The Australian and New Zealand dollar are among the most expensive currencies. The former looks especially vulnerable to a mild pullback.At their November monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at, respectively, 1.50% and 1.75%.The RBA sounded relatively cautious given low wage growth and high household debt. The RBNZ was more upbeat in light of the potential for more fiscal stimulus under...

Read More »ECB, in search of a comprehensive strategy to tackle bad loans

Greater visibility on the ECB’s plans for dealing with the overhang of non-performing loans would help banks and the euro area recovery.The ECB has become under renewed pressure over its recent guidance on non-performing loans (NPL) and its plan to force banks to increase provisions against bad loans. The backlash, including at this week’s European parliament hearing of Danièle Nouy, Chair of the Supervisory Board, was fuelled by various gripes, including whether the ECB has gone beyond its...

Read More »Low loan demand: a bad omen for investment

Tax reform could help sluggish demand for corporate loans, but unlikely to be a game changer when it comes to business investment.A key question for the 2018 US outlook, and beyond, is whether US firms will finally open their purses and invest more after years of frugality. Investment is key to sustaining the current expansion. Recent buoyant business surveys like the ISM manufacturing index seem to point that way. However, a chasm has opened between what firms are saying and what they do....

Read More »Upward potential for oil prices is limited

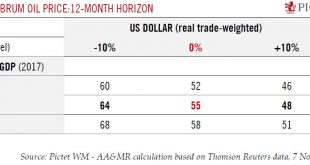

Various factors have contributed to the oil price rally since August, but while a further short-term surge is possible the fundamental long-term equilibrium price for WTI remains USD55-USD58.Recent developments have brought noticeable changes to the outlook for the supply-demand balance. First of all, the steady decline in the value of the US dollar since the end of 2016 has been stopped. In fact, the dollar appreciated by 4% between end September and 7 November.Second, world economic...

Read More »What does thinking sustainably really mean?

Published: Tuesday November 07 2017Stephen Barber digs into the foundations of sustainable investment.Humans are not, by nature, very sustainable. We collapse and dissolve all too soon.It’s because life is so desperately brief for all of us that a capacity to think and act sustainably is such a daunting task – yet, when achieved, it is also a deeply impressive concept. Housed in fragile bodies, daily subject to short-term appetites, we are sometimes nevertheless capable of identifying with...

Read More »Keeping a jewellery business in the family

Published: Monday November 06 2017Two sixth-generation members of the Boghossian family are continuing to develop high-end jewellery with their father and uncle, blending Eastern and Western cultures to create contemporary masterpieces.In the exclusive world of high-end jewellers, the Geneva-based Boghossian House is making waves with stunning pieces of fine and high jewellery that reflect its Armenian heritage. Now run by the fifth and sixth generations of the family, its origins date back...

Read More »US employment—It’s Goldilocks!

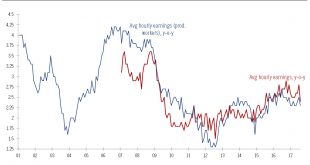

October non-farm payrolls provided another sign of the US economy’s strength. But tepid wage growth means the Fed will likely remain cautious.October payrolls showed the US economy remains in fine fettle, as underlying payroll growth remained firm. Robust labour-market signals echo recent solid business surveys, strong job opening data, and very low levels of initial jobless claims.Payrolls rose 261,000, reversing some hurricane-related weakness (payroll growth was only 18,000 in September)....

Read More »Laggards are catching up with the euro area recovery

Accelerating growth in France and Italy should make the ECB more confident about its plans for policy normalisation.The current leg of the euro area recovery is about both quantitative and qualitative improvement in the economic outlook.Trend GDP growth in France and Italy has risen to 2.2% and 1.8%, respectively, on an annualised basis. Those countries are catching up with the strongest member states, more than compensating for the moderate growth slowdown we forecast in Germany and...

Read More »Federal Reserve – New sheriff in town

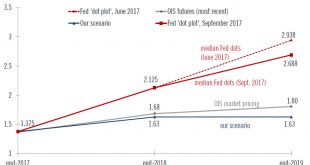

Janet Yellen’s likely successor is cut from the same cloth as Janet Yellen. The Fed will remain prudent when it comes to rate hikes, but its stance on banking deregulation will merit watching.On 2 November, President Trump nominated Jerome (‘Jay’) Powell to succeed Janet Yellen at the helm of the Federal Reserve System, confirming recent press speculation. The next step before the new Fed chairman can enter office next February is Senate confirmation. This looks unlikely to be problematic...

Read More »Voyages promoting peace and sustainable development

Published: Friday November 03 2017Peace Boat, founded by a group of Japanese students over three decades ago, sails around the world, enabling people to engage across borders, fostering dialogue and mutual cooperation – a floating bridge between culturesThe world faces many serious challenges, such as armed conflicts, nuclear threats, poverty, disease and environmental threats – and finding solutions often seems to be beyond the reach of individuals and communities. But in 1983, a Japanese...

Read More » Perspectives Pictet

Perspectives Pictet