The market implications of Emmanuel Macron’s win are likely to prove positive but short lived as the focus will quickly shift to the legislative elections in June.The first round of the French presidential election has come as a relief for markets as a pro-European, reformist candidate came first and now looks very likely to win the second round. For once, opinion polls were fairly accurate in capturing voting intentions and last-minute momentum. But the result of the first round is not prompting us to make any change to our base scenario for growth and inflation and Emmanuel Macron’s probable victory in the second round on 7 May still raises a number of political, economic and market questions.First, while we expect Macron to be elected president with possibly over 60% of the vote versus 40% for Le Pen, it remains to be seen how he will form a government and who will be his prime minister. He may spend the next two weeks trying to gather moderate right and left wing politicians around him ahead of the parliamentary elections in June.Economically, we know Macron is in favour of European integration and structural reforms, but his programme still needs fleshing out. He seems to represent a combination of mild Keynesianism and supply-side economics.

Topics:

Christophe Donay considers the following as important: french election hypotheses, french election scenarios, french election second round, Macron win and markets, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The market implications of Emmanuel Macron’s win are likely to prove positive but short lived as the focus will quickly shift to the legislative elections in June.

The first round of the French presidential election has come as a relief for markets as a pro-European, reformist candidate came first and now looks very likely to win the second round. For once, opinion polls were fairly accurate in capturing voting intentions and last-minute momentum. But the result of the first round is not prompting us to make any change to our base scenario for growth and inflation and Emmanuel Macron’s probable victory in the second round on 7 May still raises a number of political, economic and market questions.

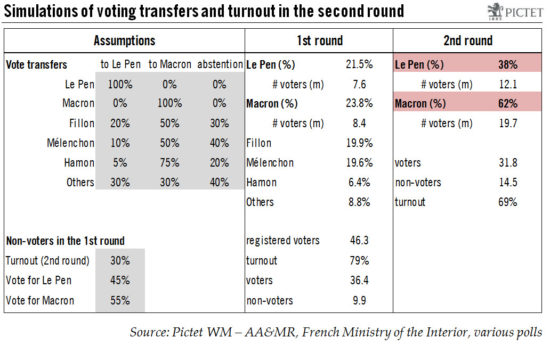

First, while we expect Macron to be elected president with possibly over 60% of the vote versus 40% for Le Pen, it remains to be seen how he will form a government and who will be his prime minister. He may spend the next two weeks trying to gather moderate right and left wing politicians around him ahead of the parliamentary elections in June.

Economically, we know Macron is in favour of European integration and structural reforms, but his programme still needs fleshing out. He seems to represent a combination of mild Keynesianism and supply-side economics. But will he be able to push through long-term structural change?

Unsurprisingly, the markets welcomed Macron’s win in the first round: the result is positive in the short term for euro equities, the euro, French government bonds and, to a lesser extent, for euro high yield. But the market reaction is likely to be short lived and of small magnitude, for two reasons: First, the outcome was more or less factored in and, second, markets still need to know more about the political coalitions Macron will form before making any durable progress, in our view.

For Marine Le Pen to win, she needs a (in our view, unlikely) combination factors: a sharp drop in overall participation, a very favourable transfer of votes, and an unprecedented increase in votes from 1st round non-voters. While not impossible, we deem such a scenario as highly unlikely.

At the same time, the best-case scenario for markets – an absolute government majority for Macron’s party – is far from guaranteed. Moreover, the ECB is likely to move to a more neutral policy stance in the coming months, effectively capping risk sentiment.