– Gold is better store of value than bitcoin – Goldman Sachs report– Gold will continue to perform well thanks to uncertainty and wealth demand– Bitcoin’s volatility continues to impact its role as money– Gold up 12% in 2017, bitcoin over 600% – BTC is six times more volatile than gold – see chart– Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value Bitcoin Price in USD, Jan - Oct 2017(see more posts on Bitcoin, ) - Click to enlarge Since the birth of bitcoin there has been one question that has repeatedly grabbed headlines and led debates all over the world – will bitcoin replace gold? The latest to weigh in on this question is Goldman Sachs which, in a

Topics:

Jan Skoyles considers the following as important: Bitcoin, Daily Market Update, Featured, Gold, gold price, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

| – Gold is better store of value than bitcoin – Goldman Sachs report – Gold will continue to perform well thanks to uncertainty and wealth demand – Bitcoin’s volatility continues to impact its role as money – Gold up 12% in 2017, bitcoin over 600% – BTC is six times more volatile than gold – see chart – Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value |

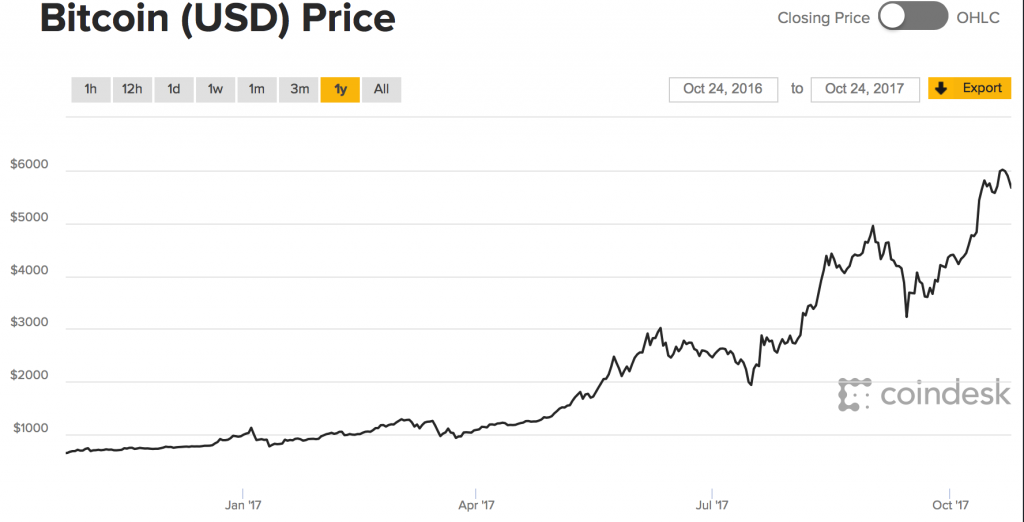

Bitcoin Price in USD, Jan - Oct 2017(see more posts on Bitcoin, ) |

| Since the birth of bitcoin there has been one question that has repeatedly grabbed headlines and led debates all over the world – will bitcoin replace gold?

The latest to weigh in on this question is Goldman Sachs which, in a research note entitled ‘Fear and Wealth’, has concluded that gold is better than bitcoin. Examining gold and bitcoin against the key characteristics of money, the report concludes that “Precious metals remain a relevant asset class in modern portfolios, despite their lack of yield…They are neither a historic accident or a relic.” Goldman Sachs looked at four key properties of a long-term store of value – durability, portability, intrinsic value and unit of account – concluding that the reasons why gold was originally adopted remain relevant to today. They believe as the level of uncertainty increases investors increase their exposure to gold. Fear is the medium to short-term driver of the gold price. The long-term driver, Goldman Sachs believes, is wealth. The debate of gold versus bitcoin is really a rather tedious one. So rarely do you see any other two assets pitched against one another. Yet those choosing to debate it manage to find common ground between the two, so the debate rages on. Bitcoin’s finite supply and occasional rise on the back of geopolitical tensions has led to such comparisons. Conversely the debate is relevant as both assets are ones which evoke a strong emotive reaction and raise similar questions about the state of the economy and the investment space. As bitcoin’s market cap increases (heading to $100 billion) it is inevitable that it will continue to grab the attention of the likes of Goldman Sachs and institutional investors. Most recently, Ray Dallio, the world’s biggest fund manager felt the need to point out the bitcoin bubble and how he favoured gold over the cryptocurrency. The debate is of particular interest this year given bitcoin’s performance. It has climbed from around $1,000 at the start of the year to nearly $6,000. In the same period gold is up 12%. “Gold wins out over cryptocurrencies in a majority of the key characteristics of money,” |

|

| The first record of gold being used as money is from around 700 B.C. when the Lydians combined it with silver, to form electrum coins.

Bitcoin’s role as money is one which is still being established. Many of the problems it faces are down to infrastructure and price volatility. Goldman Sachs addressed the main characteristics that make a medium of exchange and found gold to outperform bitcoin. The findings were summarised by Bloomberg:

|

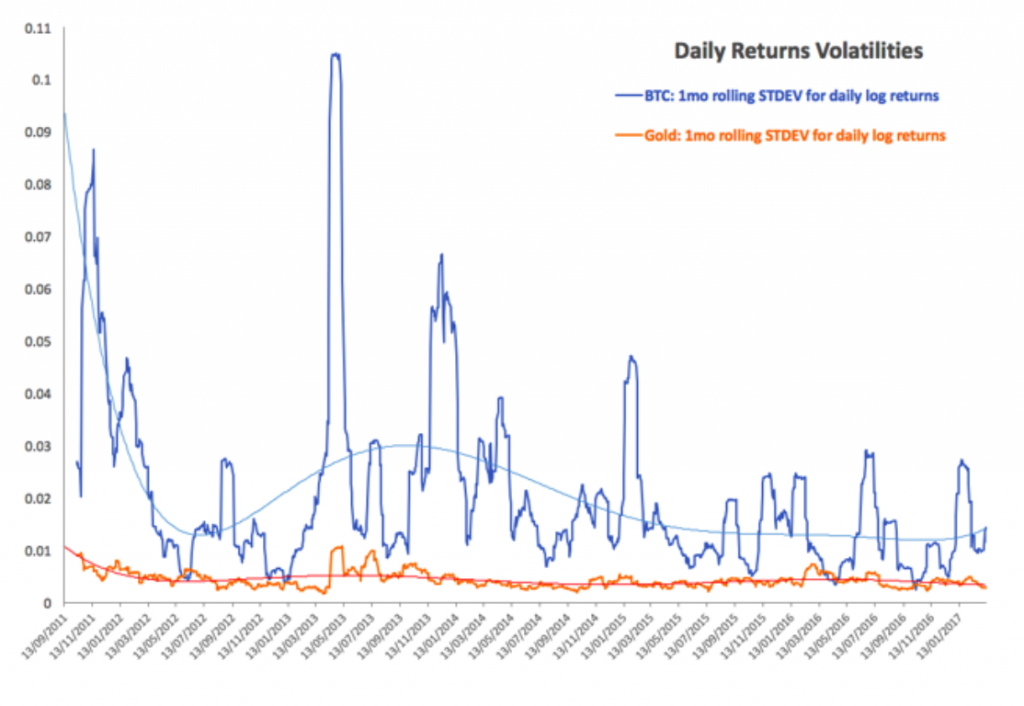

Daily Volatility Returns, Sep 2011 - Jan 2017 |

| In regard to volatility the Fear and Wealth report stressed how “a 3-day USD/BTC put option at historical average volatility results in a premium of around 2.3%.” This is clearly a prohibitive premium. Fiat to bitcoin volatility this year stands at more than six times that seen with gold.

The authors conclude that these factors “clearly illustrate that Bitcoin as a unit of account and medium of exchange is nowhere near as favourable as it first appears.” Is gold that immovable? Goldman Sachs found gold was only at a disadvantage to bitcoin when it came down to portability. This is something that is often cited about gold. Bullion is often accused of being bulky and therefore dysfunctional as a form of money. However, there are two main factors that are overlooked by those who argue this: – Size of gold bars and coins relative to value If you consider that the high income households in the UK are estimated to have around £63,000 (on average) in savings then this would be just 2 kilogram bars of gold. About the size of a smart phone each. Not exactly immovable. Then consider coins, far more portable and a great way to divide up your gold holdings. Should you hold gold (either at home or in a vault) then you are rarely under the same requirements to move the gold as you are if you had the equivalent held in a bank. Often banks demand a few days’ notice, or limit the amount of cash you can move in one go. Arguably, less portable than a trusty gold bar. – Technology In order to spend bitcoin you are required to be ‘online’. Fantastic for those of us who are able to go anywhere without worrying about connectivity. Not so great for those countries, remote areas or disaster struck places (such as Puerto Rico) that do not find it so easy to just jump online and shift a few bitcoin. Spending a few gold coins, or even a small gold bar, does not require you to partake in an online transaction. Should you find yourself in a position where you need to spend your gold, a power outage or loss of connection will not be your biggest problem. Uncertainty and fear: the drivers of gold |

|

| It is interesting that given the title of the report is Fear and Wealth, the authors do not consider why gold’s portability is relevant and addresses fears surrounding uncertainty.

There are a number of fears about the direction both the financial and political spheres are heading in. Consider real interest rates issues, debasement, sovereign balance-sheet, geopolitical and other market risks. The main fear is that no-one knows how bad things will be and so investment decisions are coming down to uncertainty. This is good for gold and its price.

People like to hold gold because they can balance the uncertainty with the certainty that gold will be accepted regardless of how things pan out. Holders know that they can easily transport and transfer it, in order to make an exchange for goods. They cannot know this with bitcoin, both because of its design and because it has never been tested in such a way. Gold investors are also exposed to far less uncertainties when it comes to professional storage, something Goldman Sachs does acknowledge:

Despite this acknowledgement it is interesting that ‘portability’ is still seen as a negative for gold. This has not restricted gold too much in the past. Long-term investors are clearly also not too concerned about portability either. Goldman Sachs believes these investors are the key to gold’s long-term performance, thanks to a desire to build and protect their wealth. |

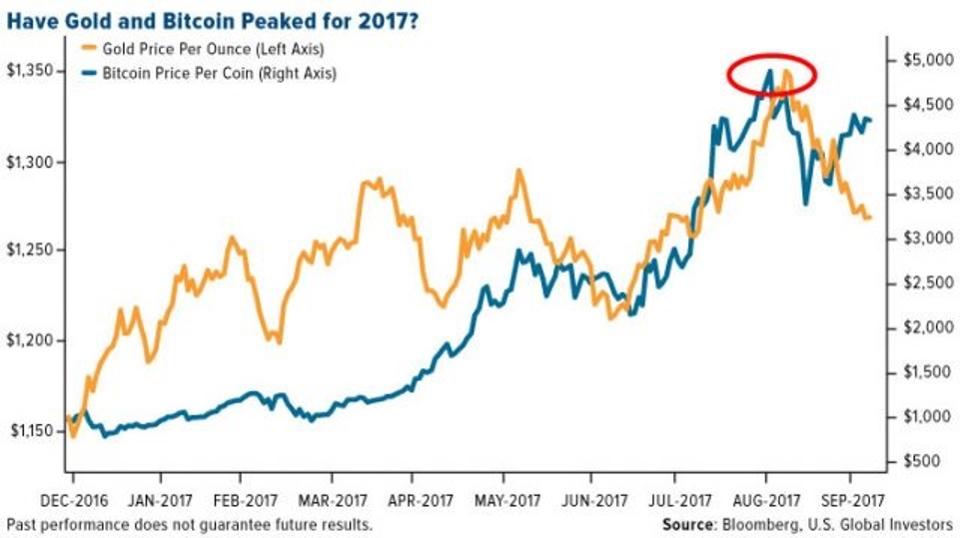

Gold and Bitcoin Price, Dec 2016 - Sep 2017(see more posts on Bitcoin, gold price, ) |

Gold’s future

Goldman Sachs forecasts that emerging market economies will be the key drivers of wealth-based demand for gold.

“As more EM economies — including China — are set to grow to these income levels over the next few decades, the underlying long-term demand picture remains supportive of gold prices…While fear can spike or fall relatively quickly, wealth tends to accumulate slowly. This makes wealth an important, but easy to overlook in short-term forecasting, driver of gold.”

The likes of China and India are experiencing a rapidly growing middle-class, all of whom are interested in buying gold. Between the two countries they account for 60% of the global jewellery market.

This is likely to boost long-term demand for the precious metal given rapid accumulation of gold tends to occur when per-capita gross domestic product reaches roughly $20,000 to $30,000.

There is still a long-way to go for 29 developing countries, each of whom have an interest in holding gold.

“Our modeling, based on the historical experiences of 29 countries at various stages of development since the early 1990s, suggests that this is still very far from peak annual demand,”

Uncertainty will lead to wealth protection in the future

Goldman Sachs expects to see the price of gold falter somewhat before reaching nearly $1,400/oz in 2018. The expected stumble is down to tightening of monetary policy and a moderation of the fear factor.

Investors should not be put off by Goldman Sachs’ forecast. If there is any takeaway from their report it is that gold is both a long-term investment and a safe haven.

Whilst fear and uncertainty may well subside, they will not disappear until the factors that cause them also vanish. In all likelihood this is impossible without years of serious economic and political change. Unlikely, especially in the West with short-term policies for maximum political gains and disastrous economic consequences.

By showing gold has true value as a medium of exchange and store of value, Goldman Sachs has demonstrated how important it is to hold some in your portfolio. You may not feel fearful but you cannot be be sure of no uncertainties.

Those who hold gold as a form of financial insurance will benefit in two ways. Firstly, they have a balanced portfolio that will support them in times of unforeseen crises. Secondly, should a crisis be averted then gold will accumulate in value as fiat devaluation continues, thus still protecting the investor and their savings.

Bitcoin has done a stellar job in motivating millennials into taking an interest in money and investments, however the cryptocurrency market is in itself an entire uncertainty. It’s main premise – as a medium of exchange – has been rapidly dismissed on several accounts.

As throughout history, gold remains a vital store of value. It’s role as money and as a safe haven continues to be proven thanks to the actions of central bankers and those using technology to affect monetary markets.

Tags: Bitcoin,Daily Market Update,Featured,Gold,gold price,newsletter