More of the same in the US labour market: strong jobs and moderate wage growth.The June employment report showed ‘more of the same’, with payroll growth still strong and wage growth still moderate—in other words, it’s still ‘Goldilocks’. Crucially, the payroll report shows that trade tensions are still having a minimal impact, and supporting our view that the US economy will continue to chug along at a robust pace in the near term. Based on recent data, we still expect Q2 GDP growth of c.4-4.5% q-o-q SAAR (the figures will be released later in July).Nonfarm payrolls rose 213,000 in June, compared with 244,000 in May. The three-month average was 211,000. Readings above 200,000 are quite spectacular, especially given the US is in late phase of the business cycle. Mostly for technical

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

More of the same in the US labour market: strong jobs and moderate wage growth.

The June employment report showed ‘more of the same’, with payroll growth still strong and wage growth still moderate—in other words, it’s still ‘Goldilocks’. Crucially, the payroll report shows that trade tensions are still having a minimal impact, and supporting our view that the US economy will continue to chug along at a robust pace in the near term. Based on recent data, we still expect Q2 GDP growth of c.4-4.5% q-o-q SAAR (the figures will be released later in July).

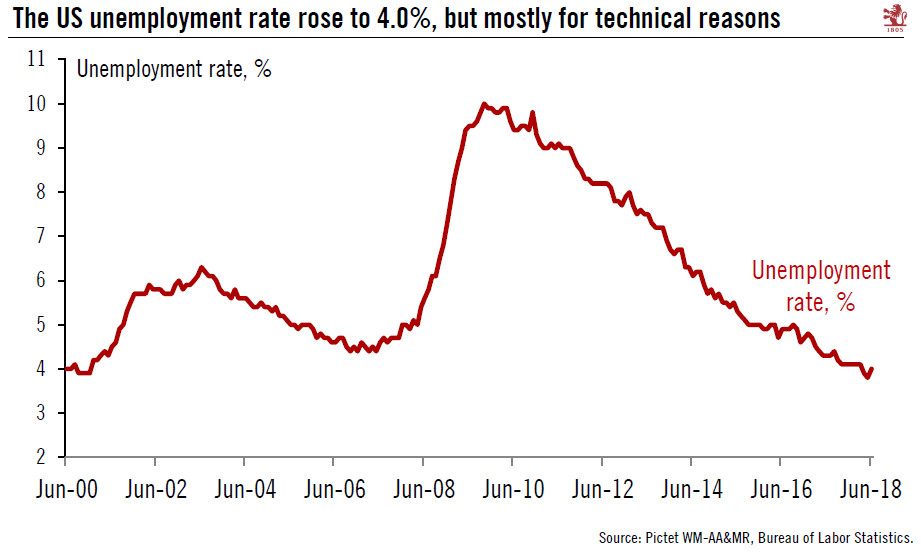

Nonfarm payrolls rose 213,000 in June, compared with 244,000 in May. The three-month average was 211,000. Readings above 200,000 are quite spectacular, especially given the US is in late phase of the business cycle. Mostly for technical reasons, the unemployment rate inched up to 4.0% in June from 3.8% in May, but the participation rate rose to 62.9% from 62.7%. Average hourly earnings were up 0.2% m-o-m (below the 0.3% expected), and the y-o-y print was a modest 2.7%—still stuck below the 3% mark.

The Federal Reserve has been anxious lately about the ongoing trade ‘noise’, as this week’s minutes from its June meeting demonstrated. But its concerns could be put to rest temporarily by the latest evidence that the US economy continues to perform strongly, with no sign of a recession on the horizon. Manufacturing employment growth was particularly strong in June (+36,000), a sign that the US business cycle remains in strong shape. We still see the next rate hikes coming at the Fed’s September and December meetings, with two further ones in 2019.