The sector may remain prone to volatility until the Trump administration provides more policy clarity. But a weak 2016 at least helped reset expectations and US biopharm is riding a crest of innovation.Biopharma suffered a poor 2016 after years of strong performance. Political rhetoric was the main source of volatility, but the sector also suffered from poor execution. We think 2016 helped reset expectations and created an attractive opportunity to build long-term positions. Uncertainty will linger in the first half of 2017, but overall we expect a better relative and absolute performance this year.Key drivers of the improved outlook include the following: we are only midway through a major scientific innovation wave and late-stage clinical trials are set to mature, particularly in the second half of 2017 and even more so in 2018; EPS and revenue growth expectations are beatable; valuations are attractive and will be boosted by buybacks and M&A.Importantly, we also expect the political controversy on drugs pricing in the US to tone down, probably in the second half of the year. We think the Republican administration will ultimately adopt a more pro-business agenda. The sector will remain volatile until investors have better clarity over which views will prevail—probably within the first 100 days of the Trump administration.

Topics:

Adrien Brossard considers the following as important: Biopharma, Macroview, US drug companies, US drug pricing

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The sector may remain prone to volatility until the Trump administration provides more policy clarity. But a weak 2016 at least helped reset expectations and US biopharm is riding a crest of innovation.

Biopharma suffered a poor 2016 after years of strong performance. Political rhetoric was the main source of volatility, but the sector also suffered from poor execution. We think 2016 helped reset expectations and created an attractive opportunity to build long-term positions. Uncertainty will linger in the first half of 2017, but overall we expect a better relative and absolute performance this year.

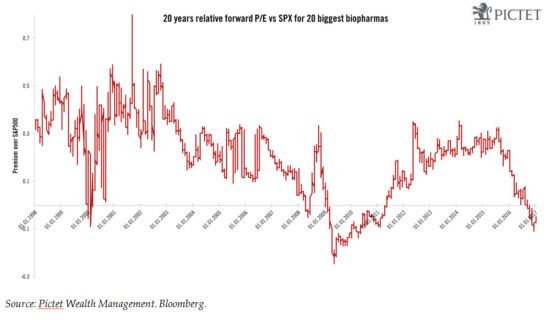

Key drivers of the improved outlook include the following: we are only midway through a major scientific innovation wave and late-stage clinical trials are set to mature, particularly in the second half of 2017 and even more so in 2018; EPS and revenue growth expectations are beatable; valuations are attractive and will be boosted by buybacks and M&A.

Importantly, we also expect the political controversy on drugs pricing in the US to tone down, probably in the second half of the year. We think the Republican administration will ultimately adopt a more pro-business agenda. The sector will remain volatile until investors have better clarity over which views will prevail—probably within the first 100 days of the Trump administration.

US biopharmas are attractive based on current multi-year low relative valuation, global trends and sector specific catalysts. However, clarity will likely be needed over what changes will be implemented by the new US administration before the sector can durably outperform again. The second half of 2017 looks to us more likely to bring performance, but we do not think that current positions should be reduced.

At a company level, US biopharmas are better positioned than their European peers to navigate pressure from commercial payers, as their drug portfolios’ relative exposure to competitive therapeutic categories is less significant. Therapeutic areas in which they specialise like oncology, orphan disease, HIV, vaccines and multiple sclerosis are more insulated from commercial-payer pressure. Profitable and innovative US companies with market values between USD20bn and USD100bn look to us to offer the best balance of growth and profitability. The very large caps will all face headwinds and will likely be forced towards M&A in the medium term, an issue that generally applies to European biopharmas as well.