Today’s retail sales report was a clear disappointment, particularly at the core level. However, we continue to expect solid consumption growth in Q1 and overall in 2016. Nominal total retail sales dropped by 0.1% m-o-m in February, slightly above consensus expectations (-0.2%). However, January’s number was revised down markedly from +0.2% to -0.4%. Total sales were dented by a 4.4% m-o-m fall in nominal sales at gasoline stations (on the back of sharply lower gasoline prices). Nominal auto sales decreased by 0.2% m-o-m, in line with what already published data on unit car sales (real) were suggesting (-0.2% m-o-m). Meanwhile, sales of building materials increased by a solid 1.6%. Control sales: softer than expected in January-February As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, February’s numbers were quite disappointing. Core sales were flat m-o-m in February, below consensus expectations of a 0.2% rise. Moreover, January’s number was revised sharply down from +0.6% to +0.2% (but December’s reading slightly up from -0.3% to -0.2%). The end result is that between Q4 2015 and January-February 2016, core retail sales grew by only a meagre 1.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

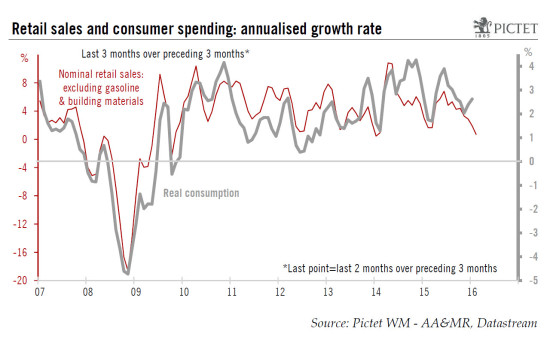

Today’s retail sales report was a clear disappointment, particularly at the core level. However, we continue to expect solid consumption growth in Q1 and overall in 2016.

Nominal total retail sales dropped by 0.1% m-o-m in February, slightly above consensus expectations (-0.2%). However, January’s number was revised down markedly from +0.2% to -0.4%. Total sales were dented by a 4.4% m-o-m fall in nominal sales at gasoline stations (on the back of sharply lower gasoline prices). Nominal auto sales decreased by 0.2% m-o-m, in line with what already published data on unit car sales (real) were suggesting (-0.2% m-o-m). Meanwhile, sales of building materials increased by a solid 1.6%.

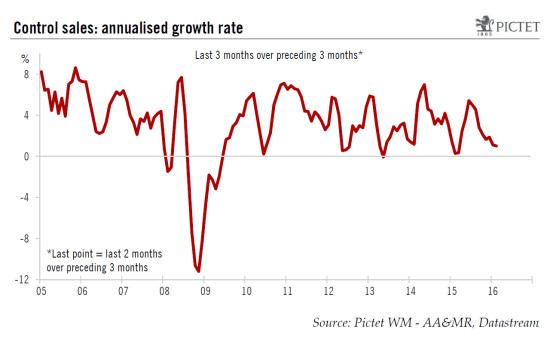

Control sales: softer than expected in January-February

As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, February’s numbers were quite disappointing. Core sales were flat m-o-m in February, below consensus expectations of a 0.2% rise. Moreover, January’s number was revised sharply down from +0.6% to +0.2% (but December’s reading slightly up from -0.3% to -0.2%). The end result is that between Q4 2015 and January-February 2016, core retail sales grew by only a meagre 1.0% annualised, following an already soft +1.6% q-o-q in Q4 2015.

Core retail sales were surprisingly weak so far in Q1 2016. However, as retail sales are measured in nominal terms, they can be very volatile on a monthly basis and are often revised substantially (that was actually the case today). In any case, core retail sales account for only around 25% of total consumption and they have often given a poor indication of overall consumption growth.

In spite of today’s disappointing retail sales data, we remain reasonably sanguine on consumption growth in Q1. Consumption of utilities is recovering from its temporary weather-related slump in Q4 and the sharp additional fall in gasoline prices recorded in February is likely to continue to have a positive impact on consumption. Moreover, overall consumer spending rose by a strong 3.6% annualised between Q4 and January. Although this figure should be revised slightly down following today’s statistics, it should remain upbeat. In that context, our forecast that consumer spending will grow by a solid 3.0% q-o-q annualised in Q1 remains unchanged, although the risks on that forecast are now tilted on the downside.

We remain optimistic on consumption in 2016

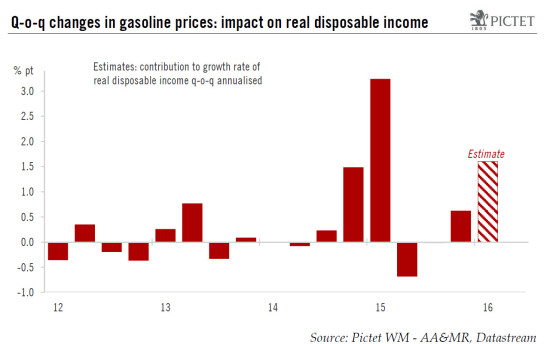

And our scenario for household consumption in 2016 overall remains also unchanged. Employment growth should slow somewhat and the massive boost to real income that the fall in gasoline prices has implied in 2015 will not be repeated this year, at least not to the same extent. However, job creation should remain healthy, while wage increases are likely to pick up gradually. Regarding the beneficial effect from the fall in oil prices, although the oil windfall should be lighter overall this year compared with 2015, it should nevertheless be sizeable, particularly in H1 (see chart hereunder). Moreover, part of last year’s windfall was not spent. In other words, the saving rate currently remains relatively high, and may well decline over the coming months. The consequence of all this is that we continue to expect healthy consumption growth overall in 2016, although it is likely to slow somewhat from the high rate recorded on average in 2015. On a yearly average basis, we continue to expect consumption growth to settle at a robust 2.7% in 2016, following 3.1% in 2015.

Regarding overall economic growth, we continue to believe that a serious downturn in the US economy is unlikely this year and expect growth to remain relatively healthy. Our forecasts that GDP growth will reach 2.0% q-o-q annualised in Q1 and 2.0% on average in 2016 remain unchanged.