The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year (down from our previous forecast of 2.3% for 2018).Euro area economic activity was buoyant in 2017. While a slowdown this year was expected, its magnitude has surprised. Several one-off factors are seen as having hurt growth data. But the loss of economic momentum is also the result of more persistent

Topics:

Nadia Gharbi considers the following as important: euro area, Euro area GDP growth, Euro area Q2 GDP, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The cut to our growth forecast reflects slippage in euro area data.

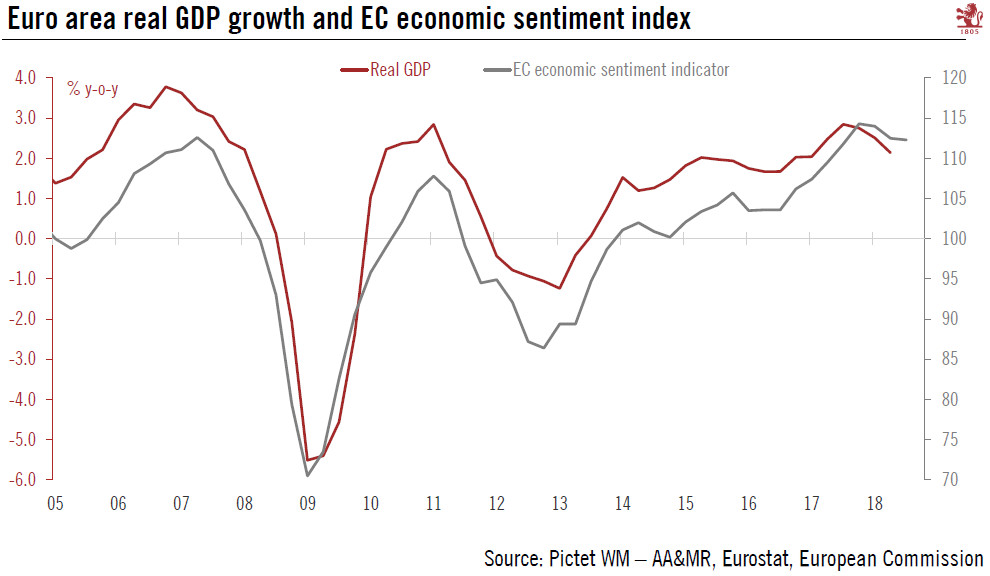

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.

Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year (down from our previous forecast of 2.3% for 2018).

Euro area economic activity was buoyant in 2017. While a slowdown this year was expected, its magnitude has surprised. Several one-off factors are seen as having hurt growth data. But the loss of economic momentum is also the result of more persistent factors, such as supply-side constraints and a sharp slowdown in exports.

Nonetheless, euro area economic fundamentals remain robust. In spite of the slowdown, the euro area economy is likely to continue to grow at rates above its long-term potential. Solid job creation, monetary policy that is still highly accommodative and favourable financial conditions all continue to support household spending and business investment. We therefore remain constructive on the cyclical outlook for the euro area. Forward-looking indicators (purchasing manager indexes and the European Commission’s economic sentiment indicator) have recently shown signs of stabilising after weakening earlier this year. But risks to the growth outlook remain tilted to the downside, with global trade tensions the most prominent of them.