Simple Classifications Let’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star. The sun is not just a star, it is a benevolent star. Look, it is smiling… sort of. - Click to enlarge Facts, of course, must not be confused with opinions, which are based upon observations. Barack Obama throws like a girl. The Federal Register is for idiots. Two slices of chocolate cake are one too many. Are these opinions right or wrong? The answer depends on who you ask. What’s certain about opinions, however, is that like bellybuttons, everybody has one. Moreover, unlike

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Simple ClassificationsLet’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star. |

|

| Facts, of course, must not be confused with opinions, which are based upon observations. Barack Obama throws like a girl. The Federal Register is for idiots. Two slices of chocolate cake are one too many. Are these opinions right or wrong?

The answer depends on who you ask. What’s certain about opinions, however, is that like bellybuttons, everybody has one. Moreover, unlike free drugs from the government, everyone is in fact entitled to their own opinion. Moving on from facts and opinions, the next classification we encounter is the wholly asinine. This broadly contains the absurd and ridiculous. Take most university teachers, barring natural science professors, for instance. They’re wholly asinine. The wholly asinine also extends to editors at the New York Times, Washington Post, circus hunchbacks, and the like. Lastly, we want to mention the downright sinister. This includes sociopaths like Hillary Rodham Clinton, John McCain, nearly all of Congress, the Federal Reserve, fractional reserve banking, Washington lobbyists, a good part of Wall Street, and much, much more. Clearly, such people and professions don’t represent honest work. Rather, they epitomize less than honest work that’s performed by less than honest people. |

Sinister mafia boss from Arkansas, possibly checking classified material on private phone… |

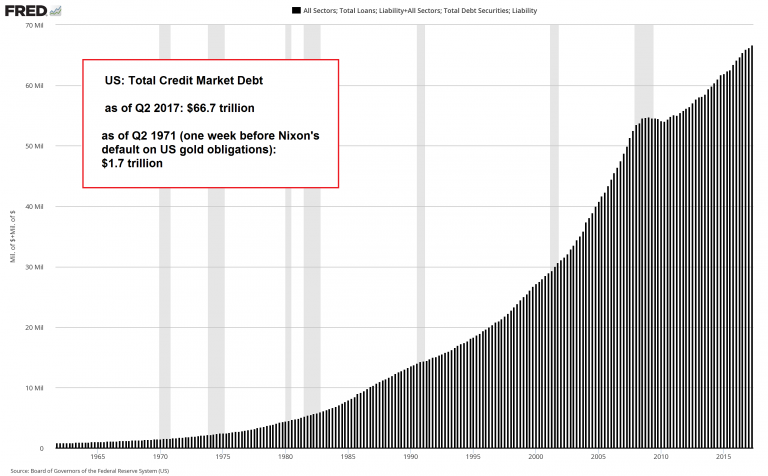

Nixon Casts the DieFrom this point forward, the weight of today’s reflection falls squarely on the shady shoulders of the downright sinister. But within this category, we dig deeper and uncover a certain subcategory: grand larceny. Namely, we want to better understand the incessant pilfering going on about us. Where to begin? When Tricky Dick Nixon closed the gold window in 1971, severing the last tether holding the money supply in orbit, the national debt was under $400 billion. Today it’s over $20 trillion. What’s more, it’s now common for a single year’s budget deficit to top $1 trillion. But it’s not just government debt that has drifted into deep space due to the Federal Reserve’s ability to issue limitless credit. Corporate and consumer debt has also drifted out of orbit. Since 1971, nonfinancial corporate debt has increased over 3,200 percent. And consumer debt is now at a record high of $12.8 trillion. However, while public and private debt has radically increased, and the money supply has radically inflated, economic growth has lagged. Certainly, one would expect this radical money supply inflation and debt growth to show up in consumer prices. Yet somehow consumer prices are always reported as being nearly flat. One reason for this is that the government’s statisticians at the Bureau of Labor Statistics have made a fine art of subtracting price inflation from their monthly propaganda reports. Hedonic price adjustments. Price deflators. Seasonal adjustments. These all serve to mask the rate of consumer price inflation and to conceal the effects of the Federal Reserve’s ongoing currency debasement program. Specifically, these various adjustments and deflators paint an incomplete picture of what’s going on. For what good is it if you can get a really powerful laptop computer for $500 and a new pair of jeans for $20, when half your paycheck goes to pay the rent and another quarter of it goes to cover medical insurance and transportation costs? In addition, it has become near impossible to get a college education without going tens of thousands of dollars into debt. |

US Total Credit Market Debt, 1965 - 2015 Total US credit market debt – ever since Nixon’s gold default and the adoption of a completely unanchored fiat money system, debt has grown at an explosive trajectory. - Click to enlarge At the same time, economic output growth has slowed ever more, decade after decade. This is a sign that the massive growth in the supply of money and credit has fostered malinvestment and capital consumption on a grand scale. |

The Downright Sinister Rearrangement of RichesThe discrepancy between low cost consumable goods and living, transportation, medical, and education costs illustrate the true effects of the government’s incessant pilfering of the wage earner, student debtor, and fixed income retiree. Those who’ve never scratched below the surface to take a closer look at what’s going on may be unclear how Nixon’s closure of the gold window has been so destructive for so many people. This is understandable; most are unable to diagnose it. However, the ultimate effect of these actions, including debt servitude, has been demonstrated for millennia. |

Nixon “temporarily” suspends the gold standard and concurrently imposes tariffs and price controls. The usual bromides and economic falsehoods are provided as justifications, including the standard attack on “shadowy foreign speculators” who are supposedly attacking an innocent US dollar. This is an excellent demonstration of a fact people need to be reminded of over and over again: governments lie. |

Ironically, John Maynard Keynes, the godfather of modern day economic intervention by governments, confessed to this fact. If you didn’t know, Keynes provided one of the better explanations of the relationship between money debasement and the economy. What follows is an excerpt of Keynes from The Economic Consequences of the Peace, written in 1919.

Could there be a more accurate characterization of the present structure of systematic grand larceny? More importantly, what should one do? First, one should grin and bear it. Then one should grin and bear it some more. After that, one should buy gold. |

What did Lenin actually say about currency debauchment? The complete quote was: “Experience has taught us it is impossible to root out the evils of capitalism merely by confiscation and expropriation, for however ruthlessly such measures may be applied, astute speculators and obstinate survivors of the capitalist classes will always manage to evade them and continue to corrupt the life of the community. The simplest way to exterminate the very spirit of capitalism is therefore to flood the country with notes of a high face-value without financial guarantees of any sort. Already even a hundred-ruble note is almost valueless in Russia. Soon even the simplest peasant will realize that it is only a scrap of paper, not worth more than the rags from which it is manufactured. Men will cease to covet and hoard it so soon as they discover it will not buy anything, and the great illusion of the value and power of money, on which the capitalist state is based will have been definitely destroyed. This is the real reason why our presses are printing ruble bills day and night, without rest.” |

Tags: Featured,newsletter,On Economy,On Politics