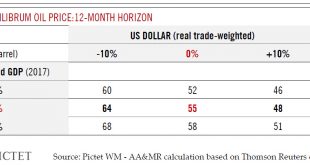

The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in...

Read More »如何购买比特币?How to Buy Bitcoin

Buy Bitcoin Easily https://tinyurl.com/buybitcoineasily Compare bitcoin price? Buying bitcoin with lower price can be easy. 购买比特币非常简单。 尤其是在马来西亚 Use below link to buy bitcoin with discount优惠价比特币 https://tinyurl.com/localbitcoin-coupon https://tinyurl.com/remitano-coupon https://tinyurl.com/coinmama-coupon 1300 Cryptocurrency Signal 别错过 EXA ICO - https://exacoin.co/ref/coinsecret VBlog: https://buysellcoin.blogspot.com 联络:https://t.me/coinsecret 比特幣錢包 https://tinyurl.com/qoinpro-wallet...

Read More »The Swiss economy is gaining momentum

Leading indicators are running at multi-year highs, suggesting that underlying momentum is strengthening and becoming more broadly based. Owing to weak GDP momentum in late 2016 and the first half of the year, the Swiss economy is likely to see relatively weak growth in 2017. Part of the weakness in GDP figures was due to specific factors. However, leading indicators, notably consumer confidence, manufacturing PMI and the KoF economic indicator are...

Read More » Perspectives Pictet

Perspectives Pictet