The performance of hedge funds has been bolstered in 2017 by the reversal of the tight market correlations of recent years. The gradual reversal of quantitative easing offers further opportunities to shine.A few years back, news that the Fed was reducing its balance sheet and considering rate rises would have prompted a severe market reaction. Today, as the ECB sets out plans for shrinking its own quantitative easing (QE) programme, the calm on financial markets is striking, affording, we believe, new opportunities for hedge funds. In hindsight, three obvious trends stand out. First, backed by significant and sustained monetary stimulus, long-only assets have risen in unison over the past 10 years. To take two examples, the S&P500 index has returned +15% a year since its nadir in Q1 2009

Topics:

Heinrich Merz considers the following as important: active management, chasing alpha, hedge funds, Macroview, market correlations, Perspectives

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The performance of hedge funds has been bolstered in 2017 by the reversal of the tight market correlations of recent years. The gradual reversal of quantitative easing offers further opportunities to shine.

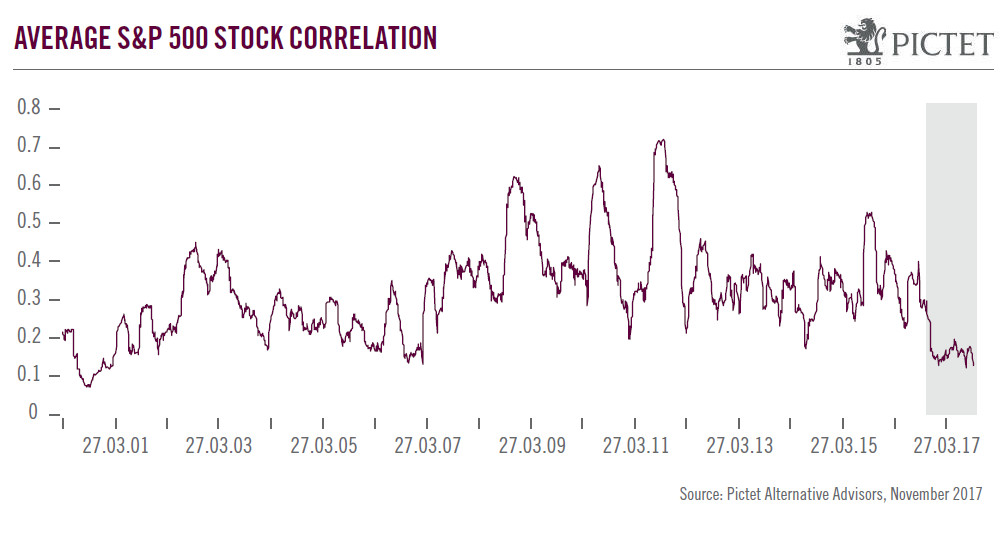

A few years back, news that the Fed was reducing its balance sheet and considering rate rises would have prompted a severe market reaction. Today, as the ECB sets out plans for shrinking its own quantitative easing (QE) programme, the calm on financial markets is striking, affording, we believe, new opportunities for hedge funds. In hindsight, three obvious trends stand out. First, backed by significant and sustained monetary stimulus, long-only assets have risen in unison over the past 10 years. To take two examples, the S&P500 index has returned +15% a year since its nadir in Q1 2009 and US high-yield spreads have fallen well below their historic median, to between 350-400 bps today. Second, volatility has fallen year upon year. In early November, the VIX index of equity volatility stood at 9.4, close to the historic low set earlier in the year. Lastly, correlations—the degree to which assets move in unison—have, until recently, remained stubbornly high (see chart).

Together, these factors explain the headwinds faced by hedge funds up to now: profiting from picking winners and shorting losers relies on their existence in the first place. Low volatility combined with high correlation suppresses dispersion–the degree to which winners and losers diverge from their respective benchmark. Add in limited market exposure and higher human capital costs and it is unsurprising that hedge funds as a group have faced increased competition from passive long-only ETFs.

The key question, as the monetary tide gradually recedes is whether the future will mirror the past. For our part, we believe less QE translates to higher volatility, corrections of inefficiencies, the reversal of capital misallocations and, concurrently, greater alpha. Indeed, despite continued low volatility, the performance of our managers over the last year reassures us that it does not take much policy normalisation for alpha to rebound strongly.

Below the current calm surface, we see a broad range of themes and investment strategies. Yes, in certain cases, performance continues to be driven by long exposure to well-known technology names (dominant US groups and Chinese e-commerce) against short positions in high-street retailers. In general, however, the drivers have broadened and deepened. Equity long/short managers are identifying and now profiting from corporate change and innovation cycles in immuno-oncology, managed care, industrial cyclicals, consolidating transport industries and niche areas such as online gaming, to name but a few. Relative Value and Event Driven managers are converting their activist shareholder campaigns into portfolio performance across a range of (increasingly European) industries. Convertible as well as capital structure arbitrage strategies are benefitting from the translation of improved corporate sentiment into corporate actions.

Resilience to tail risks

At a superficial level, markets are more resilient than before the financial crisis: banking leverage, for example, has been reduced, in part through regulation. At a granular level, however, several developments have increased systemic fragility. The rise of passive strategies (which simply mirror an index but provide no fundamental corrective mechanism) and risk-parity strategies (leveraging the least volatile asset index, only to try to sell it quickly should its volatility spike), the increased dominance of rapid-momentum trading algorithms, and the ‘reach for yield’ in less liquid corners of global credit markets are interdependent developments that could make a reversal more sudden than its build-up. Despite the opportunity cost, it is to control such tail-risks that we maintain allocations to macro and CTA strategies.

We firmly believe that a carefully selected group of managers, conducting deep fundamental due diligence and applying rigorous analytical methods, face a richer opportunity set and have the ability to differentiate themselves more clearly from their peers and competitors than ever before.