Summary: Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged. United States Nonfarm payrolls The market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and the details were mostly favorable. There were upward revisions to the May and June reports. Monthly NFP Change – click to enlarge. U.S. Unemployment Rate The underemployment rose to 9.7% from 9.6%, which may have been the only poor element of the report. Click to enlarge. U.S. Participation Rate The 9k increase in manufacturing and the overall rise in the workweek bodes well for output. The participation rate ticked up. Click to enlarge. Average Hourly Earnings Average hourly earnings rose by 0.3%, a little more than expected, and when rounded, the year-over-year rate of stayed at 2.6%, which matches the cyclical high, and will likely support consumption. Average Hourly Earnings – click to enlarge.

Topics:

Marc Chandler considers the following as important: Canada Employment Change, Canada participation rate, Canada unemployment rate, Featured, FX Trends, newsletter, Nonfarm payroll, participation rate, U.S. Average Hourly Earnings, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. unemployment rate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Underlying concerns about US labor market ease after two robust reports.

Sept Fed views will not change much.

Canada’s data is disappointing, BOC optimism may be challenged.

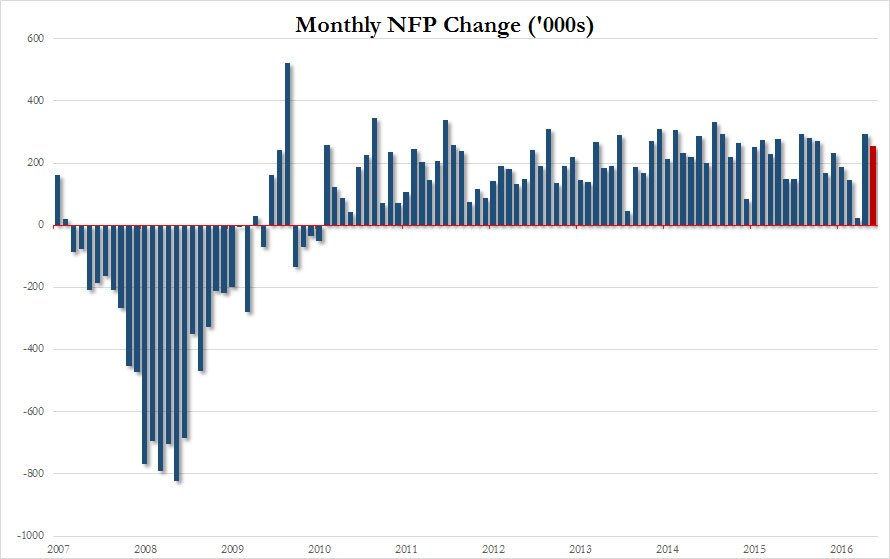

United StatesNonfarm payrollsThe market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and the details were mostly favorable. There were upward revisions to the May and June reports. |

|

U.S. Unemployment RateThe underemployment rose to 9.7% from 9.6%, which may have been the only poor element of the report. |

|

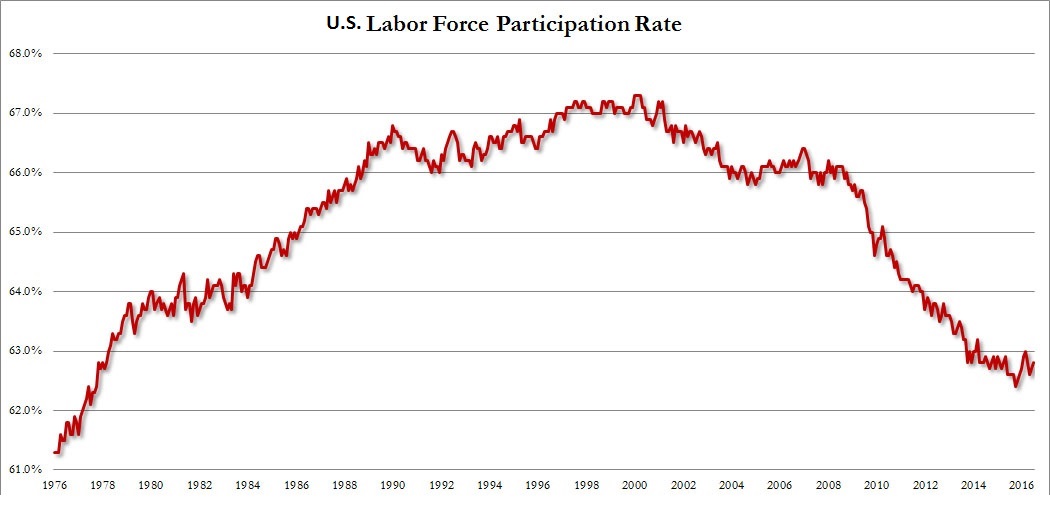

U.S. Participation RateThe 9k increase in manufacturing and the overall rise in the workweek bodes well for output. The participation rate ticked up. |

|

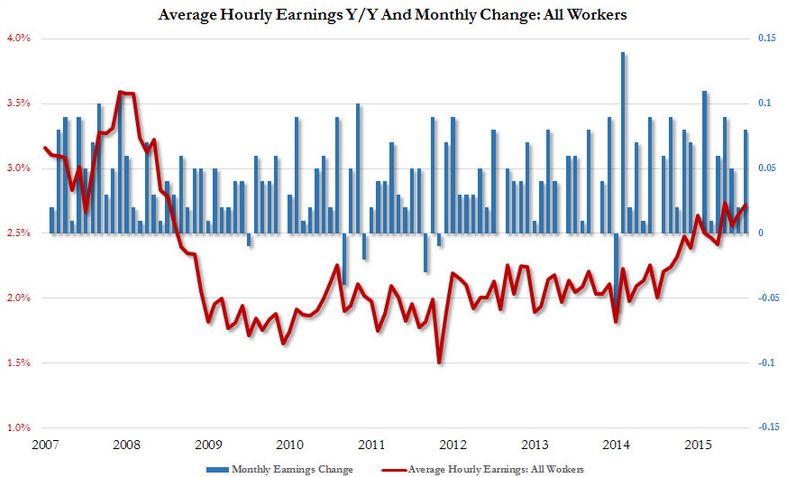

Average Hourly EarningsAverage hourly earnings rose by 0.3%, a little more than expected, and when rounded, the year-over-year rate of stayed at 2.6%, which matches the cyclical high, and will likely support consumption. |

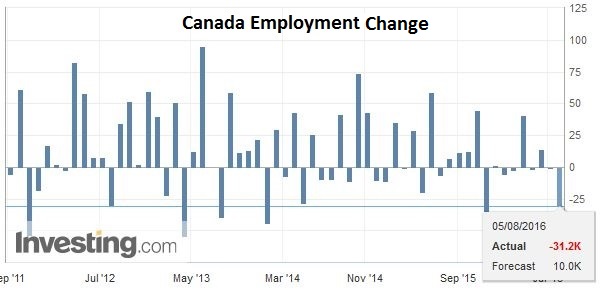

Canada Employment RateCanada’s employment report was poor. Canada lost 71.4k full-time jobs in July after businesses shed 40.1k in June. |

|

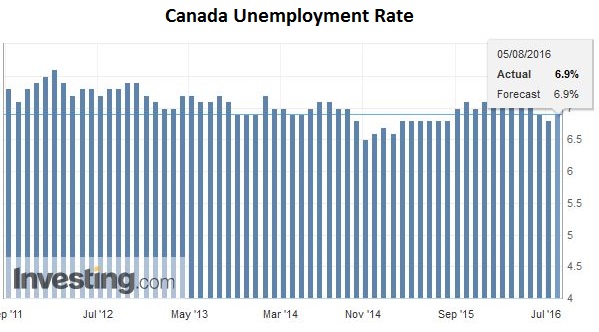

Canada Unemployment Rate

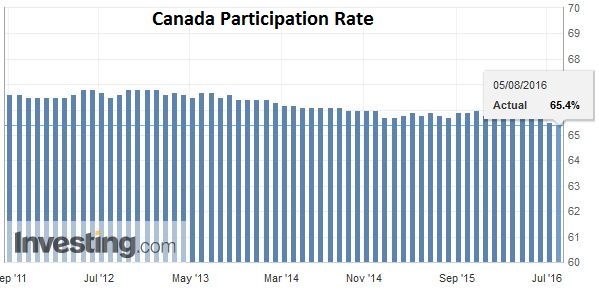

The unemployment ticked up (to 6.9% from 6.8%), while the participation rate slipped to65.4% from 65.5%. |

|

Canada Participation RateThe Canadian participation is nearly three percent higher than the American one. On the other side, Canadian unemployment is two percent higher.

|

We do not expect today’s jobs report to significantly boost the market odds of a Fed move in September. There are too many moving pieces, and the meeting is not until late-September. Still, the data may limit how far the dollar will fall after appreciating (on a real trade-weighted basis) for the past three-months.