Insolvency isn’t restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge–and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in government union employee wages and benefits ratchet higher. Since personnel costs are 70+% of city and county budgets, those ever-increasing payroll, pension and benefits costs are the key driver of budgets expanding. But local governments’ ability to increase revenues are also essentially

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There are no institutional memories or mechanisms for contraction, i.e. reduced revenues, so when revenues decline sharply, the institution breaks down.

The Ratchet Effect sets up The Rising Wedge Model of Breakdown: as complexity, costs and layers of management all ratchet higher, the organization loses the flexibility required to deal with outright declines in revenues. As a result, any sustained drop in revenues causes the institution to break down, i.e. fail systemically. Allow me to explain another mechanism of rampant inflation triggered by local government. Cities and counties discovered a new revenue source in the late 20th century: real estate development fees. Building permits that once cost a few hundred dollars now cost thousands of dollars, and a host of new fees are now standard: sewer hookup fees, plan review fees, and development fees. Then there are transfer fees for every sale of real estate, and mandated subsidized housing requirements for new apartment buildings: a percentage of the new apartments must be made available at below-market rents for qualified tenants. The cost of the subsidized units are borne by the owner/developer, not the taxpayer, so the subsidy in effect raises the market rents. |

The Rising Wedge Model of Breakdown |

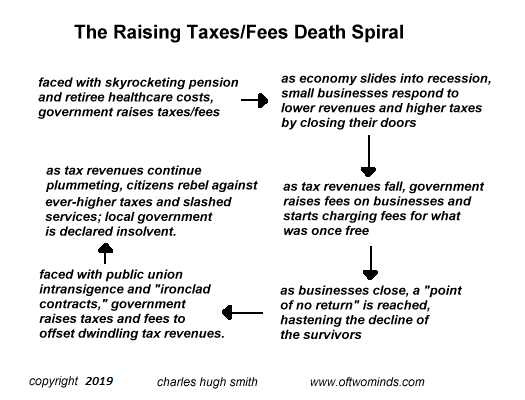

| This sets up the rising tax/fee spiral of death, as local government seeks to replace the lost revenues by jacking up taxes and fees on the remaining small businesses. The higher costs appear “affordable” to a public and city staff who don’t have to pay the soaring costs of keeping the doors open, so they’re mystified when one small business after another closes their doors forever.

The Ratchet Effect has pushed costs above the point the businesses can survive, so they close. Local government then increases tax and fee burdens on the remaining businesses, pushing more of them over the edge. At some point, the trickle of businesses closing becomes a self-reinforcing flood. As vacant storefronts become the norm, cities respond to the loss of tax donkeys by launching desperate marketing campaigns which do nothing to address the real problem, high costs: come spend money in our commercial districts! These campaigns fail to move the needle, and as the economy slips into a long-delayed recession, city revenues plummet, triggering even more onerous fees and taxes. The resulting collapse in small business eventually leads to a collapse in city finances. Insolvency isn’t restricted to private enterprise; governments go broke, too. |

The Raising Taxes/Fees Death Spiral |

Tags: Featured,newsletter