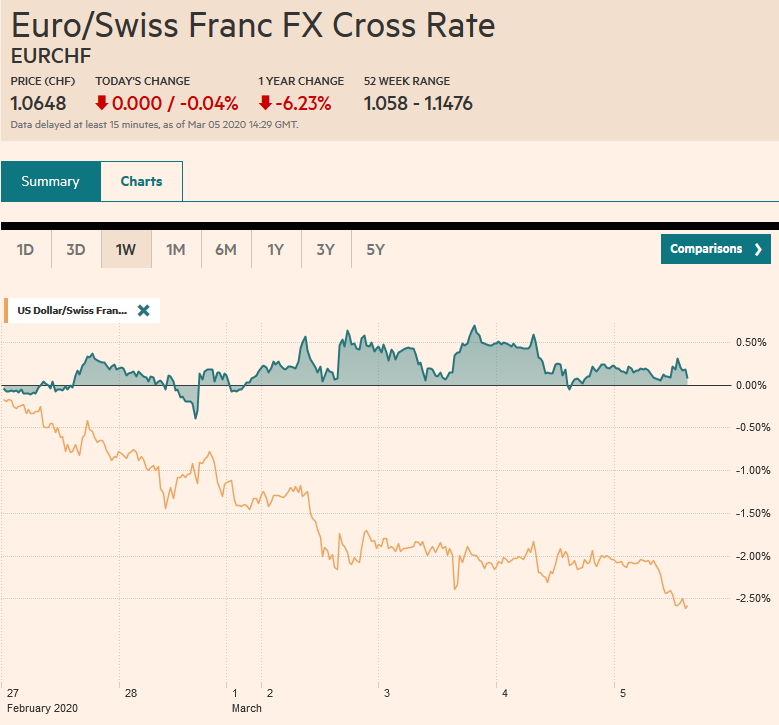

Swiss Franc The Euro has fallen by 0.04% to 1.0648 EUR/CHF and USD/CHF, March 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 4.2% rally in the S&P 500 yesterday helped lift Asia Pacific markets earlier today, and the five basis point backing up of the US 10-year yield pushed regional yields higher. However, the coattails proved short, and Europe’s Dow Jones Stoxx 600 is snapping a three-day advance and is off about 1.3% in late morning turnover to give back yesterday’s gains. US shares are also trading heavily, and the S&P 500 looks almost 2% lower. European benchmark 10-year yields are mostly 1-3 bp firmer, though German Bund yields are slightly softer. The US 10-year yield is pushing back to nearly

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Bank of Canada, Bank of England, Currency Movement, Featured, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss FrancThe Euro has fallen by 0.04% to 1.0648 |

EUR/CHF and USD/CHF, March 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The 4.2% rally in the S&P 500 yesterday helped lift Asia Pacific markets earlier today, and the five basis point backing up of the US 10-year yield pushed regional yields higher. However, the coattails proved short, and Europe’s Dow Jones Stoxx 600 is snapping a three-day advance and is off about 1.3% in late morning turnover to give back yesterday’s gains. US shares are also trading heavily, and the S&P 500 looks almost 2% lower. European benchmark 10-year yields are mostly 1-3 bp firmer, though German Bund yields are slightly softer. The US 10-year yield is pushing back to nearly 95 bp as it unwinds yesterday’s pick-up. The dollar is lower against almost all of the major currencies, but the Canadian dollar and the Norwegian krone. The liquid, accessible emerging market currencies are softer, including the South African rand, Turkish lira, and Mexican peso.The South Korean won was the strongest, with a 0.5% gain. Foreigners continue to sell Korean shares, but fully offsetting it and more, are their purchases of Korean bonds. Gold and oil are consolidating inside yesterday’s ranges. OPEC+ meet, and many expect that the current cuts in production will be extended, while extra cuts of around 750k barrels per day can be cut for a quarter or two. |

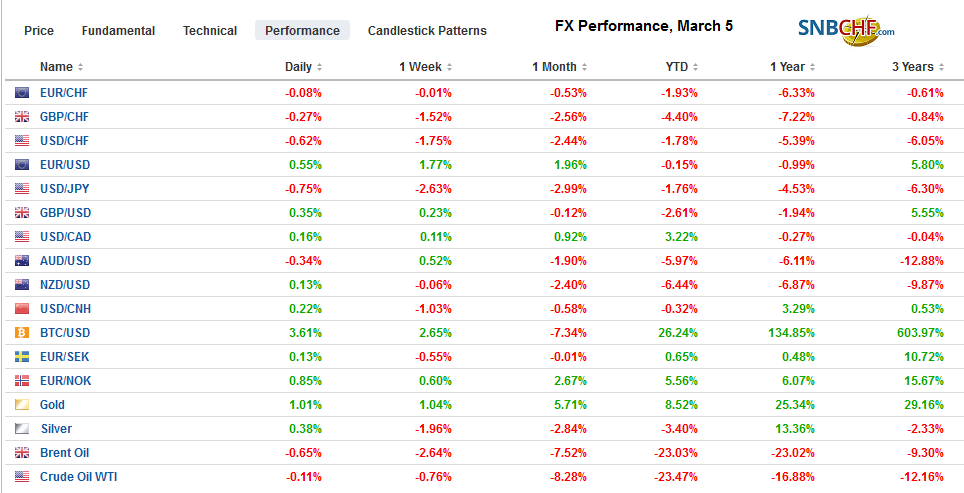

FX Performance, March 5 |

Asia Pacific

Foreign investors continued to buy negative-yielding Japanese bonds last week, according to MOF figures. It was the sixth consecutive week of purchases, during which time they bought about $39 bln, the most in a six-week period in over a year. Many seem to be buying on a hedged basis. Consider that a dollar-based investor buys a short-dated JGB yielding minus 25 bp, hedging the yen back into dollars, one is paid sufficiently to turn the overall yield of the trade into more than a US two-year Treasury.

The Bank of Japan does not meet until March 18-19. Market News International reported that officials do not see the need for an emergency meeting unless the yen were to strengthen sharply with the dollar falling through JPY105 toward JPY100. Reports suggest the BOJ will downgrade it economic assessment and either launch a new facility to ensure lending firms disrupted by the virus or scale-up existing facilities.

The head of Australia’s Treasury warned that his country will likely experience its first quarterly contraction in nine years but expects a recovery in Q2, avoiding the rule-of-thumb definition of a recession. A measured and targeted fiscal response is likely in the coming days. Asia-Pacific countries have already announced around $38 bln in fiscal measures. The IMF has made $50 bln available to help countries cope with the virus, including $10 bln to be lent at zero interest rates to help the poorest countries.

The dollar initially rose to nearly JPY107.70, marginally taking out yesterday’s high in early Tokyo trading before reversing lower and in the European morning has been sold through yesterday’s low (~JPY106.85). The low from last October was set near JPY106.50, and below there was congestion around JPY106 from last August and September. As of about a week ago, the speculative market (non-commercials) had its largest gross short yen position in the CME futures since last May, apparently leaving plenty of scope for a short-squeeze. The Australian dollar is firm and held above $0.6600. However, the 20-day moving average, which it has not closed above since January 6 is the nearby hurdle and is found around $0.6640 today. The Chinese yuan consolidated its recent gains in subdued turnover. The dollar firmed slightly but remains below previous support around CNY6.95.

Europe

Germany’s construction PMI rose to 55.8 from 54.9. This is the strongest reading since January 2018. Of course, the construction sector is a smaller proportion of the German economy than manufacturing and services. However, it speaks to the resilience of the domestic economy. Germany exports around 40% of GDP, but construction is nearly exclusively a domestic activity. The focus is shifting toward the ECB meeting next week. It is the only major central bank meeting, and the market is expecting a policy response, supported by updated staff forecasts.

Carney’s replacement at the Bank of England, Bailey does not take office until March 16. However, he weighed in on two issues. First, next week’s budget is the near-term focus, and Bailey indicated the BOE will work closely with Chancellor of the Exchequer Sunak to coordinate the response to the virus. Second, the next MPC meeting is March 26, and Bailey seemed to push back against some speculation of an inter-meeting cut like the Fed delivered this week. Bailey indicated he thought more evidence is needed before acting.

For the second consecutive session, the euro found solid bids below $1.11 yesterday and is consolidating inside yesterday’s range today. It is testing the $1.1175 area in the European morning, where an option for about 775 mln euros expires later today. There is another option at $1.12 for roughly 565 mln euro that also gets cut today. The week’s high set on Tuesday was just shy of $1.1215. A third expiring option for around 525 mln euros is struck at $1.1225. Sterling is bid for the third session in a row and is pushing above $1.29 for the first time this week. An option for nearly GBP210 mln placed there that expires today. Above there resistance is seen in the $1.2950 area and then $1.30. That said, the intraday technicals are stretched, cautioning early North American traders from chasing it. The euro’s gain against sterling has been frustrated by the 200-day moving average (~GBP0.8740) for the past three sessions and reversed lower yesterday. The cross found support today near GBP0.8620, ahead of chart support near GBP0.8600, where an option for around 640 mln euro will expire today.

America

The market had clearly recognized the risk but was still surprised when the Bank of Canada announced a 50 bp rate cut to 1.25%. Last year, when the Fed cut three times, the Bank of Canada stood pat. However, the combination of Covid-19, which is what the Bank called “material negative shock,” and the Fed’s move, likely pushed Governor Poloz over the edge. The Bank of Canada’s policy rate is still the highest in the G7. It was also dovish ease in the sense that it seemed clear from Poloz’s comments that the bar to additional cuts is not particularly high. Poloz presents the Economic Progress Report (the text on its website at 12:45 pm), and impressions from the rate cut will be clarified. The next Bank of Canada meeting is in the middle of next month.

Canada became the third major central bank to ease, following the Reserve Bank of Australia and the Federal Reserve. Although most centers in Europe have lower rates than the US, there is speculation of action by the ECB, which meets next week. The market appears to be pricing in seven basis points of a 10 bp move, and there is some speculation of expanding the asset purchases, and maybe a new TLTRO facility to aid lending to be small and medium-sized businesses. The BOJ meets March 18-19, and it appears to be the most difficult central bank to read now. Its asset purchase programs can be scaled-up, but the market seems nearly evenly divided about the prospects of a deeper negative rate. The Bank of England does not meet until March 26, but an earlier move is being discussed by market participants, though, as noted above, was pushed back against by the incoming Governor Bailey. Another scenario is a 50 bp cut rather than 25 bp. These actions were not coordinated, but central banks are responding to the same thing.

The US is joining mostly Asia Pacific countries at this juncture, with a fiscal response. In a bipartisan effort, the House of Representatives approved $7.8 bln emergency spending to cope with the virus, which is around three times more than what White House sought last week. The Senate is expected to take up the measure today or tomorrow. California has declared a state emergency, and this will also free up funds, while the CDC lifted restrictions on testing for the virus, which has been low in the US in both absolute and relative terms.

The Beige Book, prepared for the upcoming FOMC meeting, reported broad concerns about supply chain disruptions but also hits to the travel and tourist industries. St. Louis Fed’s Bullard cautioned against market expectations for a follow-up cut at the FOMC meeting, suggesting little new information may be known by then. The market appears to have another 25 bp cut fully discounted (which is what we suspect is the most likely scenario in a fluid situation) and about 70% chance of 50 bp move.

The US dollar is trying again to establish a foothold above CAD1.34. It finished last week above there but has not done so this week. Canada’s 2-year premium over the US is about 32 bp, the most in five years. However, it is not sufficient to compensate for the risk-off mood and the softer commodity prices. Initial resistance is seen near yesterday’s high around CAD1.3430. Nearby support is cited by CAD1.3380, with stronger support in the CAD1.3320-CAD1.3340 band. The greenback will begin the North American session above yesterday’s highs against the Mexican peso (~MXN19.6250). A move above MXN19.68 today could signal gains toward MXN19.80. Given the sensitivity to the broader environment, participants may not attempt to pick a top until after the first equity losses.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Bank of England,Currency Movement,Featured,newsletter,South Korea