Video Content Abstract at: LINK Analytics.htm#Smith-10-02-15.

Read More »MACRO ANALYTICS – 07 14 17 – The Road to Financialization w/ Charles Hugh Smith

Anyone interested in how we got to where we are today will enjoy this tutorial discussion of the chronology of US & Global Monetary Events regarding the

Read More »02 09 15 – MACRO ANALYTICS – The Next Peg To Fall – w/ Charles Hugh Smith

Go to LINK: for supporting Interview abstract and slides.

Read More »Emerging Markets: What has Changed

Summary China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again. Former President Cardoso...

Read More »01 07 15 – MACRO ANALYTICS – 2015 Global Theme – DEFLATION – w/ Charles Hugh Smith

ri8r7

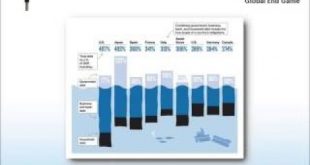

Read More »03-05-13-Macro Analytics – The Global End Game – with Charles Hugh Smith

Charles Hugh Smith's recent article The Global End Game in Fourteen Points is the basis for this discussion on the traditional Business Cycle, the Credit Cycle

Read More »BMW must pay multimillion-franc fine, Swiss court rules

The case against the Munich-based luxury car manufacturer was first sparked by a customer complaint in 2010. (Keystone) - Click to enlarge Switzerland’s highest court has confirmed a CHF157 million ($158 million) fine against German luxury carmaker BMW for blocking car shipments to Switzerland. The fine was originally levied on BMWexternal link by Switzerland’s Competition Commissionexternal link (COMCO)...

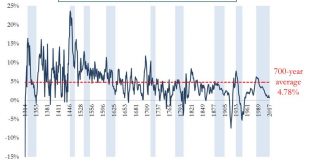

Read More »Prepare For Interest Rate Rises And Global Debt Bubble Collapse

– Diversify, rebalance investments and prepare for interest rate rises – UK launches inquiry into household finances as £200bn debt pile looms – Centuries of data forewarn of rapid reversal from ultra low interest rates – 700-year average real interest rate is 4.78% (must see chart) – Massive global debt bubble – over $217 trillion (see table) – Global debt levels are building up to a gigantic tidal wave – Move to safe...

Read More »The Downright Sinister Rearrangement of Riches

Simple Classifications Let’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star. The sun is not just a star, it is a benevolent star. Look, it is smiling… sort of. - Click to enlarge Facts, of course, must not be confused with opinions, which are based upon...

Read More »Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods. Thus, most kinds of turmoil are noticeable. Most. My own brief survey of this morning’s news from...

Read More » SNB & CHF

SNB & CHF