Data shows strong fixed investment and industrial production, but consumption has weakened. We still expect 2017 GDP growth of 6.2%.The first batch of hard data on domestic activity for 2017 point to strong momentum in fixed-asset investment (FAI) and industrial production, while consumption has been on the weak side. In the first two months of 2017, FAI grew by 8.9% y-o-y, compared to 6.5% for December 2016 and 8.1% for 2016 as a whole. As FAI has been the key variable that drives China’s growth in recent years, this data indicate that GDP growth very likely will remain solid in Q1 2017 and that the momentum could last through Q2 as well. Industrial production is also showing strength, rising by 6.3% y-o-y in January and February, compared to 6% for the entire 2016.The property market has also been much more resilient than we had earlier expected, with investment rising 8.9% y-o-y in Jan & Feb compared to 6.9% in 2016. In addition, Industrial production rose by 6.3% y-o-y in January and February, compared to 6% for the entire 2016.However, relatively disappointing retail sales point to weak consumer spending. The growth in nominal retail sales for January and February came in at 9.5% y-o-y, compared to 10.9% in December 2016. In real term, the growth was even lower at 8.1%.

Topics:

Dong Chen considers the following as important: china fiscal stimulus, China GDP, China growth forecast, china property investment, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Data shows strong fixed investment and industrial production, but consumption has weakened. We still expect 2017 GDP growth of 6.2%.

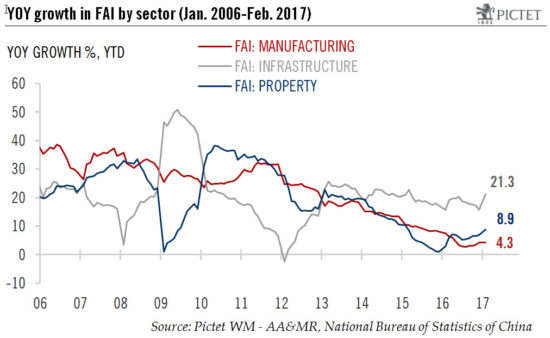

The first batch of hard data on domestic activity for 2017 point to strong momentum in fixed-asset investment (FAI) and industrial production, while consumption has been on the weak side. In the first two months of 2017, FAI grew by 8.9% y-o-y, compared to 6.5% for December 2016 and 8.1% for 2016 as a whole. As FAI has been the key variable that drives China’s growth in recent years, this data indicate that GDP growth very likely will remain solid in Q1 2017 and that the momentum could last through Q2 as well. Industrial production is also showing strength, rising by 6.3% y-o-y in January and February, compared to 6% for the entire 2016.

The property market has also been much more resilient than we had earlier expected, with investment rising 8.9% y-o-y in Jan & Feb compared to 6.9% in 2016. In addition, Industrial production rose by 6.3% y-o-y in January and February, compared to 6% for the entire 2016.

However, relatively disappointing retail sales point to weak consumer spending. The growth in nominal retail sales for January and February came in at 9.5% y-o-y, compared to 10.9% in December 2016. In real term, the growth was even lower at 8.1%.

Overall, while the first half is looking good for growth, we are more cautious about the outlook in the second half of this year. As the data clearly show, the current strength in the Chinese economy is to a large extent related to the rebound in FAI, which, in our view, is not sustainable in the medium term. While infrastructure will continue to be an important driver of growth, the support that the government may offer through fiscal spending is unlikely to be significantly larger than last year. In addition, we remain sceptical about the sustainability of the continued growth in property investment in China. For the moment, we have decided to maintain our GDP growth forecast of 6.2% for China in 2017.