Trade tensions and heavy short positioning should pave the way for appreciation against the US dollar.The Swiss franc has been relatively weak since the end of June (depreciating 1.3% vs USD) despite increasing trade tensions. Yet the defensive feature of the Swiss currency, stemming from a structurally large current account surplus and elevated stock of foreign assets (i.e. its net international investment position), favour some appreciation of the franc.For the moment, as highlighted by subdued levels of volatility in US equity markets, investors do not seem particularly concerned about the impact of current trade tensions on the US business cycle. A US economy still displaying ‘Goldilocks’ characteristics combined with an unsupportive interest rate differential also help explain the

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trade tensions and heavy short positioning should pave the way for appreciation against the US dollar.

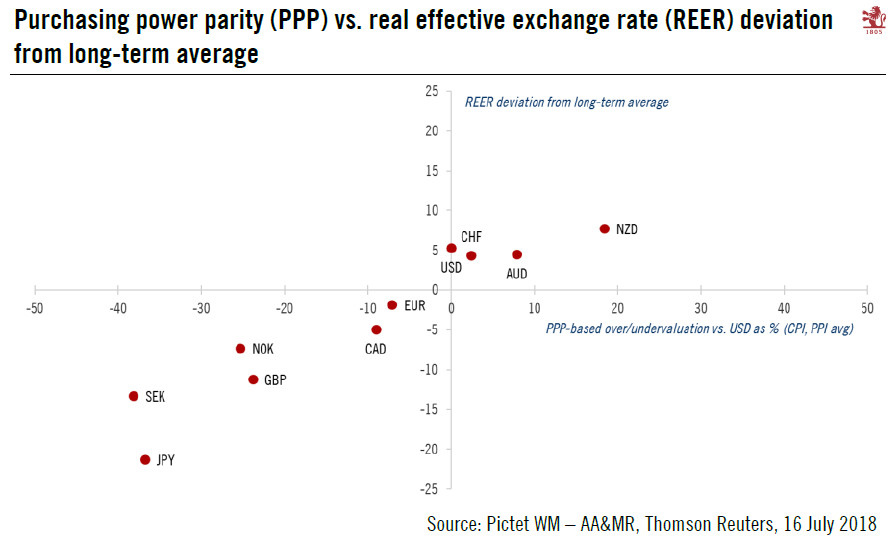

The Swiss franc has been relatively weak since the end of June (depreciating 1.3% vs USD) despite increasing trade tensions. Yet the defensive feature of the Swiss currency, stemming from a structurally large current account surplus and elevated stock of foreign assets (i.e. its net international investment position), favour some appreciation of the franc.

For the moment, as highlighted by subdued levels of volatility in US equity markets, investors do not seem particularly concerned about the impact of current trade tensions on the US business cycle. A US economy still displaying ‘Goldilocks’ characteristics combined with an unsupportive interest rate differential also help explain the recent weakness of the Swiss franc as well as of other defensive assets, such as the Japanese yen and gold.

But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential. In addition, the Swiss National Bank may have growing difficulties to justify its very accommodative monetary policy going forward. Given the moderation in euro area growth in the past couple of months and given the renewed political uncertainty originating in Italy, capital outflows are unlikely to significantly curb the upward pressure on the franc that results from Switzerland’s current account surplus.

It seems unlikely, in our view, that the Swiss franc will weaken significantly relative to the US dollar from current levels (the two currencies were at parity on 18 July). On the contrary, increasing trade tensions and heavy short positioning on the franc should pave the way for appreciation of the Swiss franc against the US dollar in the short term. In our base scenario, we project a USD/CHF rate of CHF0.98 on a three-month horizon and of CHF 0.92 on a 12-month horizon.