Risk assets had an exceptionally strong first quarter, but a repeat performance will require overcoming numerous obstacles.The first quarter was an exceptional one for risk assets—so exceptional that it is difficult to see how their performance can be repeated in the present quarter without some strong catalysts. According to our analysis, annualised returns on equities in the first quarter were up to three times higher than their historic average in the case of developed-market equities, and six times higher in the case of emerging-market ones.There are four areas that hold out the potential for disappointment, but also for more positive outcomes: politics, fiscal policy, economic data, and the role of central banks.First, on the political front, the coming weeks will be dominated by polls in different European countries, most notably the presidential election in France. Although nothing can be excluded, our core scenario holds as improbable the most extreme outcomes (such as ‘Frexit’). The same cannot be said about the US. With his bid to ‘repeal and reform’ Obamacare blocked, attention has swiftly turned to President Trump’s ambitious plans for tax cuts and reform as well as significant infrastructure spending, the second item sustaining market hopes at present.

Topics:

Christophe Donay considers the following as important: Macroview, market outlook, market performance, risk assets prospects

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Risk assets had an exceptionally strong first quarter, but a repeat performance will require overcoming numerous obstacles.

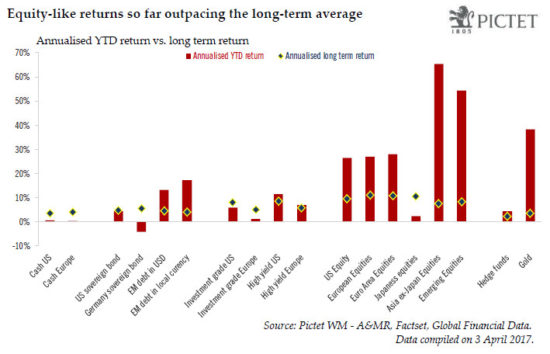

The first quarter was an exceptional one for risk assets—so exceptional that it is difficult to see how their performance can be repeated in the present quarter without some strong catalysts. According to our analysis, annualised returns on equities in the first quarter were up to three times higher than their historic average in the case of developed-market equities, and six times higher in the case of emerging-market ones.

There are four areas that hold out the potential for disappointment, but also for more positive outcomes: politics, fiscal policy, economic data, and the role of central banks.

First, on the political front, the coming weeks will be dominated by polls in different European countries, most notably the presidential election in France. Although nothing can be excluded, our core scenario holds as improbable the most extreme outcomes (such as ‘Frexit’). The same cannot be said about the US. With his bid to ‘repeal and reform’ Obamacare blocked, attention has swiftly turned to President Trump’s ambitious plans for tax cuts and reform as well as significant infrastructure spending, the second item sustaining market hopes at present.

But Trump’s plans face many hurdles in Congress and may not be voted until October and November, which means their full effect will not be felt until 2018. We are not at all sure that markets are willing to wait that long.

As for economic data, the third factor influencing market prospects, there is still a gap between ‘soft’ data, including confidence surveys of various kinds, and actual ‘hard’ statistics. Strong US consumer confidence contrasts with relatively poor consumer spending trends, for example. There is a chance that hard data and confidence surveys only meet half way. Would that be enough to assuage markets’ expectations? Here too, there is plenty of room for disappointment.

Finally, central banks are starting to withdraw their support. The Fed is well embarked on a rate-tightening cycle and is set to unveil plans to reduce its balance sheet. The European Central Bank is somewhat behind, but may shortly provide forward guidance on ending negative bank deposit rates, and by September outline plans for tapering monthly asset purchases next year. In short, we are left contemplating monetary policies that are less generous at a time when the type of fiscal policies that could compensate are not yet in place.

These considerations, plus the rapid run-up in prices, suggest risk assets could be facing a short-term reality check. Fundamentals allow us to remain buoyant about the prospects for equities and equity-like assets as a whole. But sufficient reasons can now be found for seeking to protect portfolios while the current doubts are being overcome.