Right on the Money OUZILLY, France – It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice But yesterday, Republican presidential candidate Donald Trump gave investors both good advice and good analysis. Bloomberg has the report: Donald Trump on Stocks Photo credit: Michael Nagle / Getty Images The Donald dispenses investment advice. “Better get out buddy, while the getting is still good”. Donald Trump on Tuesday said interest rates set by the Federal Reserve are inflating the stock market and recommended 401(k)-holders to get out of equities, just like he did. “I did invest and I got out, and it was actually very good timing,” the Republican presidential nominee said in a phone interview with Fox Business. “But I’ve never been a big investor in the stock market.” “Interest rates are artificially low,” Trump said. “The only reason the stock market is where it is is because you get free money.” Mr. Trump is right on the money. The reason stocks are near their all-time highs is that there is a lot of free money around. Money lent out at interest rates below the rate of inflation is free. Of course, as we’ve been explaining to our 14-month-old grandson, it is not real money. It is fake money.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Right on the MoneyOUZILLY, France – It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice But yesterday, Republican presidential candidate Donald Trump gave investors both good advice and good analysis. Bloomberg has the report: |

The Donald dispenses investment advice. “Better get out buddy, while the getting is still good”. |

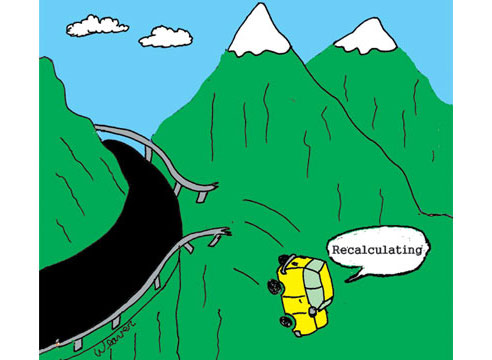

Mr. Trump is right on the money. The reason stocks are near their all-time highs is that there is a lot of free money around. Money lent out at interest rates below the rate of inflation is free. Of course, as we’ve been explaining to our 14-month-old grandson, it is not real money. It is fake money. Like a claim ticket on someone else’s parked car. If you get there before the car’s real owner, you can drive away. Otherwise, you’ll have to walk. “Money” has always been the subject of these Diaries. Except for occasional sorties into politics, crime, religion, and travel – from which we usually come back bruised from our Dear Reader mail – we stick to our beat, money. For the last couple of months, we have been looking at fake money – the stuff we use to buy things and to store wealth. It is like a GPS that gives you the wrong information. It tells you to turn right when you should turn left. It sends you to Ho-Ho-Kus when you were aiming for Hoboken. You follow its directions and run into a brick wall. |

|

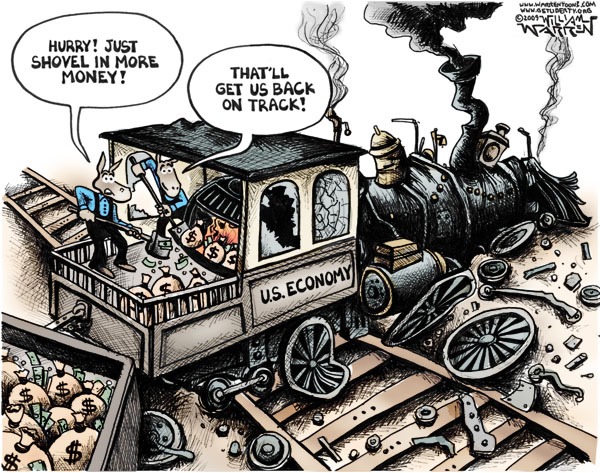

Wrong DirectionThe developed economies of the world seemed to run into a brick wall in 2008. The free money just didn’t work the way it used to. And even though the feds rushed in with even more free money, there has been no real recovery. Why? What’s the matter with free money? It boosts the stock market. It makes some people – those who get to the parking garage first – rich. Why doesn’t it bring about a real economic recovery, with higher real earnings for everyone? That is the discussion we’ve been having with Dear Readers, grandson James, and anyone else who will listen. In a nutshell, fake money buys real resources (aka capital). At artificially low interest rates, this fake money leads capital in the wrong direction. It is invested in projects that don’t make sense, lent to governments that waste it, borrowed by corporations to buy back their own shares and cancel them (boosting the value of the remaining shares), or used by speculators to make short-term bets. It is as though a teenager got hold of a fake claim ticket, took your car from the garage, drove it to across town and wrecked it. |

|

Fiddles and ManipulationsIn the absence of real money and honest interest rates and with no way of knowing if they are adding wealth or destroying it, people use capital as though they had stolen it. But don’t expect this system to change anytime soon. The authorities built it. They like it. And they will do everything they can to keep it in business – even forcing drivers to put their cars in the garage! Reporting on how new regulations favor investments in government debt over corporate debt in “prime funds” (money market funds that invest in short-term, low-risk debt), the Wall Street Journal reports:

|

Carmen Reinhart is telling it like it is – which is actually remarkable. Most mainstream economists are unfortunately cheering government-directed wealth destruction on, in the vain hope that it will “boost demand” (which is supposed to create “growth”, as though one could possibly consume oneself to prosperity!). |

More fiddles. More manipulations. More accidents. Our advice is the same as the Republican candidate’s: Try to stay off the road. |

Image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.