Scandinavian currencies have lost ground lately against the euro, but a favourable economic and policy backdrop point to strengthening of the Swedish krona.Recent months have not been kind to Scandinavian currencies: the Swedish krona and the Norwegian krone lost, respectively, 4.3% and 4.7% against the euro from the start of September to 24 November.The weakness of the Swedish krona could be explained by some disappointment at the re-election of the very dovish Stefan Ingves as Riksbank governor, by some moderation in inflationary pressure in October, and by the currency’s previous strong performance. For the krone, the reasons are more difficult to find, although it seems that ongoing low inflation (CPI inflation hit a 56-month low in October) has become a major drag for the Norwegian

Topics:

Luc Luyet considers the following as important: Macroview, Norwegian Krone, Scandinavian currencies, Scandinavian monetary policy, Swedish krona

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Scandinavian currencies have lost ground lately against the euro, but a favourable economic and policy backdrop point to strengthening of the Swedish krona.

Recent months have not been kind to Scandinavian currencies: the Swedish krona and the Norwegian krone lost, respectively, 4.3% and 4.7% against the euro from the start of September to 24 November.

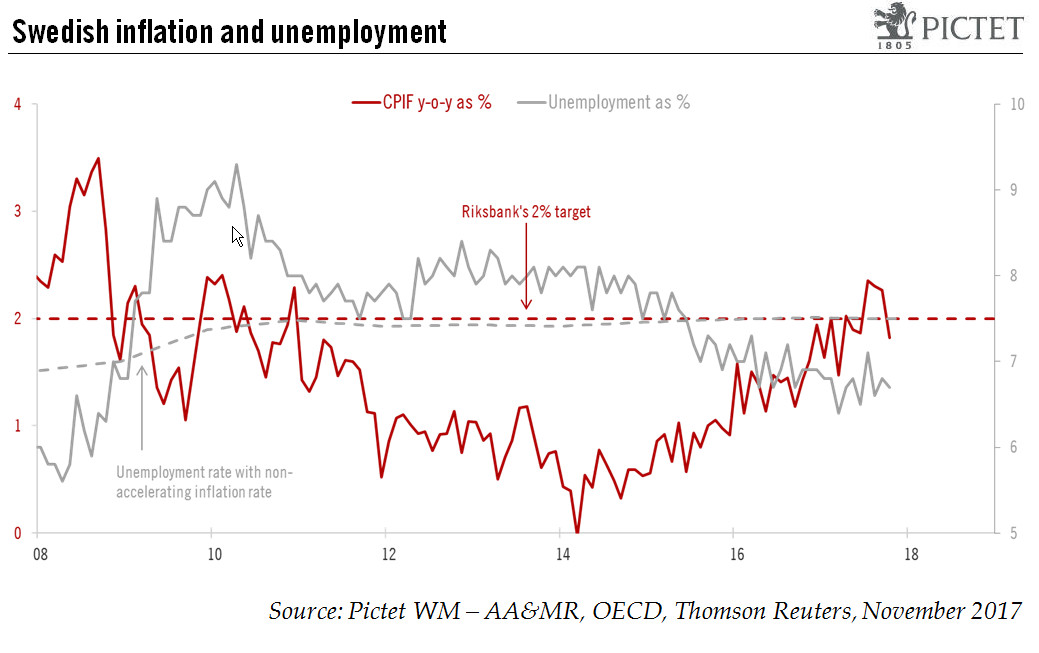

The weakness of the Swedish krona could be explained by some disappointment at the re-election of the very dovish Stefan Ingves as Riksbank governor, by some moderation in inflationary pressure in October, and by the currency’s previous strong performance. For the krone, the reasons are more difficult to find, although it seems that ongoing low inflation (CPI inflation hit a 56-month low in October) has become a major drag for the Norwegian currency.

Yet the rationale for krona appreciation remains compelling: the growth outlook is robust, inflation is close to the Riksbank’s 2% target, the output gap is closed and the currency is more than 20% undervalued against the euro on measures such as CPI-based purchasing power parity.

Ultimately, given the extent of its accommodative monetary policy in recent years and given the current strong macro backdrop, the Riksbank’s normalisation of policy should be the most significant of any major central bank, potentially leading to strong outperformance by the krona. That said, housing market vulnerabilities and the dovishness of the Riksbank suggest that krona appreciation is unlikely to follow a straight line. Our 12-month projection is for a rate of SEK9.30 against the euro.

Meanwhile, in our view, the Norwegian krone remains one of the most attractive currencies given its fundamental undervaluation (-18% relative to the US dollar), the improving growth outlook in Norway, and its positive carry. Furthermore, Norway’s current account surplus makes the krone less risky than other commodity currencies.

Unfortunately, inflationary pressure should remain subdued, a by-product of the large negative output gap (estimated at -1.9% in 2017 by the OECD). The Norges Bank’s own projections see inflation remaining low in the years ahead, pointing to no rate hike in 2018.

Our modestly constructive view on the krone mostly stems from the likelihood that inflation will not move much lower given the positive global economic backdrop, while the Norwegian economy should benefit from a broad and resilient recovery of the euro area through the trade channel. Our 12-month projection is for a rate of NOK9.20 to the euro.