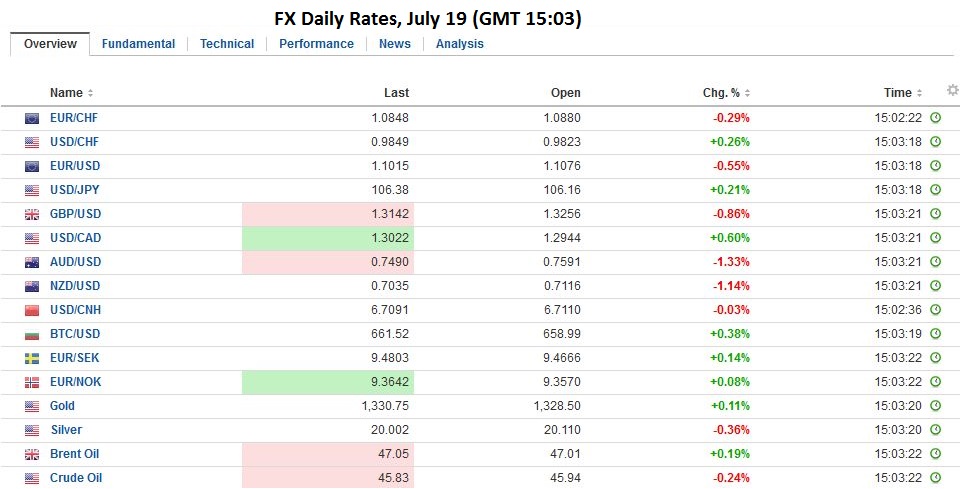

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event. Sterling is trading heavily as well, and it was even before the inflation gauges were reported, which were a little firmer than expected. Despite today’s slippage, sterling is trading within yesterday’s range, which is within last Friday’s. Click to enlarge. The euro and yen are little changed. The consolidation evident in sterling is also manifest in the euro. The single currency is within yesterday’s range, and that was inside last Friday’s range. The greenback initially ticked higher in Asia, and the Nikkei bucked the regional fall to extend its recent nearly 1.4%. The performance of Japanese stocks seemed to be a little catch-up after the Monday holiday, but also the anticipation of new fiscal and monetary support has seen sentiment toward Japanese equities improve. Click to enlarge.

Topics:

Marc Chandler considers the following as important: AUD, EUR, FX Daily, FX Trends, GBP, Germany, Germany ZEW Current Conditions, Germany ZEW Economic Sentiment, JPY, newslettersent, U.K. Consumer Price Index, USD

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Swiss Franc |

|

FX RatesThe US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event. Sterling is trading heavily as well, and it was even before the inflation gauges were reported, which were a little firmer than expected. Despite today’s slippage, sterling is trading within yesterday’s range, which is within last Friday’s. |

|

| The euro and yen are little changed. The consolidation evident in sterling is also manifest in the euro. The single currency is within yesterday’s range, and that was inside last Friday’s range. The greenback initially ticked higher in Asia, and the Nikkei bucked the regional fall to extend its recent nearly 1.4%. The performance of Japanese stocks seemed to be a little catch-up after the Monday holiday, but also the anticipation of new fiscal and monetary support has seen sentiment toward Japanese equities improve. |

European stocks are moving lower, with the Dow Jones Stoxx 600 off one percent near midday in London after setting a three-month high yesterday. All the main industry groups are lower, with the materials and financials off the most. European bond yields are 1-2 bp lower, and the US 10-year Treasury yields three bp lower at 1.54%.

There are five macro-developments to note today ahead of the North American session:

New Zealand announced new lending limits on property purchases, which frees up a monetary policy that can be used to support the economy. The new measures (including a 40% deposit on new purchases) go into effect 1 September. Investors understand this macro-prudential step to increase the risk of a rate cut (from about 40% a week ago to around 75% now) at the August 11 RBNZ meeting.

Minutes from the recent Reserve Bank of Australia meeting reinforce ideas that a soft Q2 CPI report next week could see a rate cut delivered next month as well. Indicative pricing in the derivatives market implies about a 60% chance of a 25 bp cut, up from 45% last week. The $0.7490 area, which the Australian dollar has tested in the European morning, represents a 50% retracement of the post-UK referendum bounce, while $0.7475 is a 38.2% retracement of the larger rally since late-May.

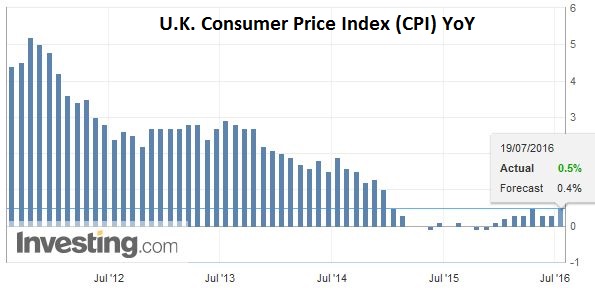

United KingdomSlightly firmer than expected UK CPI did not impact interest rate expectations and did nothing for sterling, which was already trading with a heavier bias within the ranges of the past couple of sessions. The headline CPI rose 0.5% from a year ago. Most expectations had been for a 0.4% increase after 0.3% in May. A key factor was the 11% increase in airfare, which also helped lift the core rate to 1.4% (from 1.2%). The data was mostly collected before the referendum and that Europe 2016 football may have been a distorting factor. Sterling reached a high yesterday, as the London markets were closing, near $1.3315. Today’s low was set in early European turnover just ahead of $1.3170. The middle of that range, roughly 1.3240 may offer intraday resistance. |

Click to enlarge. Source Investing.com |

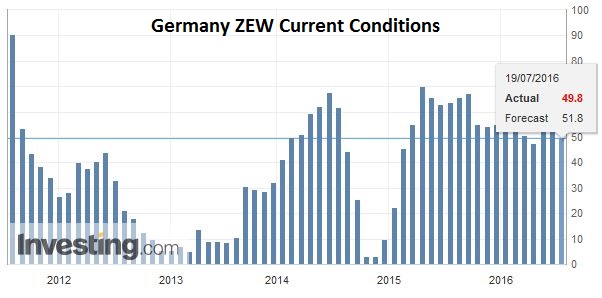

GermanyThe German ZEW measure of investor confidence deteriorated in July by more than expected, and the UK referendum is the likely culprit, though the news about the country’s largest bank may not have been helpful. The assessment of the current situation tumbled to 49.8 from 54.5. It is the lowest since April. The larger impact was seen in terms of forward-looking expectations. |

Click to enlarge. Source Investing.com |

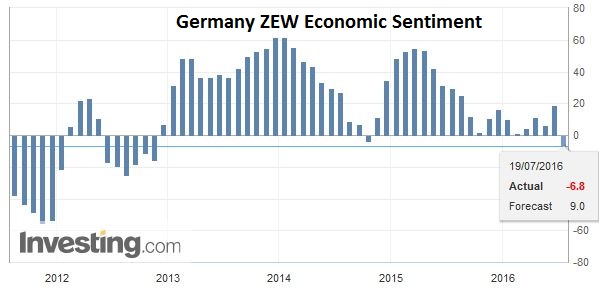

| It fell to -6.8 from 19.2. Many expected to have only been halved. Expectations are at their lowest level since Q4 12. Perhaps what illustrates the magnitude of the swing in sentiment is the fact hat the June read was the highest in nearly a years. |

Click to enlarge. Source Investing.com |

The ECB bank lending survey was reported. The survey was conducted between June 14 and June 29, so a few days of after the referendum were captured. It reported that loan terms improved and demand increased. It did not seem to find much impact from the UK referendum and cited competitive pressures as the main factor behind the easing of credit standards to companies and households. The new TLTROs were seen by the banks as bolstering their profitability and translating into more relaxed lending terms. However, moving forward banks anticipated that the regulatory/supervisory requirements would have a net tightening impact in H2. For its part, the euro seems to be comfortable in the range seen before the weekend between $1.1025 and $1.1150, with the ECB meeting on Thursday looming.

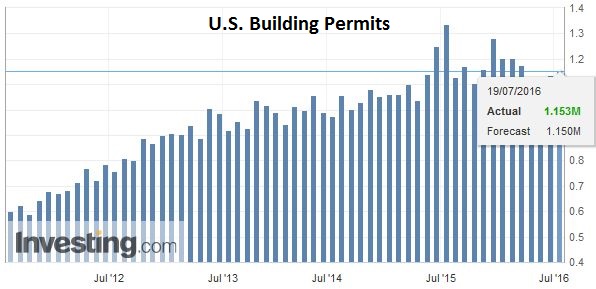

United StatesThe North American session features US June housing stands and permits. A small increase in both (0.2% and 1.2% respectively) is expected. It is unlikely to have much market impact. If the report is as anticipated, it will be a part string of recent reports that show the US economy finished Q2 on a firm note. This is consistent with the NY Fed GDP tracker that has the US economy accelerating in Q3 and Q2 show a recovery after a two-quarter slow patch. The Dollar Index is at the upper end of the range seen in Q2. A move above 97.25, if sustained, would lift the medium-term outlook. |

Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.