Summary China regulators have taken over Anbang Insurance. Group for at least one year RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index. Israeli Prime Minister Netanyahu is coming under increasing pressure. South African corporates will be impacted by new eligibility rules for the Barclays Global Aggregate Index effective May 1. South African Finance Minister Gigaba announced fiscal tightening in the first budget under President Ramaphosa. Moody’s cut the outlook on Colombia’s Baa2 rating from stable to

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Summary

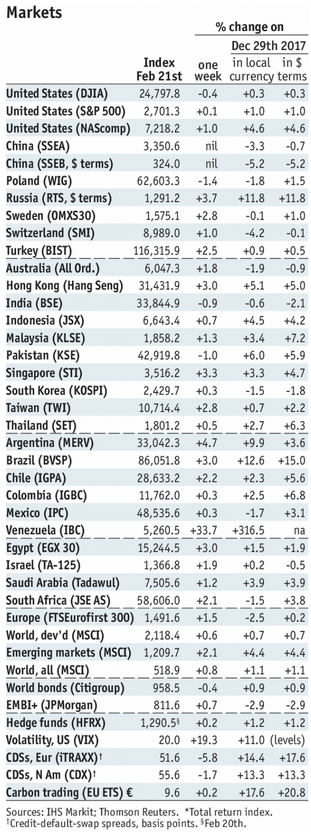

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (+4.8%), Russia (+3.8%), and Singapore (+2.6%) have outperformed this week, while Hungary (-2.4%), Philippines (-1.8%), and Mexico (-0.7%) have underperformed. To put this in better context, MSCI EM rose 1.3% this week while MSCI DM fell -0.5%. In the EM local currency bond space, Mexico (10-year yield -8 bp), South Africa (-7 bp), and Israel (-7 bp) have outperformed this week, while the Philippines (10-year yield +29 bp), Singapore (+15 bp), and Indonesia (+9 bp) have underperformed. To put this in better context, the 10-year UST yield fell 2 bp to 2.89%. In the EM FX space, ILS (+1.5% vs. USD), PHP (+0.7% vs. USD), and CLP (+0.3% vs. USD) have outperformed this week, while KRW (-1.5% vs. USD), TRY (-1.2% vs. USD), and IDR (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, February 21 Source: economist.com - Click to enlarge |

ChinaChina regulators have taken over Anbang Insurance Group for at least one year. Anbang Chairman Wu Xiaohui was detained by authorities last year and will now face fraud and embezzlement charges. Anbang’s success was fueled by aggressive sales of high-yield products, but officials have recently been trying to crack down on the sale of risky and leveraged investments. Wu’s arrest also seems to fit in with President Xi’s anti-corruption drive. AustriaRBI minutes from this month’s meeting were more hawkish than expected. With inflation running above 5%, officials fretted that the 2-6% target band will be breached as fiscal policy runs too hot. One member of the MPC noted that “Fixed income markets are telling us that we have fallen behind the curve.” Next policy meeting is April 5 and markets should start preparing for a possible rate hike then. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. The bank is apparently concerned that future FX movements may hurt these companies’ ability to repay their external debt obligations. The RBI is also looking more closely at the hedging practices of borrowers. Observers said that the new process has resulted in slower approvals for external debt issuance in recent weeks. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index. Fifty IDR-denominated government bonds totaling $151.3 bln in market value will enter the Global Aggregate and Global Treasury universes in early May and will contribute to index returns starting June 1. IsraelIsraeli Prime Minister Netanyahu is coming under increasing pressure. Israeli police arrested several of Netanyahu’s friends and aides in a widening corruption investigation. One of those arrested subsequently agreed to become a government witness. This comes after reports that one of Netanyahu’s closest advisers sought to bribe a judge into dropping a criminal investigation involving his wife. South AfricaSouth African corporates will be impacted by new eligibility rules for the Barclays Global Aggregate Index effective May 1. If the local sovereign debt is not eligible for the index, then no other securities denominated in that currency will be eligible regardless of their ratings. As a result, 32 government-related and corporate bonds ($7.5 bln in market value) denominated in ZAR will be removed from the Global Aggregate Index in early April and will not contribute to May index performance. South African Finance Minister Gigaba announced fiscal tightening in the first budget under President Ramaphosa. Key takeaways from South Africa’s budget statement: 1) VAT will be raised one percentage point to 15%, 2) other measures will impact income and estate taxes, 3) spending will be cut ZAR85 bln over next three years, 4) growth forecasts were raised modestly, and 5) deficit forecast for FY2018/19 cut to -3.6% of GDP from -3.9% previously. Bottom line: we think it buys some time but a downgrade from Moody’s still seems likely this year. ColombiaMoody’s cut the outlook on Colombia’s Baa2 rating from stable to negative. The agency cited a deteriorating fiscal outlook and risks that the next government won’t be able to limit its borrowing. Our own sovereign ratings model showed Colombia’s implied rating falling a notch this quarter to BBB-/Baa3/BBB-. This supports S&P’s recent downgrade to BBB-, and suggests pressure on Moody’s and Fitch’s ratings of Baa2 and BBB, respectively. MexicoMexico presidential candidate Andres Manuel Lopez Obrador (AMLO) appears to have softened his stance on the controversial oil sector reforms of 2013. Those reforms opened up Mexico’s energy sector to private investment, and AMLO has threatened to reverse them. Now, advisor Alfonso Romo said AMLO has reviewed most of the oil tenders awarded and found them to be beneficial for Mexico. He added that the auctions were found to be well-executed and transparent. VenezuelaVenezuela launched an oil-backed cryptocurrency called the petro. The deal was first announced in December. Details remain sketchy, but (at least for now) a petro is meant to represent a claim of some sort on Venezuelan crude oil. We think this is just a gimmick that cashes in on the current crypto craze, aims to circumvent existing sanctions, and avoids addressing the nation’s deep structural problems. |

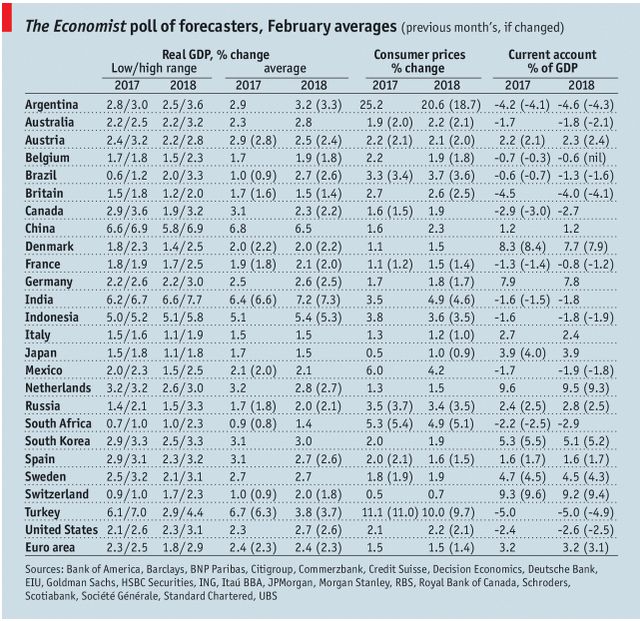

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin