We critized GDP growth that in many Western economies (e.g. Greece) has become mostly an indicator of consumption and activity. We emphasized that GDP growth in the form of consumption-driven (hyper-) activity (aka Bawerk’s “GDC” Gross Domestic Consumption) must finally lead to a depreciating currency, inflation, falling government bond prices and wealth in real terms. Instead, GDP should be driven by investment and the consequent improvements in productivity.As opposed to GDP growth, the savings is rate is able to: Measure the change in wealth. Wealth is increased by net national savings each year plus/minus a certain valuation effect. Wealth may consist of assets, either in the form of fixed (machines, homes, state investments, infrastructure) or financial investments, either the ones of the private sector or the ones of the state, like state pensions. The savings rate ignores the valuation effect of wealth. People in many advanced economies seem to rich just because they sit on a real-estate bubble caused by central banks. Savings are the basis for investments; building productive capacity is for us the major driver of an economic future. Even if banks may create credit out of “thin air”: nowadays countries with low savings have low investments too.

Topics:

George Dorgan considers the following as important: Austrian economics, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We critized GDP growth that in many Western economies (e.g. Greece) has become mostly an indicator of consumption and activity.

We emphasized that GDP growth in the form of consumption-driven (hyper-) activity (aka Bawerk’s “GDC” Gross Domestic Consumption) must finally lead to a depreciating currency, inflation, falling government bond prices and wealth in real terms. Instead, GDP should be driven by investment and the consequent improvements in productivity.

As opposed to GDP growth, the savings is rate is able to:

- Measure the change in wealth. Wealth is increased by net national savings each year plus/minus a certain valuation effect. Wealth may consist of assets, either in the form of fixed (machines, homes, state investments, infrastructure) or financial investments, either the ones of the private sector or the ones of the state, like state pensions.

- The savings rate ignores the valuation effect of wealth. People in many advanced economies seem to rich just because they sit on a real-estate bubble caused by central banks.

- Savings are the basis for investments; building productive capacity is for us the major driver of an economic future. Even if banks may create credit out of “thin air”: nowadays countries with low savings have low investments too.

- As opposed to GDP, the savings rate is able to measure savings that are not invested in the local economy. Switzerland and recently China are building a second productive economy outside of the home country, but owned by Swiss firms.

- As opposed to GDP, net national savings can quantify the desire to be less active and to consume less today but to postpone consumption to the future.

- Higher savings and lower consumption lead to current account surpluses and safety against currency devaluation and inflation.

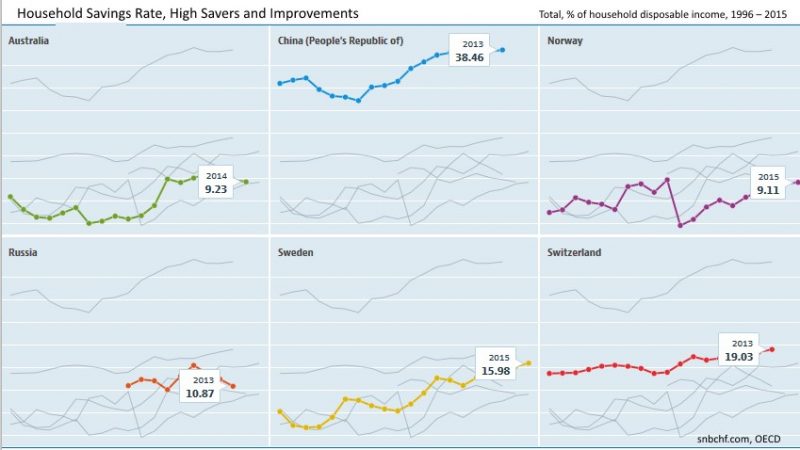

We provided detailed graphs for

Here we would like to give an update for the Household Savings Rate, collected by the OECD.

High Savings CountriesThe massive Chinese savings rate remains impressive. Switzerland has a high savings rate for decades. Russia and Norway are the two oil producers in the OECD statistics. Both Sweden and Australia have |

|

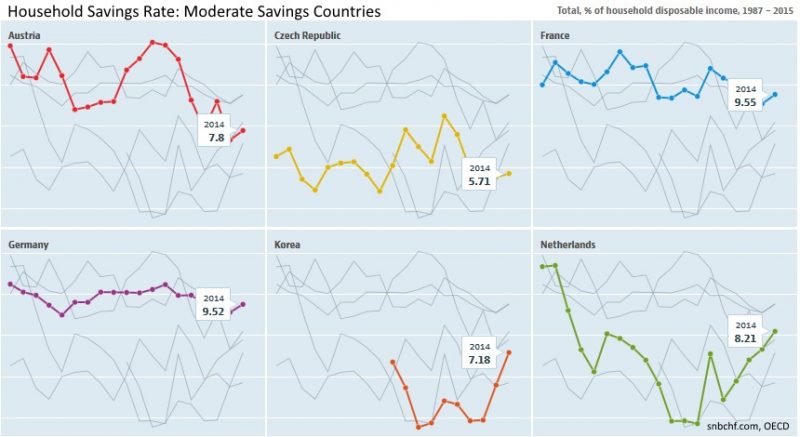

Moderate Savings CountriesBoth Germany and France have a relatively stable savings-rate for 20 years. During the real-estate boom, the Korea has not followed not yet Japan |

|

Low Savings CountriesThe United States is already for three decades a low-savings country. So are Canada, New Zealand. Italy has reduced its savings rate from over 15% in 1995 to 2.91% in A similar movement applies for |

|

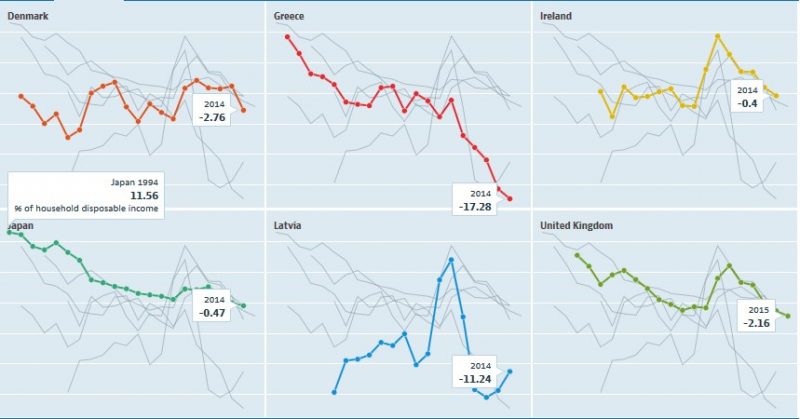

Countries with a negative savings rateNegative savings occur in different cases: Capital consumption, ageing Emigration countries: Excessive spending countries: Ireland and United Kingdom are |

|