Here’s a rough piece of calculation based on the last few years of news: When x happens, yields fall. An example of this post-GFC rule-of-thumb was Brexit and its fallout. The potential lesson from said rule is that yield hunting isn’t fun anymore, say Credit Suisse’s William Porter and team, with our emphasis: Negative (or very low) 10-year Bund yields have not been a boon for European credit markets, based on our analysis of recent history. For as long as they continue, we would warn against strong yield-seeking behaviour as a medium-term strategy. The time to hunt for yield as a dominant strategy (rather than as a short-term trade) might actually be when yields start to rise. And to set the scene… look at the absolute state of the corporate bond market right now. The cold pull of negativity is now a reality in euro corporate bonds as they follow the path trod by their Swiss cousins. Some 20 per cent of IG corporates are trading with a negative yield, a stat presumably pushed along by the ECB’s corporate bond buying programme: Running out of places to find a positive yield And fine, the US market does provide some solace. But, per CS again, “excluding the USD IG corporate bond market, we can see that 25% of bonds are now negative yielding and 80% have a yield less than 1%”.

Topics:

David Keohane considers the following as important: certain period, Credit Suisse, Featured, Government bond yield, negative interest rates, negative rates, newsletter, William Porter

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

| Here’s a rough piece of calculation based on the last few years of news: When x happens, yields fall. An example of this post-GFC rule-of-thumb was Brexit and its fallout.

The potential lesson from said rule is that yield hunting isn’t fun anymore, say Credit Suisse’s William Porter and team, with our emphasis:

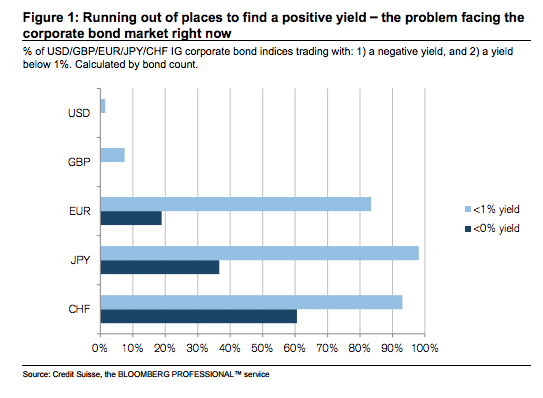

And to set the scene… look at the absolute state of the corporate bond market right now. The cold pull of negativity is now a reality in euro corporate bonds as they follow the path trod by their Swiss cousins. Some 20 per cent of IG corporates are trading with a negative yield, a stat presumably pushed along by the ECB’s corporate bond buying programme: |

|

| And fine, the US market does provide some solace. But, per CS again, “excluding the USD IG corporate bond market, we can see that 25% of bonds are now negative yielding and 80% have a yield less than 1%”. This is nuts…

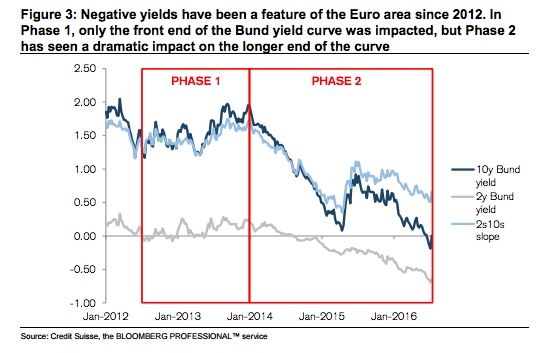

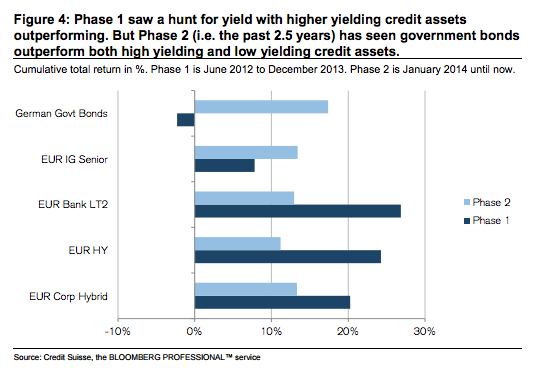

The question that CS then ask is “whether such low yields in government bond and IG corporate bond markets: 1) can be sustained, and 2) can continue to drive a hunt for yield in HY corporate bonds, CoCos, corporate hybrids and other high yielding assets”? The problem with a hunt for yield strategy for Porter et al is that it has been unsuccessful over the past 2.5yrs, as judged with Bunds as their starting point. They divide the German yield curve into two recent phases:

|

|

| Basically, in Phase 2 negative yields have taken hold and flattened the yield curve, with the 10 yr collapsing. In short, it’s not just the front end anymore. Now, with that in mind, look at “the total return performance of different asset classes during these two phases of negative yields.” |

To be crude, what you see there is a hunt for yield strategy working in Phase 1 and not working in Phase 2 — the outperformance of government bonds in the latter stands out.

As CS say:

Of course within this 2.5-year period there have been sub-periods where credit has outperformed government bonds (see Figure 5), and going forward we would expect more sub-periods like this. But January 2014 marked a very clear regime change for government bond yield curves and that regime is still in operation today, in our view. And over this whole period it is clear that hunting for yield has not been the right strategy in European fixed income markets…

While this result may come as a surprise, it should not. Taken as a snapshot in time, negative (or very low positive) yields should of course see investors rotating out of such assets into higher yielding assets, and that has happened for short periods of time within the past 2.5 years. But implicitly yields are a hold-to-maturity concept, and actual returns can, for certain periods, deviate quite far from that implied by yields as we have seen in recent years. Defining “certain periods” has become increasingly problematic as this is the fifth year of negative yields in Germany and the sixth if you include Switzerland. For 10- year bond yields in particular we could end up seeing positive returns for quite a few years going forward, at least in theory, before the pull-to-par effect starts to take place.

So negative yields have not most recently helped credit markets vs government bonds (and even within credit markets, Euro BB bonds have significantly outperformed Euro B over the last 2.5yrs, as CS note). This is still not a market to chase yield in — at least not given past short, episodic, time frames.

As CS said at the top, they think this changes when yields start to rise…

And yes, we were amongst those teasing the fund managers who said yields are “never going to rise”. But we stand by that.

Related links:

Deutsche Bahn has become the first non-financial company (admittedly state owned) to issue debt with a negative yield – FT Alphaville

In ten years times, what will we think about negative yields? – Weldon Medium

Negative govvies, why would ya? FT Alphaville