It was a miserable week that ended a miserable year, followed by an apparently bad first week in 2016. In fact it was the S&P 500’s worst since the start of the bull market in 2009, ending the year down 0.73% at 2043.94 points! Volume was seasonally very low. If you are frustrated with the stock market’s performance, I can well understand it, but if you look at the video (Ctrl + Click) below, “Ouch! 5 CEOs lost a combined billion in 2015!”, you may be comforted to see that Warren Buffet personally lost a whopping .5 billion with the two Berkshire Hathaway stocks down over 12% on the year. The S&P 500 index continued to slip in the short week. For the year 220 stocks (46.65%) posted gains, 281 (55.75%) posted losses and 3 were flat. Curiously there are 504 stocks listed in the index. The prevailing sentiment seems to signal a seamless continuation into this year as the S&P 500 has a multiple of 19 times and appears to be topping out as indicated by S&P 500 companies’ earnings suffering from a ‘growth recession’, which is mainly not the case with Grail selected stocks. Citibank sees the U.S. economy weakening and thus an increased chance of a recession. Admittedly, a lack of business confidence has contributed to this kind of sentiment.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, newsletter, Recession

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It was a miserable week that ended a miserable year, followed by an apparently bad first week in 2016.

In fact it was the S&P 500’s worst since the start of the bull market in 2009, ending the year down 0.73% at 2043.94 points! Volume was seasonally very low. If you are frustrated with the stock market’s performance, I can well understand it, but if you look at the video (Ctrl + Click) below, “Ouch! 5 CEOs lost a combined $20 billion in 2015!”, you may be comforted to see that Warren Buffet personally lost a whopping $7.5 billion with the two Berkshire Hathaway stocks down over 12% on the year.

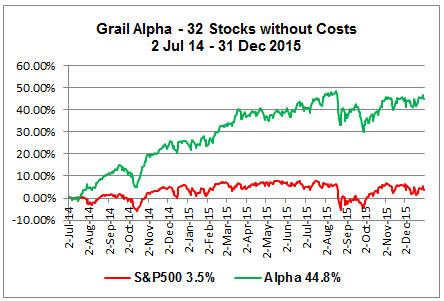

The S&P 500 index continued to slip in the short week. For the year 220 stocks (46.65%) posted gains, 281 (55.75%) posted losses and 3 were flat. Curiously there are 504 stocks listed in the index. The prevailing sentiment seems to signal a seamless continuation into this year as the S&P 500 has a multiple of 19 times and appears to be topping out as indicated by S&P 500 companies’ earnings suffering from a ‘growth recession’, which is mainly not the case with Grail selected stocks. Citibank sees the U.S. economy weakening and thus an increased chance of a recession.

Admittedly, a lack of business confidence has contributed to this kind of sentiment. Further, the very low interest rate regime encouraged corporations to buy-back their own shares instead of investing in new businesses and products, which would have been healthier for consumer demand and economic growth. Organic growth however still faces a number of global headwinds arising from such deflationary factors as crude oil, the price of which fell in 2014 46% and in 2015 30%! With the slow recovery from the 2008 stock market crash (34%) and the resulting 7-year interest rate standstill, the Federal Reserve took the decision last month into minimally increase interest rates by between 0.25% and 0.50% in a year when the U.S. dollar had strengthened by 11.4%. The currency’s reserve status, whereby it is used internationally to settle certain kinds of transactions, the interest rate increase makes such deals costlier by adding to the strength of the U.S. dollar against weaker economies and thus the measure is recessionary-tinged at the global level and makes for example commodities and U.S. products just that bit more expensive.

No comfort could be found in gold, which posted its third consecutive annual loss, a fall of more than 10% last year.

If there is a key reversal in global commodity prices, or other demand-stimulating factors, to stimulate mutual growth we could see the effects in the global stocks markets. However, it appears that the most we can hope for is for the S&P 500 earnings to grow no more that 7% this year; that is if we are lucky! However this in no way effects Grail stocks, since it has the tools to seek out stocks with high and stable growth potential.

| EPS Growth Q4 | EPS Growth Q1 | Average |

| 27% | 29% | 28% |

5 CEOs lost $20B this year

[Lost in 2015]