The 10-year Treasury yield is unlikely to reach pre-crisis levels in the current cycle. Our baseline scenario envisages its fair value being capped at 3.2% in the next two years.The 10-year US Treasury yield is probably the most watched bond yield globally, seeming to encapsulate everything from the noise coming from financial markets and politicians to the health of the world economy, not to mention monetary policy. Trying to forecast the likely behaviour of such a global indicator is challenging, which is why econometric models can help.Our estimate of fair value for the 10-year Treasury yield is determined using a model that takes into account a stable long-term relationship between the 10-year bond yield, the neutral rate, inflation expectations and movements in the size of the Fed’s

Topics:

Laureline Chatelain and Jean-Pierre Durante considers the following as important: 10-year Treasury yield fair value, Macroview, US 10-year Treasury yield

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The 10-year Treasury yield is unlikely to reach pre-crisis levels in the current cycle. Our baseline scenario envisages its fair value being capped at 3.2% in the next two years.

The 10-year US Treasury yield is probably the most watched bond yield globally, seeming to encapsulate everything from the noise coming from financial markets and politicians to the health of the world economy, not to mention monetary policy. Trying to forecast the likely behaviour of such a global indicator is challenging, which is why econometric models can help.

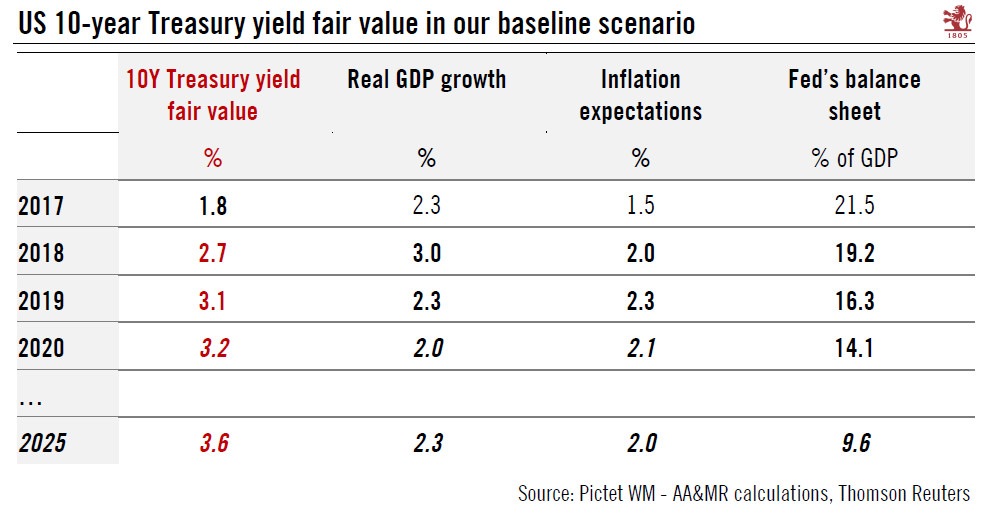

Our estimate of fair value for the 10-year Treasury yield is determined using a model that takes into account a stable long-term relationship between the 10-year bond yield, the neutral rate, inflation expectations and movements in the size of the Fed’s balance sheet.

The conclusions of our US 10-year Treasury yield fair value model are similar to those for the neutral rate—in other words, 10-year bond yields are unlikely to reach pre-crisis levels in this cycle. Our baseline scenario envisages the 10-year US Treasury yield fair value being capped at 3.2% by end-2020, compared with an average of 4.5% for the 10-year yield between 2004 and 2007.

As with the neutral rate model, the 10-year Treasury yield fair value works as an attractor for the actual yield. The further and the longer the divergence between the 10-year yield and its fair value, the stronger the pull to fair value. Hence, our year-end fair value of 2.7% underpins our 3% target for the 10-year Treasury yield for end-2018.

According to our projections, the environment of low short-term rates in the US is likely to last, as it would require a significant boost to economic growth from current levels to bring the Fed funds rate back to its pre-crisis average of 4.4%. We estimate that the neutral rate should rise gradually towards 3.0% by mid-2019, capping the 10-year Treasury yield fair value at 3.2% in 2020.

However, as the 10-year fair value works as an attractor, movements around this trajectory are likely, especially if we see a surge in the oil price or in core inflation (through US import tariffs or accelerating wage growth). In light of baseline scenario for US growth and inflation, we remain comfortable with our 10-year Treasury yield target of 3% for year’s end, which is slightly above our fair value estimate of 2.7%. We continue to monitor the situation, paying special attention to developments on the trade tariff front.