The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.Using macroeconomic regimes for asset allocationWe have identified three broad growth and inflation regimes. Analysis of the combined macroeconomic regimes shows a high degree of correlation between these regimes and asset returns.Using growth and inflation data stretching back to the end of World War Two, we have developed a

Topics:

Christophe Donay considers the following as important: asset allocation, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.

Using macroeconomic regimes for asset allocation

We have identified three broad growth and inflation regimes. Analysis of the combined macroeconomic regimes shows a high degree of correlation between these regimes and asset returns.

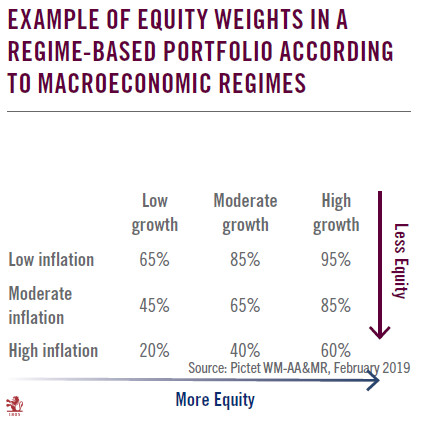

Using growth and inflation data stretching back to the end of World War Two, we have developed a methodology that identifies nine main macroeconomic regimes resulting from the interaction of three different phases of inflation (low, standard and high) and three types of growth (sluggish, standard and surging growth brought on by innovation shocks). Regime shifts occur, with varying degrees of probability, when the interaction between inflation and growth change. Unsurprisingly, a macroeconomic regime that combines moderate inflation and moderate growth is the most frequent, whereas an abrupt change from a regime of sluggish growth and disinflation to an innovation shock that produces high inflation is very rare.

Examining very long-term series of historic data enables us to properly classify different macroeconomic regimes. This approach has already helped identity correlations between different regimes and asset returns and should continue to do so in the future1. The stronger the real GDP growth, the higher the returns from the S&P 500, for example, while high inflation tends to destroy equity returns, even in a strong real growth environment.

A regime-based asset allocation assigns portfolio weightings based on the interaction between inflation and growth regimes. One might increase the allocation to equity as growth moves from a lower to a higher regime and vice versa. Conversely, one could lower the weighting of equities when inflation moves from a lower to higher regime.

Our research shows that, historically, a regime-based portfolio would have posted a higher return than a 60/40 one for a similar level of volatility, meaning that a regime-based approach could provide greater downside protection during market stress than traditional balanced portfolios.

Even though 60/40 portfolios have a very simple asset allocation approach, it is still difficult for investors to beat the risk-adjusted returns they offer in the long run. Regime-based allocation may be a first step to slightly improve these returns somewhat.

The appeal of endowment-style investing.

With the returns from classic 60/40 portfolios set to decline by over half in the coming 10 years, attention has been turning to other forms of strategic asset allocation, often to assets that offer a liquidity premium, to help investors achieve their investment goals. Specialists are increasingly looking at the style of investing adopted by US endowment funds, which are investment funds established on behalf of top-ranked universities and nonprofit organisations.

How do we explain the superior long-term investment returns earned by large endowment funds, especially over the last 20 years? Large funds have significantly reduced their exposure to traditional asset classes such as public equity and bonds over time, reallocating assets to alternatives such as private equity, real assets and absolute-return strategies. Their allocation to public equities decreased from 45% on average in 2002 to 32% in 2018 (having fallen to as low as 26% in 2009). The weighting of fixed income fell from an average of 20.5% in 2002 to just 7% over the same period2, whereas the allocation to alternative assets increased from 32% to approximately 60%. The weighting of alternative assets is far greater in large endowment portfolios than in small ones. This provides large US endowment funds with the benefits of diversification and a higher risk premium, which tends to translate into attractive long-term returns. In short, endowment-style investing can help diversification, potentially shielding portfolios at a lower cost than equities.

Diversification, the last free lunch in town?

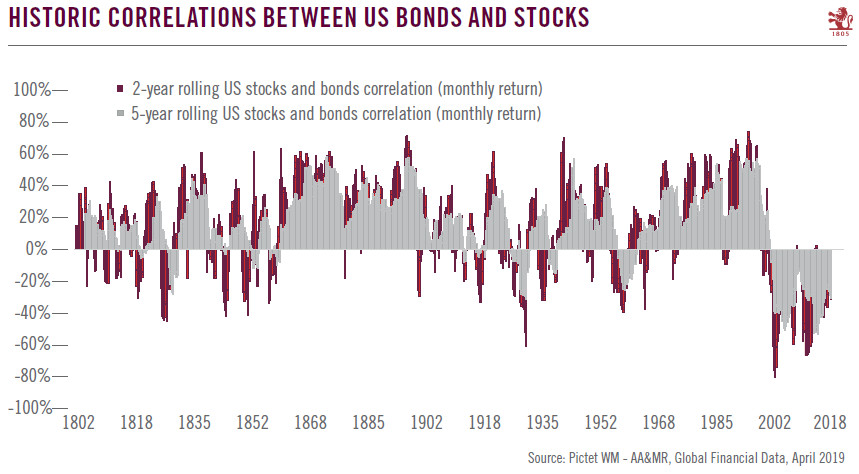

Forecasting the stock-bond correlation helps investors in their asset-allocation decisions. While other factors are at play, the correlation between the two main factors we have identified—real rates and inflation—can provide a rough estimate of the stock-bond correlation over the next 10 years.

In essence, diversification works best when the correlation between stocks and bonds is low. This correlation, which has been positive most of the time since 1800, has turned negative since the start of the century, leading to optimal conditions for diversification between stocks and bonds.

But to reap the benefits of diversification does not necessarily mean adding an ever-greater number of assets to portfolios. For instance, our analysis shows that a fixed-income investor can expect the same returns from a combination of 10-year US Treasuries and US high yield as from US investment-grade credit. However, investment grade investments make more sense in Europe over the same time horizon, where such a barbell approach is less effective. Second, the benefits of a basic diversification strategy involving stocks and bonds could be less than they have been over the past 20 years. Although inflation tends to translate into a higher stock-bond correlation, the outlook for inflation may not be strong enough to move the US stock-bond correlation back into positive territory.

There are two opposite forces at work in our secular outlook for inflation. Under a scenario based on the spread of innovation throughout the economy, inflation is expected to average 1.75% per annum in the US (i.e., a level consistent with a negative stock-bond correlation regime), whereas in the case of a populist regime shift, we see inflation reaching 3.25%, leading potentially to a positive correlation of up to 25%. In other words, populism could lead to a regime shift in the stock-bond correlation from negative to positive.

Our core, blended scenario for inflation, which takes account both of innovation (70% weighting) and the threat of populism (30%), predicts that inflation could average around 2% per year over the next 10 years, close to the current level of the consumer price index in the US. This is the scenario we used to elaborate our 10-year return expectations in the 2019 edition of Horizon. Based on our forecast for US inflation, for the real 10-year Treasury yield (1.9%) and historical statistics, the average US stock-bond correlation over the next 10 years is expected to remain negative. Under this core scenario, correlation between stocks and bonds is likely to remain negative but closer to 0 than the level that has prevailed since 2000. In other words, we continue to expect bonds to help diversify portfolios, but the benefits may not be as significant as in the past 20 years. Lower returns will be the price to pay for the extra protection that benchmark government bonds provide.