Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for imports is backloaded to last year, with little or no momentum carrying forward very far into this year. On a quarterly basis, China’s imports rose by 14.6% in Q3 combined over Q3 2016. That’s basically the same rate as in Q2 (14.2%) and down by a third from Q1’s “reflation”, which was expected to be more

Topics:

Jeffrey P. Snider considers the following as important: China, currencies, Dollar, economy, EuroDollar, exports, Featured, Federal Reserve/Monetary Policy, global trade, imports, Markets, newsletter, PBOC

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

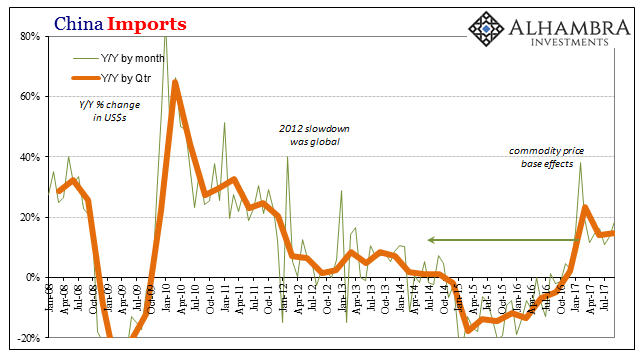

| Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for imports is backloaded to last year, with little or no momentum carrying forward very far into this year. On a quarterly basis, China’s imports rose by 14.6% in Q3 combined over Q3 2016. That’s basically the same rate as in Q2 (14.2%) and down by a third from Q1’s “reflation”, which was expected to be more than a temporary phenomenon. |

China Imports, Jan 2008 - Jul 2017(see more posts on China Imports, ) |

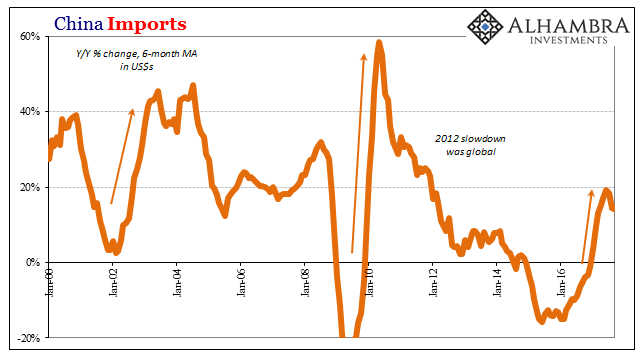

| Again, those rates sound terrific but come up very small in historical context. At this point in the global recovery from the dot-com recession, imports into China were up more than 40% and would remain at that level for two straight years – more than enough to transition both sides of the eurodollar explosion (the US housing bubble and the Chinese “miracle”) into what looked like global wealth expansion. |

China Imports, Jan 2000 - 2016(see more posts on China Imports, ) |

| Less than 20% growth, following a serious and extended contraction no less, just isn’t going to carry the global economy where “reflation” was supposed to go. The numbers are deceiving outside of context.

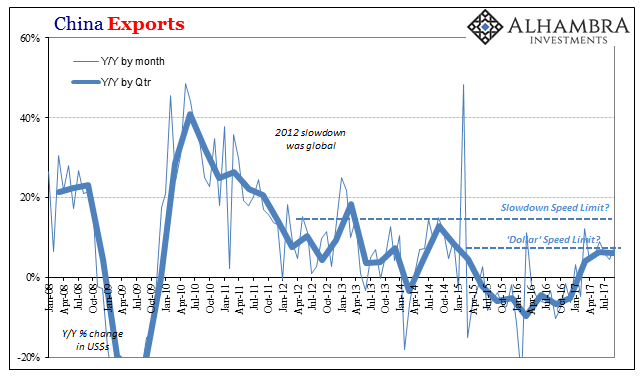

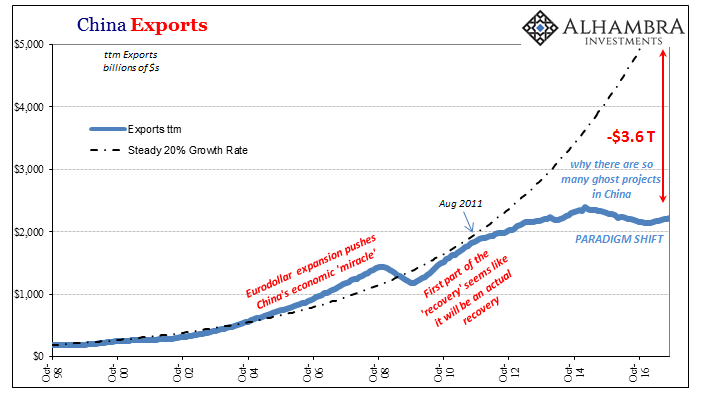

They are much less so on the export side. Chinese outbound trade with the rest of the world expanded just 8% (according to the Customs Bureau, to be revised by NBS) in September. For the quarter as a whole, like imports, Chinese export growth stalled in Q3. Rising by 6.2%, it’s almost exactly the same as Q2 (6.3%) and appreciably less than before the “rising dollar.” |

China Exports, Jan 2008 - Jul 2017(see more posts on China Exports, ) |

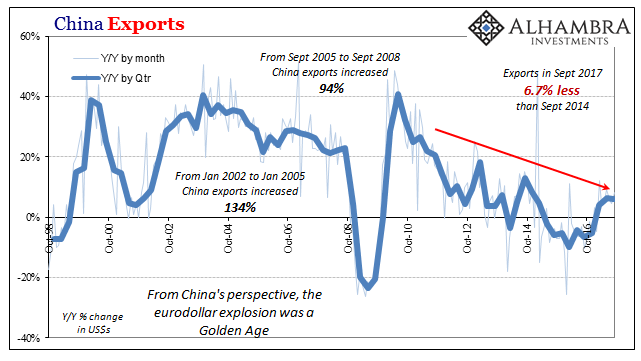

| In fact, the rebound in trade, meaning global demand, has been so tame that the total value of China’s exports in September 2017 remained almost 7% less than the total from September 2014 as the “rising dollar” was just getting started. |

China Exports, Oct 1998 - 2016(see more posts on China Exports, ) |

| Again we find where the economy gets knocked down for these monetary events and isn’t able to get back up in either absolute or relative growth terms. |

China Exports, Oct 1998 - 2016(see more posts on China Exports, ) |

| It is, of course, unlike anything we have ever seen in the past; certainly in the case of EM economies like China. You can understand, then, their sense of urgency in attempting increasingly desperate measures to do something else. The industrial basis for China’s economy isn’t coming back, a fact I have to believe Chinese officials have now accepted (unlike in 2012).

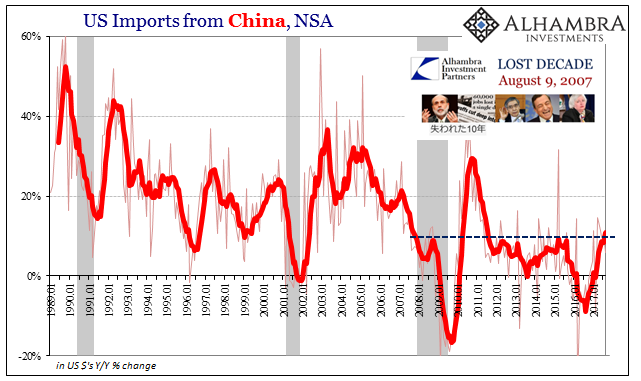

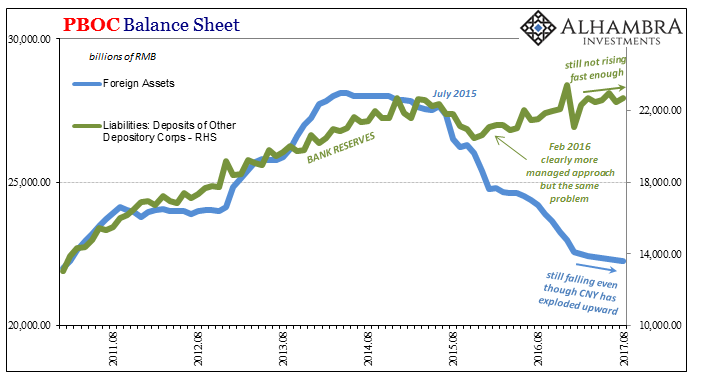

The problem is what to do about it. They’ve tried several things including textbook “stimulus”, repeating a fiscal spending program in early 2016 that has so far yielded little (as we see from imports). In the absence of real (rather than described) global growth, there doesn’t appear to be a realistic path for “rebalancing”; at least not one that is firm and sustainable. I think that is why they have selected a stable CNY policy as maybe a last ditch effort to achieve what might otherwise appear to be global growth at least in the form of eurodollar inflows. In other words, the idea seems to be to reduce the perceived risks for “dollars” in China, therefore inviting more so as to finance internal growth through a more sticky funding mechanism that would be expected to elicit the kind of sustained economic momentum the previous efforts have proven unable to achieve. |

US Imports from China, Jan 1989 - 2017 |

| Beyond specifically China’s predicament, as usual these statistics say absolutely nothing good about the global economy. They are instead far too consistent with what we find around the world, including here in the United States.

The larger problem is that each nation is attempting to deal with the collective “dollar” problem on an individual basis. That includes places like China where they are trying different techniques but also at the same time searching for their own replacement options (none of which appear viable at the moment despite the mainstream noise about oil priced in CNY and RUB/CNY bilateral clearing; it makes for sexy press releases but Russian trade is far short of a serious enough counterparty to China). This ends (favorably, I believe) when everyone stops doing their own thing and starts looking at the one thing. For China it is as simple as paying the devil his due, and he always gets paid in the end. They grew up by the eurodollar and had no problem with it while things were miraculous, and now they are stuck with it until everyone agrees to its end. It’s always too good to be true. |

PBOC Balance Sheet, Aug 2011 - 2017(see more posts on pboc balance sheet, ) |

Tags: China,currencies,dollar,economy,EuroDollar,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,Markets,newsletter,PBOC