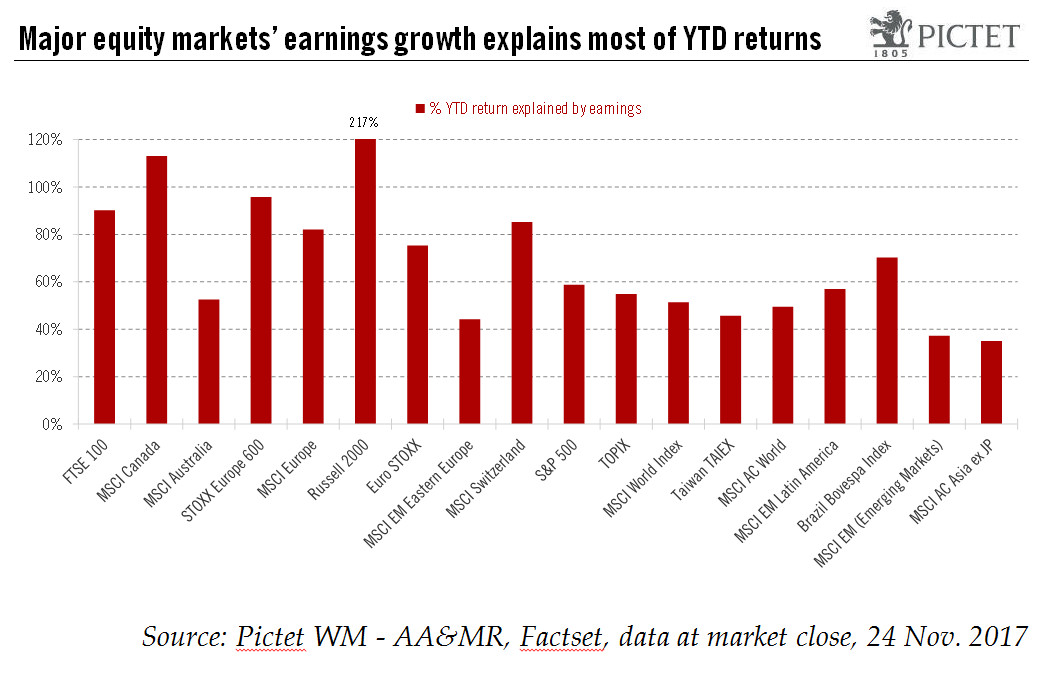

Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI Emerging Market Index’s year-to-date returns and 35% of the MSCI AC Asia (ex Japan)’s have been been due to earnings growth.Going into 2018, our central scenario is for the same trend to remain in place, i.e. DM equity returns should continue to be driven mainly by earnings growth rather than by shifts in

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: Developed market equities, earnings forecast, Earnings growth expectations, equity valuations, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Recent hard macro data confirm the resiliency of the business cycle into year end and 2018.

The momentum behind hard macro data is improving investors’ visibility on corporate profit growth in developed markets (DM), which we expect to be the main market risk factor driving equity markets over 2018.

According to our analysis, 96% of year-to-date returns of the Stoxx Europe 600 have been due to earnings growth and 59% of the S&P 500’s (see chart). By way of comparison, only 37% of the MSCI Emerging Market Index’s year-to-date returns and 35% of the MSCI AC Asia (ex Japan)’s have been been due to earnings growth.

Going into 2018, our central scenario is for the same trend to remain in place, i.e. DM equity returns should continue to be driven mainly by earnings growth rather than by shifts in valuations or by dividend yield.

With the macro backdrop providing investors with improved visibility on the resiliency of corporate earnings growth, we expect DM equity market returns to match 2018 earnings growth expectations. Specifically, 2018 consensus earnings growth estimates – and thus return forecasts – now stand at 11.6% for the S&P500, 8.7% for the Stoxx Europe 600 and 8.8% for the Topix. In short, we expect DM equity markets in general to deliver returns of the order of 10% in 2018.

At time of writing, the Trump administration’s plans for corporate tax reform still had to be passed by Senate. But our analysis suggests that US equity markets are still not anticipating any tax cut, preferring instead to rely on hard data.

In our 2018 equity scenario, we estimate that valuations can remain elevated given the supportive macro environment (including strong hard data). But valuation levels are high (12-month forward PE of 17.4x for the S&P500 and 14.9x for the Stoxx Europe 600), so any disappointment would likely lead to a significant correction in DM equity markets.

We are conscious that risks could increase at some stage, and bouts of volatility are to be expected. Overall, however, the persistence of low volatility should continue to be supportive for equities, even if our expectations are that further equity market returns are likely to slow down somewhat from the current pace.