The so-called ‘Euroboom’ is showing no sign of abating as euro area PMI indices rise to new highs, making it increasingly difficult for the ECB to justify its accommodative monetary stance.The euro area composite purchasing managers index (PMI) index surged well above expectations in November amid broad-based improvements across sectors and countries and the strongest pace of job creation in 17 years.At face value, November PMIs look consistent with real GDP growth accelerating further in Q4, to 0.8% q-o-q in the euro area, 0.9% in Germany, and 0.7% in France. Upside risks to the near-term economic outlook imply that euro area GDP growth could remain close to, if not slightly higher than, 2% in 2018.Another important feature of PMI indices has been the slow but uninterrupted build-up in

Topics:

Frederik Ducrozet considers the following as important: ECB policy, Euro area economic forecast, Euro area PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The so-called ‘Euroboom’ is showing no sign of abating as euro area PMI indices rise to new highs, making it increasingly difficult for the ECB to justify its accommodative monetary stance.

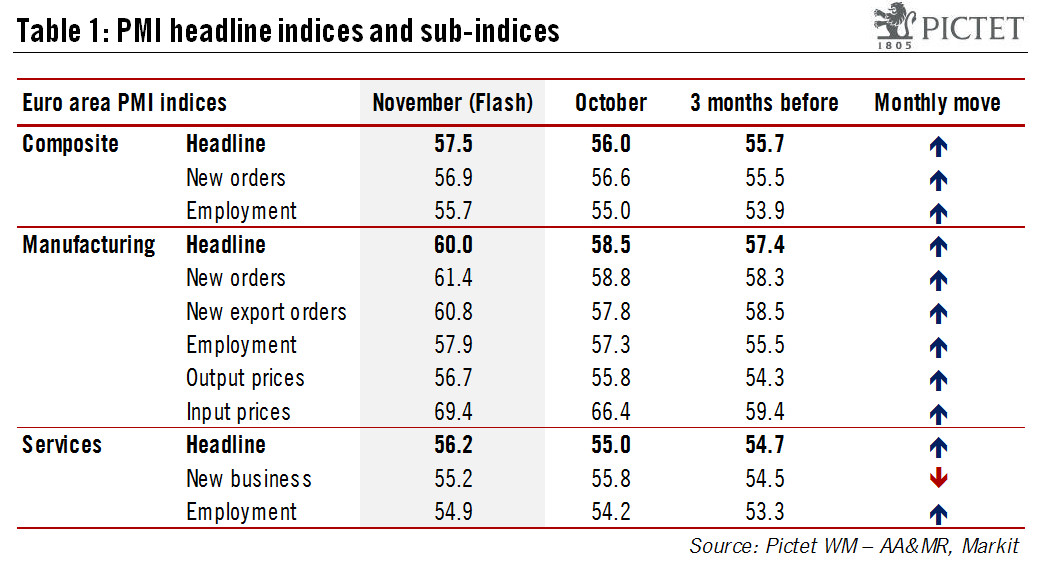

The euro area composite purchasing managers index (PMI) index surged well above expectations in November amid broad-based improvements across sectors and countries and the strongest pace of job creation in 17 years.

At face value, November PMIs look consistent with real GDP growth accelerating further in Q4, to 0.8% q-o-q in the euro area, 0.9% in Germany, and 0.7% in France. Upside risks to the near-term economic outlook imply that euro area GDP growth could remain close to, if not slightly higher than, 2% in 2018.

Another important feature of PMI indices has been the slow but uninterrupted build-up in tensions on capacity. Price pressure rose to new cyclical highs in November, hinting at higher core inflation in 2018, as per our forecasts. This, along with above-potential GDP growth, may force the ECB to adjust its communication in a more hawkish way, as suggested by Executive Board member Benoît Coeuré this week.