July is about the Olympics and reaping what was sown in June. The UK and France will have new governments. There will be a new European Commission. China will hold its Third Plenum session, out of which many expect new measures to support the economy.The Bank of Japan may announce a plan to reduce its bond purchases, which are approximately the same as the amount maturing every month and hike rates at the end of July. Reducing its JGB holdings is another step in the normalization of Japanese monetary policy. Despite the weirdly early US presidential debate at the end of last month, before either candidate was formally confirmed, the market's focus may not turn to US politics until September. In further evidence of a closely divided Federal Reserve, last month's

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Featured, macro, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

July is about the Olympics and reaping what was sown in June. The UK and France will have new governments. There will be a new European Commission. China will hold its Third Plenum session, out of which many expect new measures to support the economy.

The Bank of Japan may announce a plan to reduce its bond purchases, which are approximately the same as the amount maturing every month and hike rates at the end of July. Reducing its JGB holdings is another step in the normalization of Japanese monetary policy.

Despite the weirdly early US presidential debate at the end of last month, before either candidate was formally confirmed, the market's focus may not turn to US politics until September. In further evidence of a closely divided Federal Reserve, last month's Summary of Economic Projections showed seven officials thought one cut would be appropriate this year and eight saw the likely need for two cuts. The four officials that expected not to change rates pushed the median in favor of the one-camp. Despite what may appear to be a cacophony of Fed voices, there does seem to be an agreement that further progress toward the inflation target is necessary to be convincing.

Still, taking a step back, the US policy mix stands out, and may help explain the dollar's strength. The best policy mix for a currency is loose fiscal policy and tight monetary policy. A couple notable examples may help illustrate the point. It was the policy mix associated with Reagan-Volcker that saw the first post-Bretton Woods dollar rally. The dollar rally reached such proportions and was fueling American protectionism in response to a yawning trade deficit that the G5 countries coordinated intervention to weaken it in September 1985.

It is also the policy mix associated with Germany and the uber-mark after the Berlin Wall fell. The fiscal expansion was in the form of the levered buyout of the east (attractive conversion of Ostmarks to Deutschmarks) while the Bundesbank tightened monetary policy. The Deutschmark rally caused strains within the European Exchange Rate Mechanism. It precipitated a crisis whose resolution was the Economic and Monetary Union and a common currency, the euro.

Last month, the nonpartisan US Congressional Budget Office raised its projection for this fiscal year's (ending September 30) to 6.7% (from its earlier estimate of 5.3%) and 6.3% in FY 23. Meanwhile, the Federal Reserve is pursuing a restrictive monetary policy, and now appears that it will be among the last of the G10 central banks to cut rates.

In contrast to the US expanding fiscal policy and tight monetary policy, the European Union is moving in the opposite direction. The EC is beginning the process to tighten the enforcement of its budget rules (after suspending them due to the pandemic and energy shock spurred by Russia's invasion of Ukraine). While fiscal policy becomes less accommodative, the ECB has begun a rate cutting cycle.

The OECD expects Canada's budget deficit to fall below 1% of GDP this year and the central bank also has begun an easing cycle. The swaps market sees the Bank of Canada as the most aggressive in cutting rates the second half. After beginning the easier monetary policy in June, two more cuts are nearly fully discounted before the end of the year.

Japan is an obvious exception. It is tightening both monetary and fiscal policy. The OECD projects the budget deficit to fall to 3% this year from 5.2% last year. The Bank of Japan has begun to normalize monetary policy. More steps are likely this month. Another rate hike is possible, but the market's focus is on the BOJ's bond purchases. Currently, the pace of purchases offsets the maturing issues. A meaningful reduction in JGB purchases will signal what has become known as "quantitative tightening" where the maturing issues are greater than the new purchases.

Australia and the UK are also exceptions and that may help explain the resilience of the Australian dollar and the sterling. Australia's budget deficit is set to grow this year to almost 2%, according to the OECD, and income tax cuts will be implemented starting this month. Price pressures remain elevated, and the central bank has not adopted an easing bias. After a higher-than-expected May CPI reading, the market upgraded the chances of a hike to almost 60% by the end of Q3 (from less than 20%). This policy mix consists of expanding fiscal policy and restrictive policy for longer.

The Official for Budget Responsibility forecasts the UK budget deficit will fall to 3.1% this year from 5% last year. The OECD is more skeptical and projects a 4.6% shortfall. The swaps market does not have the first BOE rate cut fully discounted until November. By then, some central banks, including the European Central Bank, the Swiss National Bank, Sweden's Riksbank, and the Bank of Canada may have all cut rates again. We are more optimistic that a BOE rate can be delivered in August/September.

Emerging market currencies mostly traded with a heavier bias and both the JP Morgan, and the MSCI emerging market currency indices extended this year's decline in June. For what appeared to be various idiosyncratic factors, Latam currencies underperformed. The five weakest emerging market currencies last month were from the region. The Colombian peso was the hardest hit, losing 7.2%, followed by the Mexican's peso's nearly 7% decline. The Brazilian real lost about 5%, the Chilean peso almost 4%, and the Peruvian sol lost nearly 3%.

The premium demanded by investors for holding emerging market bonds widened according to the JP Morgan index, for the third consecutive month. The MSCI Emerging Market equity index outperform its major market index. The two have been alternating in the relative performance in the first half, and although the monthly performances have been divided, the major market index is up nearly twice the emerging market index.

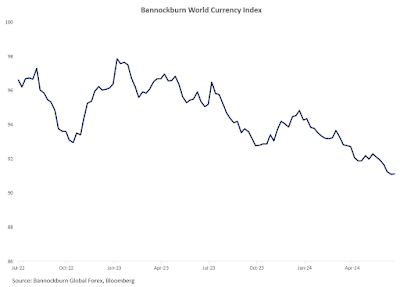

The continued weakness of most major and emerging market currencies against the dollar was reflected in new 20-year lows in Bannockburn's World Currency Index, a GDP-weighted basket of the currencies from the 12 largest economic areas. The BWCI fell by almost 0.9%. It was the fifth loss in the first six months of the year and brings the year-to-date decline to nearly 4%.

The Australian dollar was the only major currency in the index to have appreciated against the US dollar in June. Still, it has a low weight (2.1%) and remains within a one-cent range that has dominated the activity since mid-May. Half of the emerging market components rose against the dollar. The Russian ruble's 5.75% rally is a special case, and after it, the South Korean won performed best with about a 0.6% gain. Its weight in the index is the same as Australia's. The Mexican peso and Brazilian real were the worst performers in the BWCI and together have a 4.2% weight. Given the euro's weight in the index of nearly 18%, its 1.35% decline accounted more nearly twice the decline in the BWCI as the peso and real.

U.S. Dollar: Three considerations helped lift the dollar in June. First, while standing pat, the Federal Reserve median dot shifted to only one cut this year rather than the three anticipated in December 2023 and March 2024. Second, for the first time, the ECB cut rates ahead of the Federal Reserve, and another cut is favored in September. Half of the G10 central banks have cut interest rates. In addition to the trajectory of monetary policy, European politics, and especially, the snap French election, helped the dollar, even though the US election in November may be disruptive for the capital markets. Third, the Bank of Japan disappointed many participants by not announcing a change in its bond purchases, which served to dampen expectations of a rate hike in July. Still, true to the recent pattern, investors are more dovish than the Federal Reserve and is discounting more than an 85% chance that two cuts will be delivered this year. Many agree with the San Francisco Federal Reserve President Daly who cautioned that the labor market may be at an inflection point, as the four-week moving average of weekly jobless claims rose to its highest level since last September. The slower jobs growth may be reflected in the three-month moving average of nonfarm payrolls falling to its lowest level since last November, which itself was the lowest since January 2021 that reflected the pandemic. The market may be particularly sensitive to a tick up in the unemployment rate. The June CPI will be reported on July 14 and the year-over-year pace seems to be little changed from May's 3.3%-3.4% year-over-year pace. The first estimate of Q2 GDP will be published the week before the FOMC meeting (July 30-31). There is a consensus that Q2 GDP will be better than the 1.3% in Q1 23 (2.0%-3.0%), and there is little doubt that the Fed will stand pat. The statement may temper the June assessment of a "solid pace" of economic activity and "strong" job gains.

Euro: Given the European Central Bank's rate cut, and the markets' anticipation of another one before the Federal Reserve cuts once, and the political uncertainty in the wake of the snap French election, the euro held up remarkably well. It began the month rising to its best level of the quarter, slightly above $1.0915. It sold off and approached but held above the May low ($1.0650). Despite the shift to the right in the European Parliament, a centrist European Commission has been formed. In France, many investors appear to prefer Le Pen's National Rally to New Popular Front on the left. While polls give it a plurality, an outright majority seems like a stretch. The second round will be held on July 7. Last month the EC cited France, along with several other members, and have begun excessive deficit procedures. That was less a month after S&P downgraded France's credit to AA- from AA. The IMF warned that a "substantial" extra effort is needed to get French debt under control. The risk is that the new EC will be challenged by French political developments, the snubbing of Meloni, and the escalating trade tensions with China after levying an extra tariff on Chinese-made electric vehicles. Nevertheless, as a likely part of a broader US dollar pullback, we look for the euro to trade higher after some of the political clouds are lifted. There may be potential back toward $1.0850.

(As of June 28, indicative closing prices, previous in parentheses)

Spot: $1.0715 ($1.0850) Median Bloomberg One-month forecast: $1.0745 ($1.0700) One-month forward: $1.0730 ($1.0865) One-month implied vol: 6.5% (5.2%)

Japanese Yen: Japan spent a record JPY9.4 trillion (or about $62 bln) to defend the yen in April and May, but it hardly bought a month's worth of time. In June, the market succeeded in pushing the dollar to nearly JPY161.30 in a one-way market that saw the yen weaken for 12 of 15 sessions, including a streak of seven consecutive losing sessions. The market was generally skeptical of the probability of success of the intervention, given the still wide gap between US and Japanese rates. However, the yen's decline accelerated after the Bank of Japan held off announcing a decision to reduce bond purchases (which would signal the start of quantitative tightening, whereby the new bond purchases are not sufficient to replace the maturing issues in full) until the July meeting. A few days later, the US Treasury put Japan on its currency-watch list. Although that formulaic result was a consequence of Japan's rising exports to the US and its growing current account surplus, many thought it represented another hurdle to intervention. Ironically, the intervention dynamics and market positioning may help explain why the yen did not benefit from the roughly 25 bp decline in the US 10-year yield in June, the biggest monthly decline of the year. The Bank of Japan is likely to hike its overnight target rate at the end of the month, arguably creating better optics for intervention if needed, and reduce its bond purchases (from around JPY6 trillion to JPY5 trillion, maybe).

Spot: JPY160.90 (JPY157.30) Median Bloomberg One-month forecast: JPY158.20 (JPY153.50) One-month forward: JPY160.15 (JPY156.60) One-month implied vol: 9.5% (8.3%)

British Pound: Sterling's recovery from the year's low in late April ($1.2300) extended briefly above $1.2850 near mid-June. That was the peak, and sterling was sold to almost $1.2600 in late June. For the second consecutive meeting, by a seven-to-two vote, the Bank of England stood pat. Still, we suspect the risk of an August rate cut is greater than the 65% chance discounted in the swaps market, even though the best news on inflation is behind it. There is little doubt that Labour will win the July 4 election. The issue is by how much, and how much of the Tory vote will be garnered by Farage's Reform UK party. Labour is committed to a fiscally conservative course, and its pending victory has not disrupted the capital markets. The most important date for the trajectory of the Bank of England is July 17-18 when June CPI and the next employment report are due. A moderation in the headline rate of inflation (which rose by 0.3% in April and May), and services inflation (5.7% in May), with progress in wage moderation (5.9%, three-month average growth, year-over-year) could help facilitate an August cut. Provided the $1.26 area holds, sterling may trade higher in July, helped on the margins by the lifting of the political uncertainty.

Spot: $1.2645 ($1.2740) Median Bloomberg One-month forecast: $1.2630 ($1.2500) One-month forward: $1.2650 ($1.2745) One-month implied vol: 5.9% (5.8%)

Canadian Dollar: In June, US dollar tested both sides of the second quarter's range against the Canadian dollar: CAD1.36-CAD1.38. Given the Bank of Canada's rate cut and the hawkish hold by the Federal Reserve, remaining rangebound says something about the Canadian dollar. Moreover, the swaps market was pricing in a strong chance of a follow-up cut in July, but the higher-than-expected May CPI dampened such speculation. The Bank of Canada need not be in a rush. It seems that while Q1 growth of 1.7% annualized overstates the recovery after the slight contraction in H2 23, it remains intact. The economy grew by 0.3% in April after stagnating in March. April retail sales surged 1.8%, enough to offset the cumulative Q1 decline of 0.7%. Still, the unemployment rate is rising, and jobs growth is slowing. Over the past 30- and 60-sessions, the Canadian dollar seems more sensitive (correlation of changes) to the general direction of the dollar (Dollar Index as proxy) than to the risk-environment (S&P 500 as proxy). While a break of the trading range does not appear imminent, we are inclined to see an eventual downside break.

Spot: CAD1.3680 (CAD 1.3630) Median Bloomberg One-month forecast: CAD1.3650 (CAD1.3600) One-month forward: CAD1.3670 (CAD1.3620) One-month implied vol: 4.9% (4.9%)

Australian Dollar: The Australian dollar has been largely confined to half-cent range around $0.6650 since the middle of May. The lower end was frayed in early June, but the Australian dollar only settled once below $0.6600. The Reserve Bank of Australia continued to warn that demand is running ahead of capacity and has not ruled out another hike. The market did not take it very seriously until the May CPI jumped to 4.0% from 3.6% (reported on June 26). Understanding the RBA's reaction function, Q2 CPI due at the end of the month is arguably the most important economic data point in the month. Now the market is pricing in around a 50% chance of a September hike. At the end of May, there was a de minimis chance of a cut discounted. Australia's income tax cuts can help boost demand, which the RBA already sees in excess of capacity. If the Australian dollar is going to break out its range, we look for a move higher, though it has not closed above $0.6700 since mid-January. The Reserve Bank of New Zealand has downplayed the need for a rate cut if the economy evolves as it expects. However, the market thinks otherwise, and the swaps market has a cut discounted one cut fully in H2 and about a 20% chance of a second cut.

Spot: $0.6670 ($0.6655) Median Bloomberg One-month forecast: $0.6680 ($0.6600) One-month forward: $0.6675 ($0.6660) One-month implied vol: 8.1% (8.2%)

Mexican Peso: In first five months of the year, the Mexican peso was among the most resilient currencies in the face of the US dollar's recovery from its Q4 23 sell-off. It had slipped less than a third of a percentage point. Following the election results, which gave the Morena Party a sufficient majority in the lower chamber and almost as much in the upper chamber that constitutional reform is likely, the peso fell by more than 10% in the first half of June before stabilizing. Judging from surveys and the Commitment of Traders, asset managers and speculators in the futures market went into the election long pesos, seemingly expecting the Morena Party to win but not the landslide that emerged. Investors are wary of one of the key reforms being sought, the election of judges. The fear is that this will politicize (and weaken) a key check on the populist power. President-elect Sheinbaum has also warned of that the budget deficit may be closer to 3.5% than the 3% projected, which also plays on investors' anxieties. Still, some key cabinet appointments from the moderate wing of the party may have been encouraging but the more immediate focus is on what AMLO will do in his last few months in office, and especially in September, when the new congress sits, and before Sheinbaum's inauguration. The high interest rate (11% overnight target) makes is expensive to short without strong momentum, and the strong downside momentum has eased. The dollar found new bids on the pullback from MXN19.00 to almost MXN17.75.

Spot: MXN18.32 (MXN17.01) Median Bloomberg One-Month forecast: MXN18.06 (MXN17.10) One-month forward: MXN18.41cad (MXN17.10) One-month implied vol: 14.5% (10.5%)

Chinese Yuan: The measures that Beijing previously announced to absorb the unsold housing stock will take some time to roll out and in the meantime the property sector remains a drag on activity. The delay of the Third Plenum session from late last year to this month gives it a greater sense of importance, or at least anticipation. The thrust of the Third Plenum is about broad reform agenda of the nation and party. There are hopes that new stimulus measures and incentives will be provided to ensure this year's growth target of 5% is achieved. Beijing may have the power to take dramatic steps to reinvigorate the economy, it does not seem to be Xi’s way. China's equity markets ae underperforming, though foreign companies with operations have been actively issuing yuan (panda) bonds. The 10-year Chinese bond yield fell below 2.20% for the first time in at least a dozen year. The US 10-year premium over China narrowed for the second consecutive month in June but above 200 bp, it is still wider than any time last year or 2022. The central bank continues to moderate the pace of the yuan's decline. The yuan fell for the sixth consecutive month in June. The roughly 0.4% decline last month brought the year-to-date depreciation to about 2.35%. It is the third strongest Asia Pacific currency after the Hong Kong dollar and the Indian rupee. It has outperformed all the G10 currencies, but sterling. The dollar re-entered the CNY7.25-CNY7.30 range we had been anticipating, and we expect it to work in that range in the coming weeks. Concern over the currency may help explain the reluctance to cut rates. Ironically, that could imply waiting until the Federal Reserve moves.

Spot: CNY7.2675 (CNY7.2420) Median Bloomberg One-month forecast: CNY7.2615 (CNY7.2500) One-month forward: CNY7.1365 (CNY7.1125) One-month implied vol: 4.8% (4.8%)

Tags: Featured,macro,newsletter