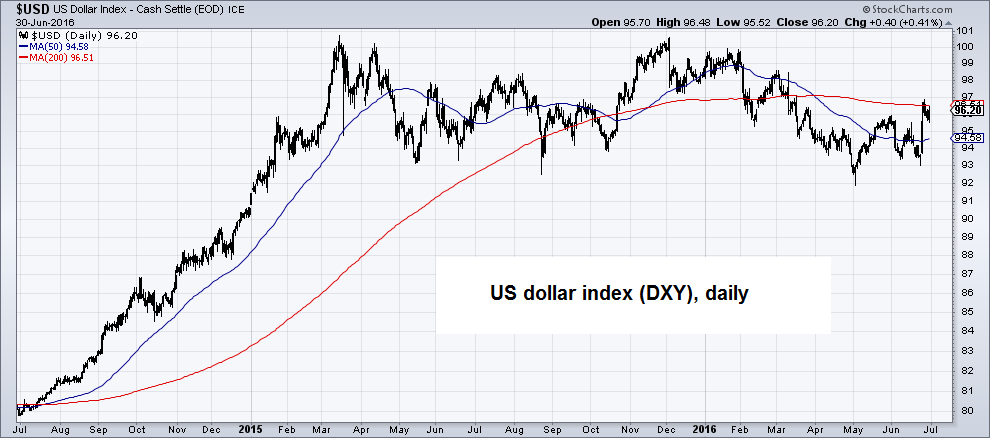

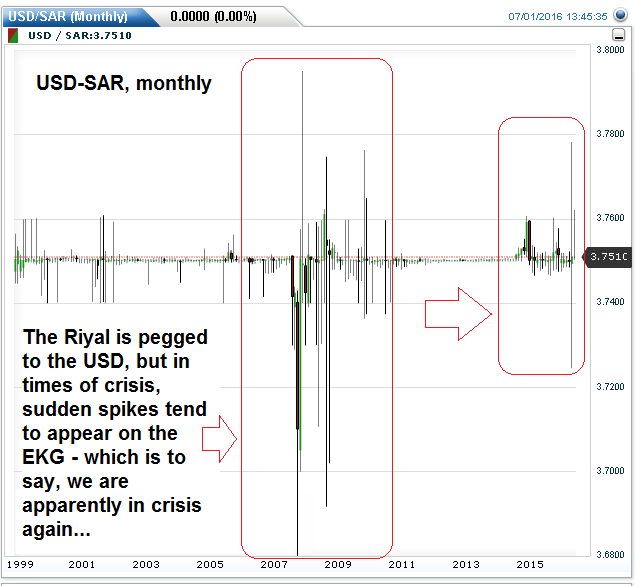

The Only Move for the Fed is Talking Down the Dollar The Fed has no more maneuvers other than to jawbone the dollar lower. Because for a variety of reasons a strong dollar, in the current market environment, is akin to tighter monetary policy. The Eccles Building US dollar index over the past 2 years And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate. US dollar index over the past two years – click to enlarge. Monthly chart of USD-SAR since the Riyal is pegged, this is essentially a straight line…but not always. Palpitations usually set in when a crisis is underway and oil prices are coming under pressure. The dollar’s whip-saw in 2016 has The Fed’s fingerprints all over it. The sequence is: Flawed forward guidance of 4 rate hikes (US dollar ramp), followed by a slowing US economy (US dollar softens)… and now the Brexit/ global economic fears (US dollar rallies in “flight to quality”). The Messenger and the Message Of course, the Fed will try to manage the dollar lower – with both an absolute intent and, naturally, uncertain outcome. Their serial monetary policy impotence will certainly never be acknowledged.

Topics:

Dominique Dassault considers the following as important: Central Banks, Featured, FX Trends, newslettersent, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Only Move for the Fed is Talking Down the DollarThe Fed has no more maneuvers other than to jawbone the dollar lower. Because for a variety of reasons a strong dollar, in the current market environment, is akin to tighter monetary policy. |

|

US dollar index over the past 2 yearsAnd right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate. |

|

Monthly chart of USD-SARsince the Riyal is pegged, this is essentially a straight line…but not always. Palpitations usually set in when a crisis is underway and oil prices are coming under pressure. The dollar’s whip-saw in 2016 has The Fed’s fingerprints all over it. The sequence is: Flawed forward guidance of 4 rate hikes (US dollar ramp), followed by a slowing US economy (US dollar softens)… and now the Brexit/ global economic fears (US dollar rallies in “flight to quality”). |

|

The Messenger and the MessageOf course, the Fed will try to manage the dollar lower – with both an absolute intent and, naturally, uncertain outcome. Their serial monetary policy impotence will certainly never be acknowledged. It may not be immediate but it will likely occur soon enough as negative rates are not a realistic option in the United States. They have already proven to be ineffective in both Japan (surging yen) and Europe (still weakening economy)… and QE4 is not necessary as rates are plunging without The Fed’s meaningful assistance (notwithstanding balance sheet asset maintenance). The only real question is, who will be the messenger? I suppose the obvious answer would be the Fed member with the most credibility – but that assumes that there is still any credibility remaining at the Fed (a heroic assumption). Actually, the delivery of the message is much more important than the specific messenger. But undoubtedly, the message will ultimately be delivered (see also my October 2014 article The Race to the Bottom for some color on the currency war). |

Chart and image captions by PT

This article appeared originally at Global Slant