USD/CHF fails to hold on to previous gains as broad weakness of the USD joins risk reshuffle. US-China trade optimism confronts Brexit risk while Japan’s data-dump joins China’s Industrial Production data. Swiss ZEW Survey, trade/political updates will be in the spotlight. With the broad US Dollar (USD) weakness joining hands with mixed fundamental catalysts, USD/CHF drops to 0.9810 amid the initial Friday trading. The greenback seems to have lost its allure amid the increasing odds of the US-China phase-one whereas year-end trading lull and downbeat data add to the greenback’s weakness off-late. On the contrary, the risk of hard Brexit, as suggested by the latest news from The Times, is likely exerting fresh downside pressure on the risk tone. As a result, the US

Topics:

Anil Panchal considers the following as important: 1) SNB and CHF, 1.) FXStreet on SNB&CHF, Featured, newsletter

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

- USD/CHF fails to hold on to previous gains as broad weakness of the USD joins risk reshuffle.

- US-China trade optimism confronts Brexit risk while Japan’s data-dump joins China’s Industrial Production data.

- Swiss ZEW Survey, trade/political updates will be in the spotlight.

With the broad US Dollar (USD) weakness joining hands with mixed fundamental catalysts, USD/CHF drops to 0.9810 amid the initial Friday trading.

The greenback seems to have lost its allure amid the increasing odds of the US-China phase-one whereas year-end trading lull and downbeat data add to the greenback’s weakness off-late.

On the contrary, the risk of hard Brexit, as suggested by the latest news from The Times, is likely exerting fresh downside pressure on the risk tone. As a result, the US 10-year treasury yields slip back to 1.89% after Wall Street benchmarks surged to record highs on Thursday.

On the economic front, recently released Japanese data dump has been positive while China’s Industrial Production should also challenge the market’s present risk reshuffle.

Looking forward, traders will now concentrate on Switzerland’s December month ZEW Survey data, expected -8.5 versus -3.9, for immediate direction. However, overall trade sentiment is likely to be less active amid year-end sparse trading and a lack of major catalysts.

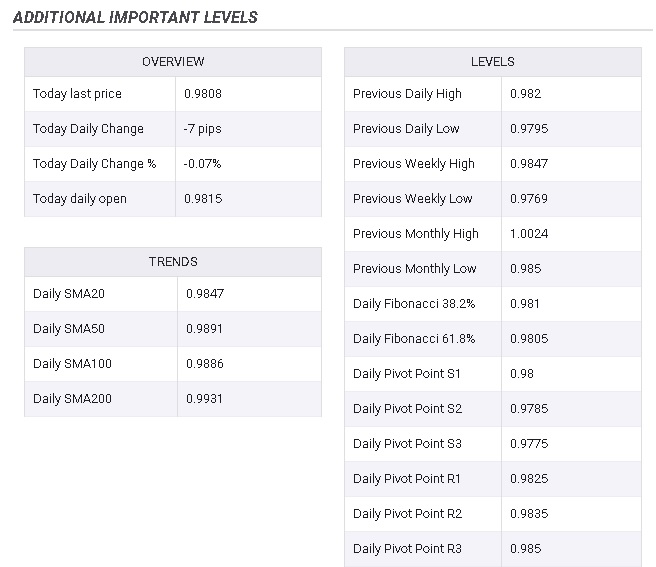

Technical Analysis10-day Exponential Moving Average (EMA) near 0.9820 acts as immediate resistance whereas pair’s declines below 0.9800 can challenge monthly bottom close to 0.9770. |

Tags: Featured,newsletter