Domestic Asian companies usually have a head start in their respective markets, but multinationals have a chance to gain share if they capture changes in user behaviour.They typically have a head-start on multinationals (MNCs) in terms of product localisation and strong relationships with distributors when it comes to rolling out products across traditional trade channels. A deep understanding of local preferences has been a key driver for the success of domestic companies as many foreign MNCs are unwilling to adapt their products and often roll out the same products across different countries.Consumer tastes in Asia are evolving constantly. New products or brands can gain traction if they successfully capture changes in user behaviour. By using sophisticated data analysis and consumer

Topics:

Swee San Tan considers the following as important: asia consumer sector, asia consumer staples, asia economy, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Domestic Asian companies usually have a head start in their respective markets, but multinationals have a chance to gain share if they capture changes in user behaviour.

They typically have a head-start on multinationals (MNCs) in terms of product localisation and strong relationships with distributors when it comes to rolling out products across traditional trade channels. A deep understanding of local preferences has been a key driver for the success of domestic companies as many foreign MNCs are unwilling to adapt their products and often roll out the same products across different countries.

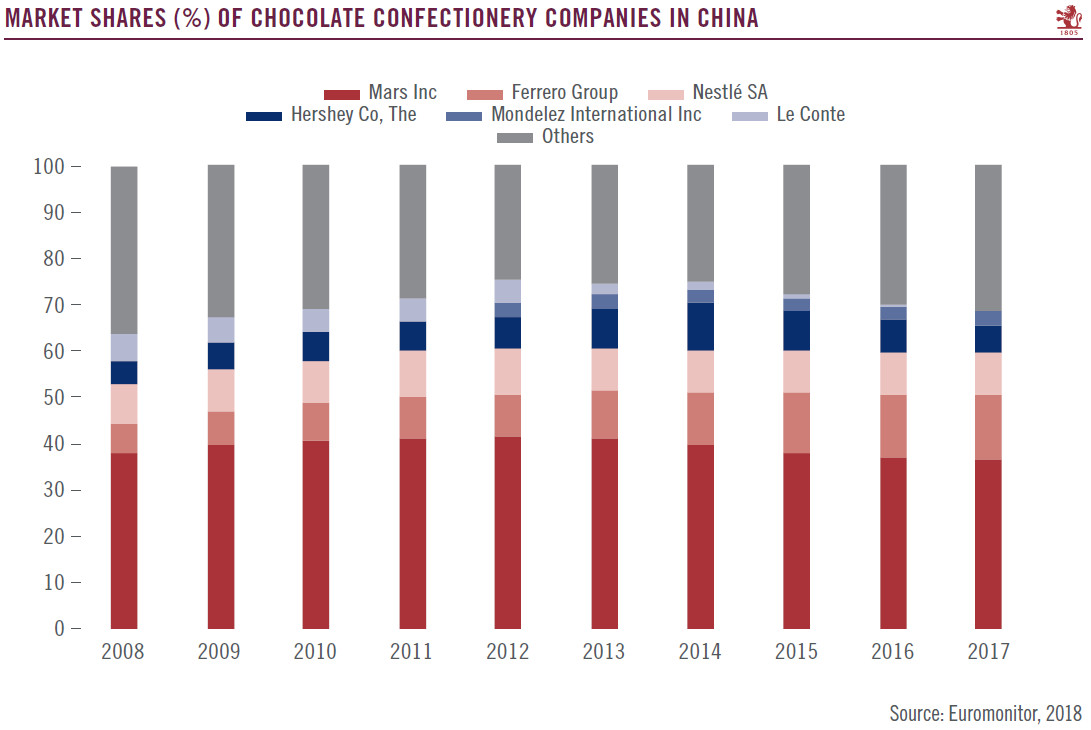

Consumer tastes in Asia are evolving constantly. New products or brands can gain traction if they successfully capture changes in user behaviour. By using sophisticated data analysis and consumer home surveys to understand user habits, foreign MNCs are able to penetrate the Chinese market and displace the incumbents. In China, local player Le Conte did not understand their consumers well and eroded their high end brand image by issuing promotions and steep discounts in a time when consumers were moving towards premium chocolates. But this gave the opportunity for foreign companies like Mars, Ferrero and Nestlé to step in and solidify their brand image in the high end.

Instead of going head to head with local champions or MNCs, some companies have succeeded in establishing themselves within a particular niche. Vitasoy, a Hong Kong-based company, was known for its soy milk product that it positioned as a soft drink in eastern and coastal cities in China. Last year, Dali Foods Group launched its premium soy milk product, Dou Ben Dou, which caters to breakfast consumption mainly in smaller cities and managed to match Vitasoy’s monthly sales revenue within 12 months.

Regional/local food and beverage companies in Asia have first-mover advantage when it comes to launching products that suit local tastes, but MNCs have taken the lead in certain categories where the growth of the middle class is creating a market for premium products. Our stock-picking favours companies that understand Asian consumers’ evolving tastes and have a track record of launching the most appropriate products to capture demand growth.