The world economy goes into 2018 with strong momentum, but policy makers could do more to improve visibility and risk asset valuations leave no room for disappointment.The current growth phase of the economic cycle started almost nine years ago in the U.S. and some emerging countries, making it the second-longest period of expansion in modern American history after the 1960s. But, increasingly, the question of whether a new recession is imminent or not has been coming up in discussions about scenarios for the year ahead.We don’t believe a recession is looming. As in previous years, our base scenario excludes a major shift in the economic cycle in the U.S. or the beginnings of a bear market. The lengthiness of the current expansion is not sufficient on its own to trigger a recession. Only

Topics:

Christophe Donay considers the following as important: Economic cycle, Growth scenario, Macroview, Market forecast, World growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The world economy goes into 2018 with strong momentum, but policy makers could do more to improve visibility and risk asset valuations leave no room for disappointment.

The current growth phase of the economic cycle started almost nine years ago in the U.S. and some emerging countries, making it the second-longest period of expansion in modern American history after the 1960s. But, increasingly, the question of whether a new recession is imminent or not has been coming up in discussions about scenarios for the year ahead.

We don’t believe a recession is looming. As in previous years, our base scenario excludes a major shift in the economic cycle in the U.S. or the beginnings of a bear market. The lengthiness of the current expansion is not sufficient on its own to trigger a recession. Only excess investment or credit would cause an inflexion in the cycle. An analysis of the density of economic activity suggests that such excesses are still absent.

There would be greater visibility about the current expansion if there were a greater impulse from economic policy—all the more so that the usefulness of the monetary policies pursued by the developed world’s most important central banks is declining, as can be seen in sub-optimal levels of growth and inflation. Ideally, fiscal and spending policies should be taking up the slack. This is one of the issues behind the Trump administration’s corporate tax reform proposals. In a similar vein are French plans to reduce corporate tax to 25% over the next five years. But the current tenor of the debate in the U.S. leads us to think that the fiscal boost in the U.S. will be relatively modest.

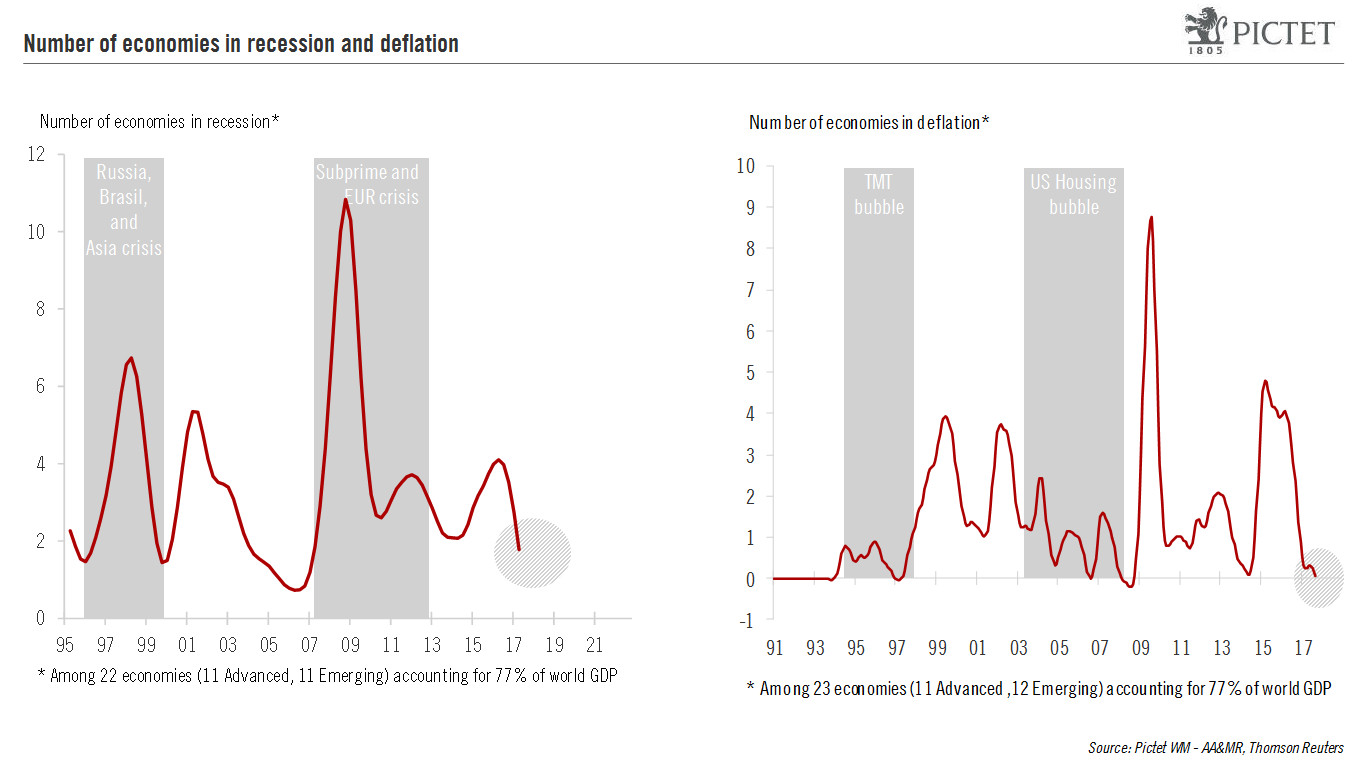

The good news is that even without a significant fiscal stimulus in the U.S., the world economy should have sufficient momentum of its own to ensure a continuation of the growth-without-inflation scenario. As growth broadens out across the planet, never have so few countries been in recession or been stuck in deflation since the dotcom bubble of the late 1990s. For once, the momentum in Europe is among the strongest anywhere.

This forms a constructive backdrop for equity markets in 2018. Yet while we are not yet in bubble territory, stocks have become expensive (about 17.5x forward P/E for the S&P500 and 14.5X for the Stoxx Europe 600). Market dynamics lead us to conclude that at current valuations, equities have the potential to rise a further 10% next year, in line with earnings expectations. Even a modest tax cut in the U.S. would increase corporate profits. But valuations are such that there is no room for disappointments—with politics, geopolitics and economic policy three of the main areas of risk, in our view. The market correction that would result from major tensions of any sort could be exacerbated by the current historically low levels of volatility.

Does that mean we should prepare for a significant rise in interest rates? Probably not. We believe central banks will remain accommodating towards growth and financial markets. Long-term rates should remain below nominal growth.