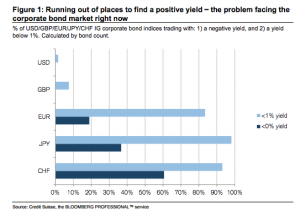

A question worth asking considering the rather large amount of them knocking about at the moment. According to JPM, the total universe of government bonds traded with a negative yield was $3.6tr last week or 16 per cent of the JPM Global Government Bond Index. It’s an answer in itself, really. Anyway, here’s a list of those willing/ forced to buy those negative yielding government bonds from JPM’s Niko Panigirtzoglou:

1) Investors who fear or expect deflation tend to find nominal bonds with even negative yields attractive as long as expected deflation makes real yields positive. In a deflationary environment investors tend to shift away from real into nominal assets. During the previous two decades in Japan, this took the form of a shift away from equities and real estate into cash and nominal JGBs.

2) Investors who speculate on currency appreciation, for example investors buying Swiss or Danish government bonds to speculate on CHF or DKK currency appreciation.

3) Investors who expect capital gains from central bank easing i.e. rate cuts or QE.