Alongside our core scenario for this year, we have a downside one which includes political and geopolitical developments that could contribute to increased market volatility in the months ahead.Over the past year and more, market fundamentals have managed to overcome the occasional, short-term bouts of volatility triggered by political and geopolitical factors. But we cannot dismiss the possibility that these factors will impinge more forcefully on economies and financial markets in the period ahead.Many of the sources of risk and uncertainty are connected to the relative decline in the power of the US, its increasing unilateralism under Donald Trump, and the crisis in global governance. The most immediate sources of global instability continue to be found in places such as the Middle

Topics:

Christophe Donay considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Alongside our core scenario for this year, we have a downside one which includes political and geopolitical developments that could contribute to increased market volatility in the months ahead.

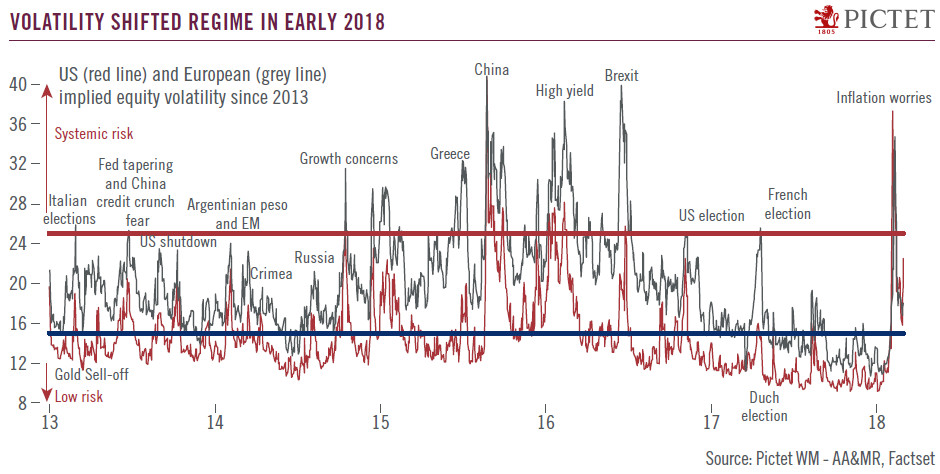

Over the past year and more, market fundamentals have managed to overcome the occasional, short-term bouts of volatility triggered by political and geopolitical factors. But we cannot dismiss the possibility that these factors will impinge more forcefully on economies and financial markets in the period ahead.

Many of the sources of risk and uncertainty are connected to the relative decline in the power of the US, its increasing unilateralism under Donald Trump, and the crisis in global governance. The most immediate sources of global instability continue to be found in places such as the Middle East, North Korea and the South China Sea. In addition, trade negotiations have hit a rocky patch and tensions between Russia and the West remain high.

On the political front, as the Italian elections show, populism remains an issue in Europe. Elections in Sweden later this year will bear watching, and in Latin America voters in Mexico and Brazil likewise have the potential to create upsets.

The new note of aggressiveness in the US’s approach to trade, populism in Europe, the long-festering problems of the Middle East and electoral upheaval in Latin America all risk eclipsing the strong corporate and economic fundamentals that have pushed risk markets higher over the past year and more. Political and geopolitical uncertainty will contribute to the rise in volatility in financial markets we expect in the months ahead. We have outlined a ‘downside’ scenario for markets posited on a sharp economic downturn and political upsets. We believe there is a 15% chance of this scenario being realised this year.