Ten newly launched US spot bitcoin exchange-traded funds (ETFs) broke their daily volume records on February 28, 2024, totaling nearly US.7 billion worth of assets being traded on that day alone, data shared on X by James Seyffart, an ETF analyst at Bloomberg Intelligence, reveal. The figure represents a staggering 63.8% increase from their previous peak of US.7 billion from their first day of trading on January 11, 2024, and demonstrates booming interest from investors in the new asset class. BlackRock’s iShares Bitcoin ETF (IBIT) is emerging as the clear winner, leading the group with US.4 billion traded on February 28 through with nearly 97 million shares traded. IBIT is followed by Grayscale Bitcoin Trust BTC (GBTC) with US.9 billion and 34 million

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, cryptocurrency, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Ten newly launched US spot bitcoin exchange-traded funds (ETFs) broke their daily volume records on February 28, 2024, totaling nearly US$7.7 billion worth of assets being traded on that day alone, data shared on X by James Seyffart, an ETF analyst at Bloomberg Intelligence, reveal.

The figure represents a staggering 63.8% increase from their previous peak of US$4.7 billion from their first day of trading on January 11, 2024, and demonstrates booming interest from investors in the new asset class.

BlackRock’s iShares Bitcoin ETF (IBIT) is emerging as the clear winner, leading the group with US$3.4 billion traded on February 28 through with nearly 97 million shares traded. IBIT is followed by Grayscale Bitcoin Trust BTC (GBTC) with US$1.9 billion and 34 million shares traded, and Fidelity Wise Origin Bitcoin Fund (FBTC) with US$1.4 billion and almost 27 million shares.

The new record for #Bitcoin ETF trading volume is officially $7.69 billion. Previous record was $4.66 billion from launch day. https://t.co/rZsOSUqk35 pic.twitter.com/QaOKe2LuVU

— James Seyffart (@JSeyff) February 28, 2024

The US Securities and Exchange Commission (SEC) approved 11 spot bitcoin ETFs on January 10, 2024 from asset managers including BlackRock, Invesco and Fidelity. These regulated investment funds, which are traded on traditional securities exchanges, allow investors to gain exposure to bitcoin without directly owning the cryptocurrency, increasing access to the cryptocurrency for everyday investors.

Bitcoin ETFs operate by allowing investors to buy shares that represent ownership in actual bitcoins held by the fund. These issuers manage purchasing, storing, and safekeeping of bitcoin on behalf of ETF investors in exchange for an annual fund management fee.

The approvals of US-listed bitcoin ETFs were a win for the crypto industry, which faced turmoil over the prior two years with several high-profile collapses including crypto exchange FTX.

Since their debut last month, ten of the newly listed spot bitcoin ETFs have witnessed tremendous traction, drawing in nearly US$7.4 billion in net inflows, data from BitMEX Research show. This week, allocations to the ETFs accelerated, surpassing US$1.7 billion in three days, with BlackRock’s IBIT alone pulling in US$1.2 billion of fresh funds.

[1/5] Bitcoin ETF Flow – 28th Feb 2024

All data in. Today was a record inflow day, with $673.4m of net inflow. This was driven by Blackrock, which also had a record day, with $612.1m of inflow pic.twitter.com/vklRVtrDoI

— BitMEX Research (@BitMEXResearch) February 29, 2024

Attacking Gold ETFs

These heavy inflows have sparked comparisons between bitcoin and gold with analysts speculating about how long it will take for the total assets under management (TAM) of bitcoin ETFs to surpass TAM for gold ETFs. Bloomberg senior ETF analyst Eric Balchunas predicts that this could take less than two years to achieve given the current market frenzy.

Gold's Pain is Bitcoin ETFs' Gain in Store of Value Smackdown.. new from me on how gold being in the gutter is like the cherry on top for bitcoin fans who just got to witness the biggest ETF launch ever. Decent chance bitcoin ETFs pass gold ETFs in aum in less than 2yrs w… pic.twitter.com/rXJra1dyhF

— Eric Balchunas (@EricBalchunas) February 26, 2024

Echoing Balchunas, Hunter Horsley, CEO of American crypto index fund manager Bitwise Investments, stated on X: “Bitcoin is going to eat into gold’s TAM faster than people expect. US$250k Bitcoin could happen much sooner than most who’ve followed the space for years would imagine.”

Bitcoin Passed 60’000USD

The market upsurge is also likely a sign that retail traders are using the bitcoin ETFs to participate in the ongoing bitcoin rally. On February 28, 2024, bitcoin surged past US$62,000, a level last seen in November 2021 and which represents an increase of 40% since the beginning of the year.

Price of bitcoin year-to-date, Source: CoinDesk Indices, Feb 29, 2024

This rise was largely driven by the launch of the US spot bitcoin ETFs and their subsequent success, fueling demand for the cryptocurrency and pushing its price further up.

Data from Vetle Lunde, a senior analyst at Norwegian digital assets brokerage K33, reveal that US spot ETFs now hold more than 760,000 BTC under management. Since their launch, these funds have seen a net inflow of over 149,000 BTC, with the past three days alone pulling in some 30,000 BTC.

U.S. spot ETFs now hold 768,280 BTC. They have seen a net inflow of a whooping 149,080 BTC since its launch.

The net flows in the past three days sit at a massive 30,754 BTC! pic.twitter.com/ndhTt3oa94

— Vetle Lunde (@VetleLunde) February 29, 2024

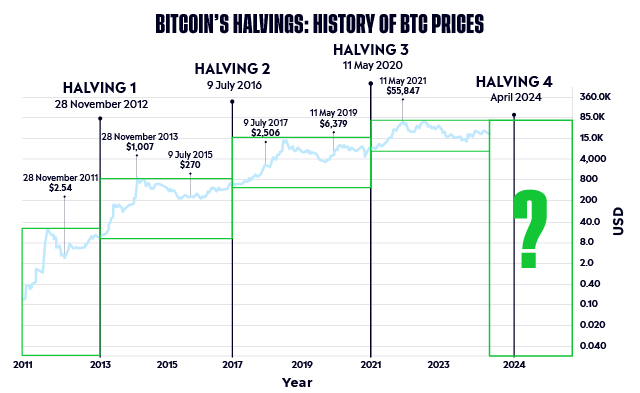

Another possible factor driving the rally is the upcoming bitcoin halving. The pre-programmed event, which occurs approximately every four years, is designed to control the issuance rate of new bitcoins into circulation by cutting the reward for mining bitcoins by half.

Upcoming Bitcoin Halfing

After the halving, which is expected to take place in April, the number of new coins mined daily will decline to 450 from 900 currently, effectively decreasing the rate of supply growth. If demand for bitcoin remains constant or increases, the reduction in new supply entering the market could create a supply-demand imbalance and potentially lead to upward price pressure, advocates claim.

Bitcoin’s halvings history, Source: eToro

Despite investor enthusiasm in the availability of bitcoin ETFs, advisors and top management at the European Central Bank (ECB) argue that bitcoin remains unsuitable both as a means of payment and as an investment.

ECB Sees Fair Value of Bitcoin at Zero

In a new blog post published on February 22, 2024, Ulrich Bindseil, general director of the Market Infrastructure and Payments at the ECB, and Jürgen Schaaf, an advisor to the senior management of the Market Infrastructure and Payments at the ECB, state:

“On 10 January, the US SEC approved spot ETFs for bitcoin. For disciples, the formal approval confirms that bitcoin investments are safe and the preceding rally is proof of an unstoppable triumph. We disagree with both claims and reiterate that the fair value of Bitcoin is still zero. For society, a renewed boom-bust cycle of Bitcoin is a dire perspective. And the collateral damage will be massive, including the environmental damage and the ultimate redistribution of wealth at the expense of the less sophisticated.”

The authors attribute the ongoing price rally to factors including rising interest rates, the forthcoming bitcoin halving and the approval of spot bitcoin ETFs, but warn that such upswings are not sustainable in the absence of economic fundamentals.

They criticize US regulatory authorities for their perceived failure to address the risks associated with bitcoin, and call for tighter regulation and enforcement measures to protect society from the negative consequences of bitcoin’s volatility, speculative behavior, and its associated risks.

Featured image credit: edited from freepik

The post US Spot Bitcoin ETFs Daily Trading Volume Soars to 6 Billion USD appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain/Bitcoin,cryptocurrency,Featured,newsletter