Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus Some minor US data will be seen today; Mexico reports May CPI Germany reported weak April trade and current account data; there were two important developments in Turkey today Japan reported weak April real cash earnings and May machine tool orders; Australia reports several sentiment indicators this week The dollar is mostly firmer against the majors as some risk-off sentiment takes hold. The yen and Swissie are outperforming, while the Antipodeans are underperforming. EM currencies are

Topics:

Win Thin considers the following as important: 5) Global Macro, 5.) Brown Brothers Harriman, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

- Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction

- The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus

- Some minor US data will be seen today; Mexico reports May CPI

- Germany reported weak April trade and current account data; there were two important developments in Turkey today

- Japan reported weak April real cash earnings and May machine tool orders; Australia reports several sentiment indicators this week

| The dollar is mostly firmer against the majors as some risk-off sentiment takes hold.

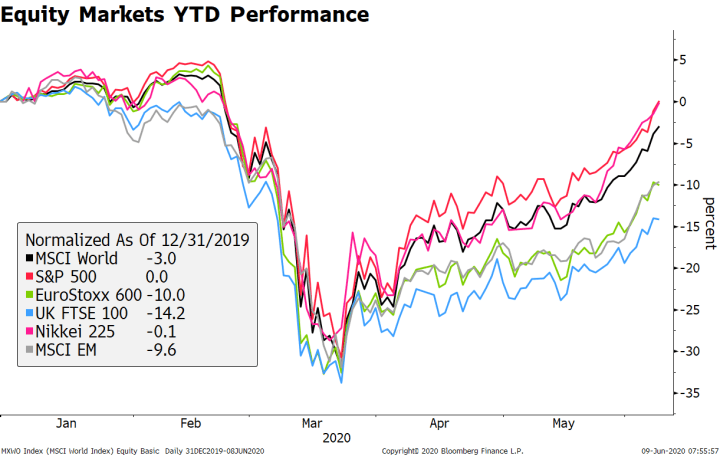

The yen and Swissie are outperforming, while the Antipodeans are underperforming. EM currencies are mostly weaker. KRW and THB are outperforming, while MXN and RUB are underperforming. MSCI Asia Pacific was up 0.5% on the day, with the Nikkei falling 0.4%. MSCI EM is up 0.2% so far today, with the Shanghai Composite rising 0.6%. Euro Stoxx 600 is down 1.4% near midday, while US futures are pointing to a lower open. 10-year UST yield is down 5 bp at 0.82%, while the 3-month to 10-year spread is down 5 bp at +67 bp. Commodity prices are mostly lower, with Brent oil down 2%, WTI oil down 2.5%, copper flat, and gold up 0.6%. Today’s risk off price action appears to have been triggered by some old-fashioned profit-taking. There is little fundamental news to speak of. The S&P 500 was flat on the year as of yesterday’s close, while the Nasdaq is up 10%. The same goes for the Nikkei 225. This powerful rally in equities along with still very negative economic reality on the ground continues to confound many observers outside and, we believe, has the potential to feed into social unrest. It certainly won’t help wealth distribution problems. Yet we don’t think the rally is that mysterious or absurd from the point of view of financial markets practitioners. As we have previously written, here is a non-exhaustive list of key driving factors: (1) markets are forward looking and the worse of Covid-19 seems to be behind us; (2) re-openings are underway with little signs of a second wave of infections; (3) massive fiscal and monetary stimulus; (4) positive sector-specific news, including a greater importance of some tech sectors (cloud computing, communication, etc.) and more recently a rebound in energy prices. |

Equity Markets YTD Performance, 2020 |

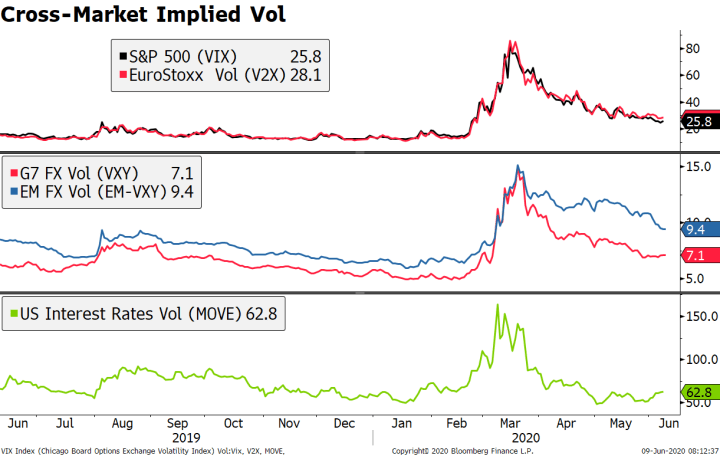

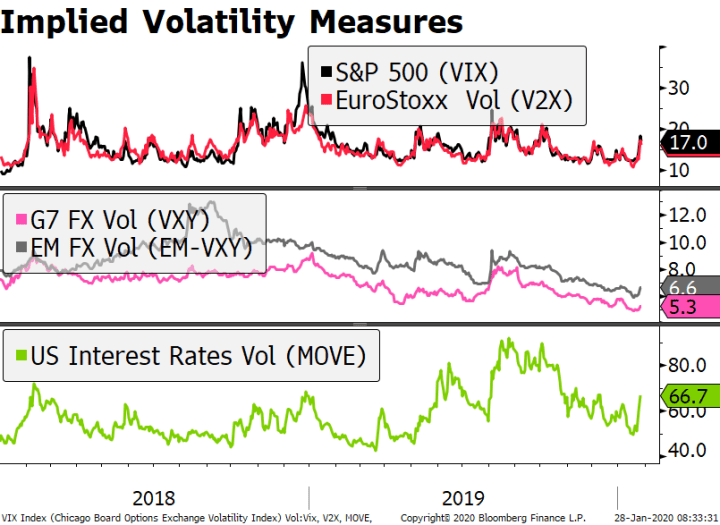

| Looking at aggregate measures of implied volatility, we see recent trends starting to diverge somewhat. In the equity space, the VIX and V2X (Europe) have stabilized around the 25 level, still some 10 points higher than pre-Covid levels. In FX, G7 implied vol (VXY) is now around 7%, compared to around 5% at the start of the year. The FX equivalent for EM (EM-VXY) has declined considerably over the last couple of weeks and is now at 9%. The recent pickup in global yields has woken up the MOVE index from its recent lows in May, but at 63 it remains around the last year’s average level.

The dollar has gotten some traction. DXY is up on the day but still seems likely to test the March low near 94.65. The euro is nearly a cent off its Friday highs and trading back below $1.13. Sterling made a marginal new high earlier today near $1.2755 but is trading back below the 200-day moving average ($1.2685) near $1.2650 currently. Lastly, USD/JPY is sharply lower and trading below 108 as yesterday’s drop presaged today’s risk-off sentiment. |

Cross-Market Implied Vol, 2019-2020 |

| EUROPE/MIDDLE EAST/AFRICA

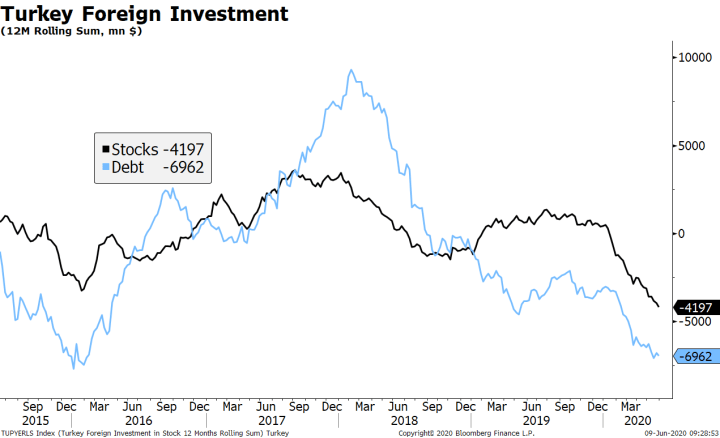

Germany reported April trade and current account data. Exports contracted -24.0% m/m vs. -15.6% expected, while imports contracted -16.5% m/m vs. -16.0% expected. This led both the trade and current account surpluses to narrow sharply to EUR3.5 bln and EUR7.7 bln, respectively, both multi-year lows. Weakness in the trade data underscore how difficult it will be for export-driven economies to rebound from the pandemic. China, which is Germany’s major export market, is struggling to recover since its major export destinations are also struggling with slow growth. Simply put, it will take some time to break this vicious cycle. There were two important developments in Turkey today. First, local bonds will start settling on Euroclear. The deal between the Turkish Treasury and Euroclear (eight years in the making) means that, in theory, local securities would be more easily tradable, and the country would be able to expand its investor base. This is good news, but opening the door does not guarantee that investors will want to come in. There is still a long road ahead to rebuild credibility and foster a market-friendly environment. That said, positioning is certainly light, so there is plenty of room to recover. Second, there has been some progress on talks over Libya. Turkish President Erdogan got off a call with President Trump saying they had reached “some agreements.” He also said that “there could be a new era between the US and Turkey” regarding Libya. We refrain from any quick conclusions on this matter given there is still a lot of rancor on the side of US lawmakers of Turkey’s S-400 missile system deal with Russia. Turkish assets prices are little changed this morning, meaning they are outperforming on a risk-off day. |

Turkey Foreign Investment, 2015-2020 |

AMERICAS

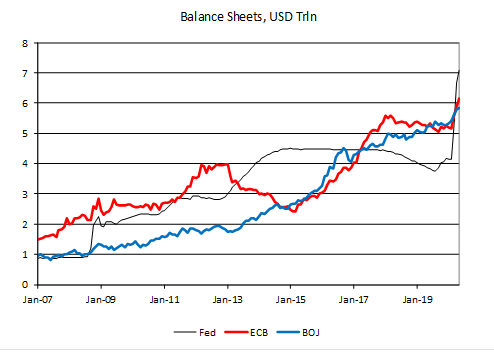

The Fed expanded its Main Street Loan Program to include more businesses. Although the program was announced back in March, it has not yet begun but will be “soon.” Principal payments will now be deferred two years vs. one year previously, while interest payments will still be deferred for one year.

The minimum loan size was decreased to $250 from $500k previously, whilst the maximum loan size was increased to $300 mln. Recipients are still limited to 15k employees or fewer as well as an annual revenue cap of $5 bln. Lenders will be required to hold 5% of the loans on their balance sheet vs. 15% previously.

This update came days before the FOMC meeting and underscores our view that the calendar no longer acts as any sort of constraint on policy. This is the second update to the program and comes after the Fed reportedly received more than 2k comment letters. The FOMC meeting starts today and the decision comes tomorrow afternoon. No policy changes are expected. for an in-depth look at what the Fed could do, please see our FOMC Preview.

The jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus. Congressional Republicans were always a bit wary, and now the improving jobs numbers are giving them cover to go slow or perhaps even avoid it altogether. Before the data, talk centered around $1 trln for the next package, though Senate Leader McConnell was not planning on holding any sort of vote until late July. One tell will be discussions planned today by the Senate Finance Committee on the extra $600 per week in jobless benefits that are set to expire July 31. Stay tuned.

Some minor US data will be seen today. April JOLTS job openings and wholesale trade sales will both be reported. JOLTS reading of 5750 is expected, down from 6191 in March. If so, it would be the lowest reading since January 2017. However, the nonfarm payrolls suggest April was the worst month for the US labor market and so the JOLTs data should also show a rebound in May.

Mexico reports May CPI. Inflation is expected to rise to 2.98% y/y from 2.15% in April. If so, inflation would accelerate for the first time since February but would remain in the bottom half of the 2-4% target range. Next policy meeting is June 25 and another 50 bp cut to 5.0% is expected. If the peso continues to strengthen, we think the odds of a dovish surprise rise.

ASIA

Japan reported weak April real cash earnings and May machine tool orders. Real earnings fell -0.7% y/y vs. -1.1% expected and -0.3% in March. While this was slightly better than expected, we expect wages to continue falling as the impact of the pandemic grows. This will further crimp spending. Elsewhere, machine tool orders contracted -52.8% y/y vs. -48.3% in April and points to continued weakness in the overall economy.

It seems that yesterday’s yen rally was an early signal of today’s risk-off sentiment. We couldn’t find any fundamental reason behind the yen buying. Indeed, it one looked yesterday at equities, EM, and other risk assets, one would have expected USD/JPY to be well above 110 but were closer to 108. The pair is back below the 200-day moving average near 108.45 and retracing nearly half of the May-June rally. The 50% retracement objective of that move comes in near 107.90 and the 62% comes in near 107.45.

Australia reports several sentiment indicators this week. May NAB business conditions came in at -24 vs. -34 in April, with business confidence improving to -20 from a revised -45 (was -46) in April. This will be followed by the weekly ANZ Roy Morgan weekly consumer confidence and June Westpac consumer confidence tomorrow. AUD is sharply lower today after trading at a new high near .7040, just above the December high near .7030. If risk sentiment recovers, the next targets are the July 2019 high near .7080 and then the April 2019 high near .7205.

HKMA continues to defend the strong end of the HKD band for the fourth straight day. Today, it sold HKD1.938 bln and follows HKD9.347 bln Monday, HKD8.758 bln last Friday and HKD977 mln last Thursday. Sentiment regarding Hong Kong has remained unshakeable despite rising political tensions. Recall that the HKMA has unlimited resources (HKD) to defend the strong end of the band.

Tags: Articles,Daily News,Featured,newsletter