Summary PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s central bank hinted at a faster pace of easing. Banco de Mexico announced a new bln FX hedging facility. Stock Markets In the EM equity space as measured by MSCI, Mexico (+2.7%), India (+1.4%), and Indonesia (+1.3%) have outperformed this week, while Egypt (-5.2%), Hungary (-3.4%), and Russia (-2.0%) have underperformed. To put this in better context, MSCI EM rose 0.5% this week while MSCI DM fell -0.1%. In the EM local currency bond space, Brazil (10-year yield -18 bp), Mexico (-14 bp), and Hungary (-12 bp) have outperformed this week, while the Philippines (10-year yield +6 bp), Romania (+4 bp), and Russia (+1 bp) have underperformed. To put this in better context, the 10-year UST yield fell 7 bp to 2.35%. In the EM FX space, MXN (+3.1% vs. USD), EGP (+1.8% vs. USD), and ARS (+1.6% vs. USD) have outperformed this week, while CLP (-0.4% vs. USD), PHP (-0.3% vs. USD), and BRL (-0.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

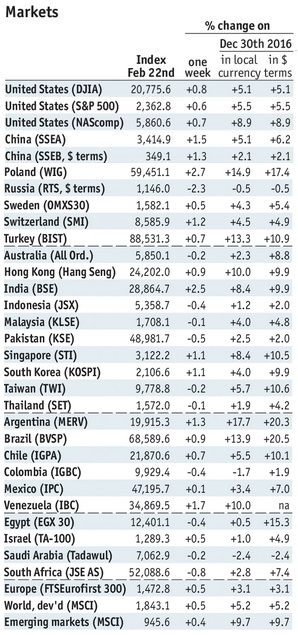

Stock MarketsIn the EM equity space as measured by MSCI, Mexico (+2.7%), India (+1.4%), and Indonesia (+1.3%) have outperformed this week, while Egypt (-5.2%), Hungary (-3.4%), and Russia (-2.0%) have underperformed. To put this in better context, MSCI EM rose 0.5% this week while MSCI DM fell -0.1%. In the EM local currency bond space, Brazil (10-year yield -18 bp), Mexico (-14 bp), and Hungary (-12 bp) have outperformed this week, while the Philippines (10-year yield +6 bp), Romania (+4 bp), and Russia (+1 bp) have underperformed. To put this in better context, the 10-year UST yield fell 7 bp to 2.35%. In the EM FX space, MXN (+3.1% vs. USD), EGP (+1.8% vs. USD), and ARS (+1.6% vs. USD) have outperformed this week, while CLP (-0.4% vs. USD), PHP (-0.3% vs. USD), and BRL (-0.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets February 22 Source: economist.com - Click to enlarge |

PBOC tweaked its process for determining the yuan reference rate. The central bank asked commercial banks to use a shorter period of time (15 hours vs. 24 hours previously) to calculate FX rates when submitting quotes for the daily reference rate. Shortening the period may let the rate better reflect market movements, but we don’t think it means a whole lot, especially since the yuan is still heavily managed.

SingaporeSingapore is reportedly studying measures to boost revenue, including higher taxes. Lawrence Wong, second minister of finance, said “Medium-term expenditures will continue to rise significantly, be it for infrastructure or for health care reasons. So we are studying revenue. Revenue means taxes.” The government is required to run a balanced budget over its term in office. RussiaMoody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. The agency said that the main driver was the government’s medium-term fiscal consolidation strategy. This is expected to lower the government’s dependence on oil and gas revenues and allow for the gradual replenishment of its savings buffers. NigeriaNigerian President Buhari extended his stay abroad. Officials said that he needs a “longer period of rest” and added that “There is no cause for worry.” Buhari left Nigeria for medical tests in London on January 19. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. It said it would provide FX to banks for retail transactions that include business/personal travel, payment of school fees, and medical bills. The bank expects these FX transactions to be settled at rates “not exceeding 20% above the interbank market rate.” For now, policymakers are showing little concern about foreign investors that need FX to repatriate money. BrazilBrazil political risk is back on the table. Lower house Vice President Ramalho threatened to break from the government because President Temer did not nominate someone from Minas Gerais to be Justice Minister. Ramalho added that he is against the current pension reform proposal and that he will reach out to others in the lower house who feel the same. Temer aides said that they will request that all government posts occupied by rebels must step down. Brazil’s central bank hinted at a faster pace of easing. Whilst cutting rates 75 bp this week, the bank made reference to a possible reduction in the “structural rate,” leading some to start looking for a faster pace and greater length of the easing cycle. CDIs are pricing in a potential 100 bp cut at the next COPOM meeting April 12, but we think the market may be getting a little ahead of itself. MexicoBanco de Mexico announced a new $20 bln FX hedging facility. Long story short, this is very much like the swaps program used by Brazil. This should allow Banxico to limit the impact of hedging demand on deliverable FX. The central bank takes on FX risk but pays out in local currency so there is no drain on its FX reserves. Any FX losses will be absorbed by Banxico, but it has been profitable over the last several years. |

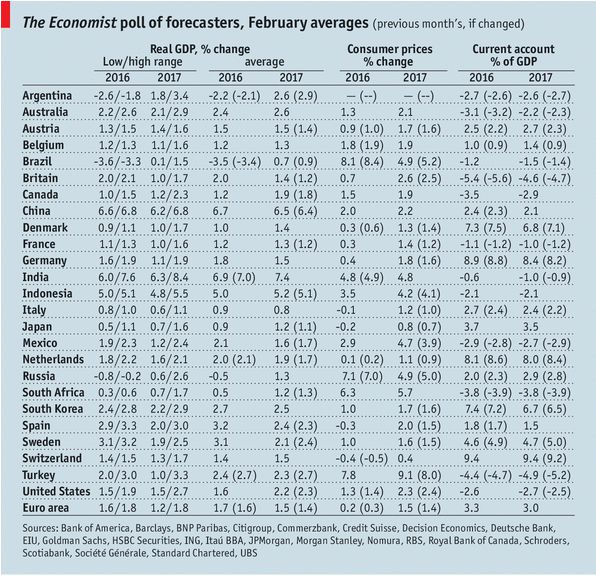

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter