Flowing Toward the Great Depression All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that: “…we’re flowing toward the path of 1928-29 when Hoover was president. Now Trump is president. Both were presidents with no experience who come in with a Congress that is all Republican, lots of big promises, lots of things that don’t happen and the fall is when people realize, ‘Wait, it hasn’t played out the way we thought.’ [By the fall], we’ll have a lot more evidence of declining growth. Growth has been slipping.” Dow Jones Industrial Average,

Topics:

MN Gordon considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Flowing Toward the Great DepressionAll remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

|

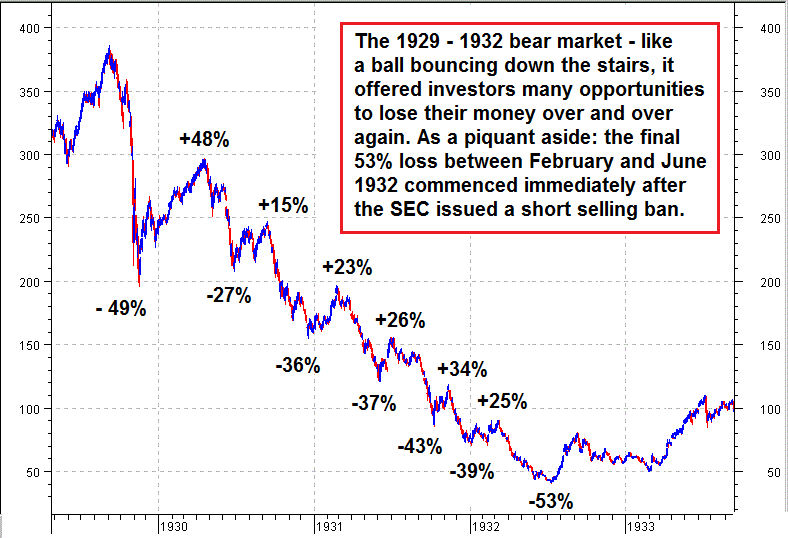

Dow Jones Industrial Average, 1929(see more posts on Dow Jones Industrial Average, ) A famous bad juju moment – the crash of 1929. Two of the annotations require a bit of elaboration. The so-called “Babson break” was a large down day on September 5 1929, two days after the market had peaked. Roger Babson was an entrepreneur (he inter alia invented the parking meter), an economic theorist and a famous skeptic who had already voiced doubts about the stock market bubble of the 1920s on numerous occasions before that day. - Click to enlarge This was the first time the market didn’t shrug his warnings off, and although it recovered most of the loss on the next trading day, it was the beginning of the end. “Fisher” refers to economist Irving Fisher, who famously announced “stocks have reached a permanent plateau” two weeks before the top. Fisher was a very wealthy man at the time, but lost the bulk of his fortune in the ensuing bear market. Although he couldn’t forecast his way out of a paper bag, his work has become the foundation of much of what is considered “orthodox” economic theory these days. His contemporaries Hayek and Mises, who like Babson warned of the coming crash, are shunned by the prevailing central planning paradigm. Hayek did so in the spring of 1929, when he said that there was no chance of a recovery in Europe unless interest rates decreased, which would require the collapse of the boom in the US; he added that this was very likely going to happen later that year. Mises was offered a well-remunerated post at Creditanstalt in the summer of 1929 and declined the offer. When asked why, he replied that he thought a great crash was coming soon and he didn’t want his name to be associated with it. Of course, Mises himself would probably point out that “prediction” is not a task of economic science. We just wanted to note in passing that these great economic theorists were also quite adept at sussing out what nearly everybody else missed at the time. Causal-realist economic theory does provide some advantages. |

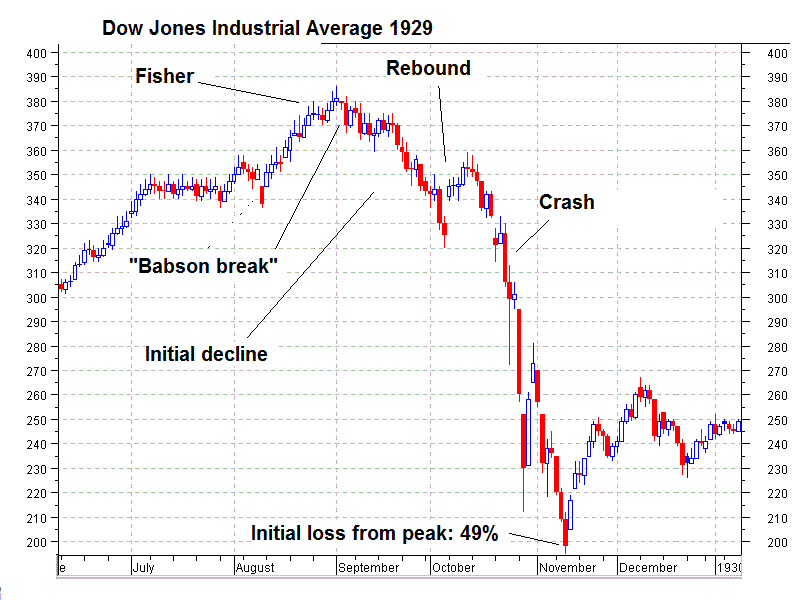

| If you recall, autumn of 1929 is when the U.S. stock market commenced a multi-year swan dive and the economy commenced a decade long Great Depression. This is the path Yusko believes we’re on. To be clear, this is a path that can be extraordinarily hazardous to your investment wealth.

For example, from September 3, 1929 to November 13, 1929, the DOW lost 48.9 percent. Then, as rarely noted, it rallied 48.1 percent through April 17, 1930. This had the adverse effect of luring the buy the dip crowd back into the stock market just in time for the next massacre. In the end, it turned out to be the ultimate sucker’s rally. The stock market subsequently crashed 89.2 percent from its initial peak, along with the hopes, dreams, and aspirations of an entire generation. Such a colossal collapse could never, ever happen again, right? |

Dow Jones Industrial Average, 1929 - 1932(see more posts on Dow Jones Industrial Average, ) |

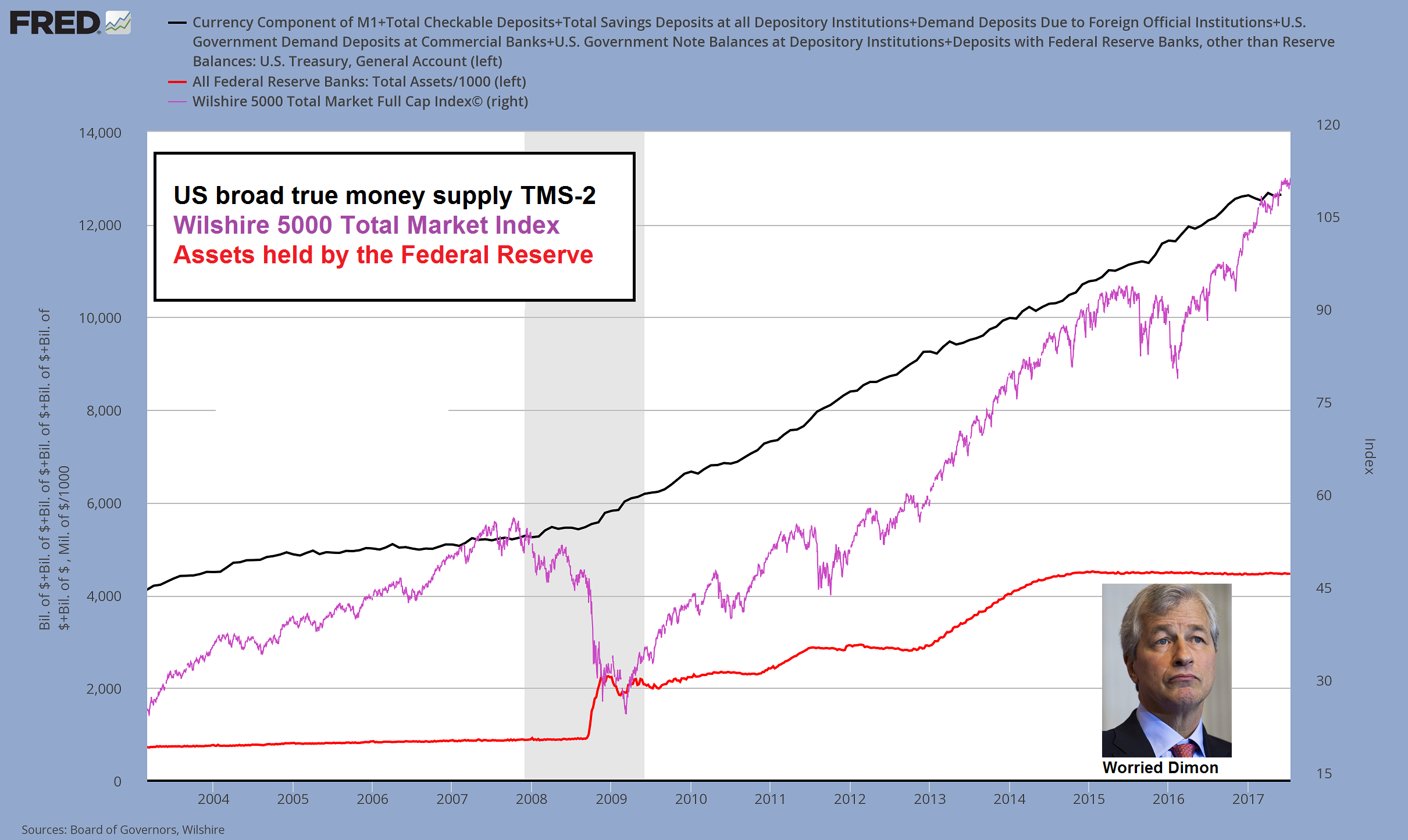

Unknown RoadIndeed, the possibility of even a partial repeat of the 1929-32 stock market crash is something to be wary of. Remember, if it happened before, by definition, it could happen again. In addition to the political similarities Yusko mentioned, including a fiscal policy flop overseen by a Republican President and Republican Congress, the economy is also faced with a tightening of monetary policy, as it was in 1929. However, this time the path has several new twists and turns that are leading down an unknown road. The Federal Reserve has quite a task ahead of it to achieve its goal of policy normalization. Raising the federal funds rate is one thing. But the Fed must also pioneer a new path of quantitative tightening. This is something the Fed has no experience with. According to Jamie Dimon, CEO of JPMorgan Chase & Company, the effects of reversing QE are “unknown”. Speaking at a conference in Paris on Tuesday, Dimon remarked that:

|

TMS-2 Fed Assets and Wilshire Dimonized, 2003 - 2017 It is true that no-one knows what will “exactly” happen when the Fed puts QE into reverse. But QE has directly increased the US money supply – and the increase in the money supply has distorted relative prices in the economy, inter alia creating the mother of all bubbles in stocks and bonds. This bubble cannot possibly be sustained under the “reverse QE” plan. - Click to enlarge |

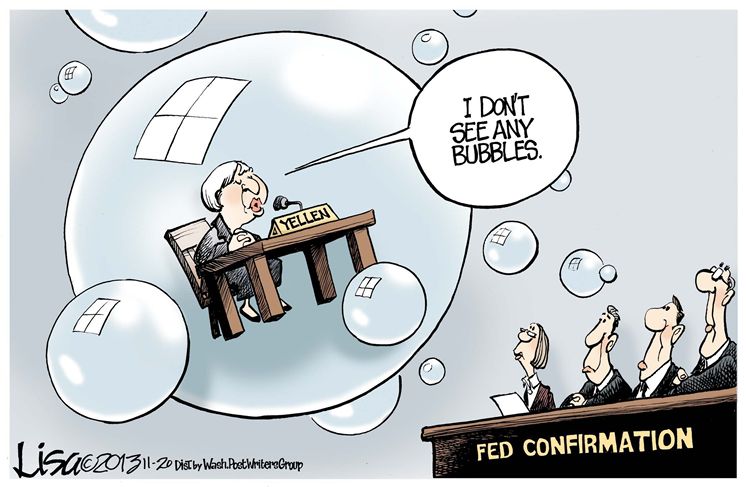

Adventures in Quantitative TighteningNo doubt, Dimon is right. No one, including the Fed, knows exactly how reducing the Fed’s balance sheet will play out. This has never been attempted before. But Dimon misses the mark. You see, quantitative tightening won’t “be a little more disruptive than people think,” as Dimon suggests. More accurately, it will be much, much more destructive than most people are capable of imagining. Still, Dimon’s remarks caught the attention of Representative David Kustoff of Tennessee. On Wednesday, during Fed Chair Janet Yellen’s semiannual Congressional testimony, Kustoff asked her if she shares Dimon’s concerns about moving assets off the Fed’s balance sheet. Yellen didn’t provide an explicit yes or no to the question:

Obviously, the reaction that comes from telegraphing your actions to the public via carefully scripted policy statements is a great deal different than the reaction that will come when central banks begin dumping mass quantities of sovereign debt in tandem. |

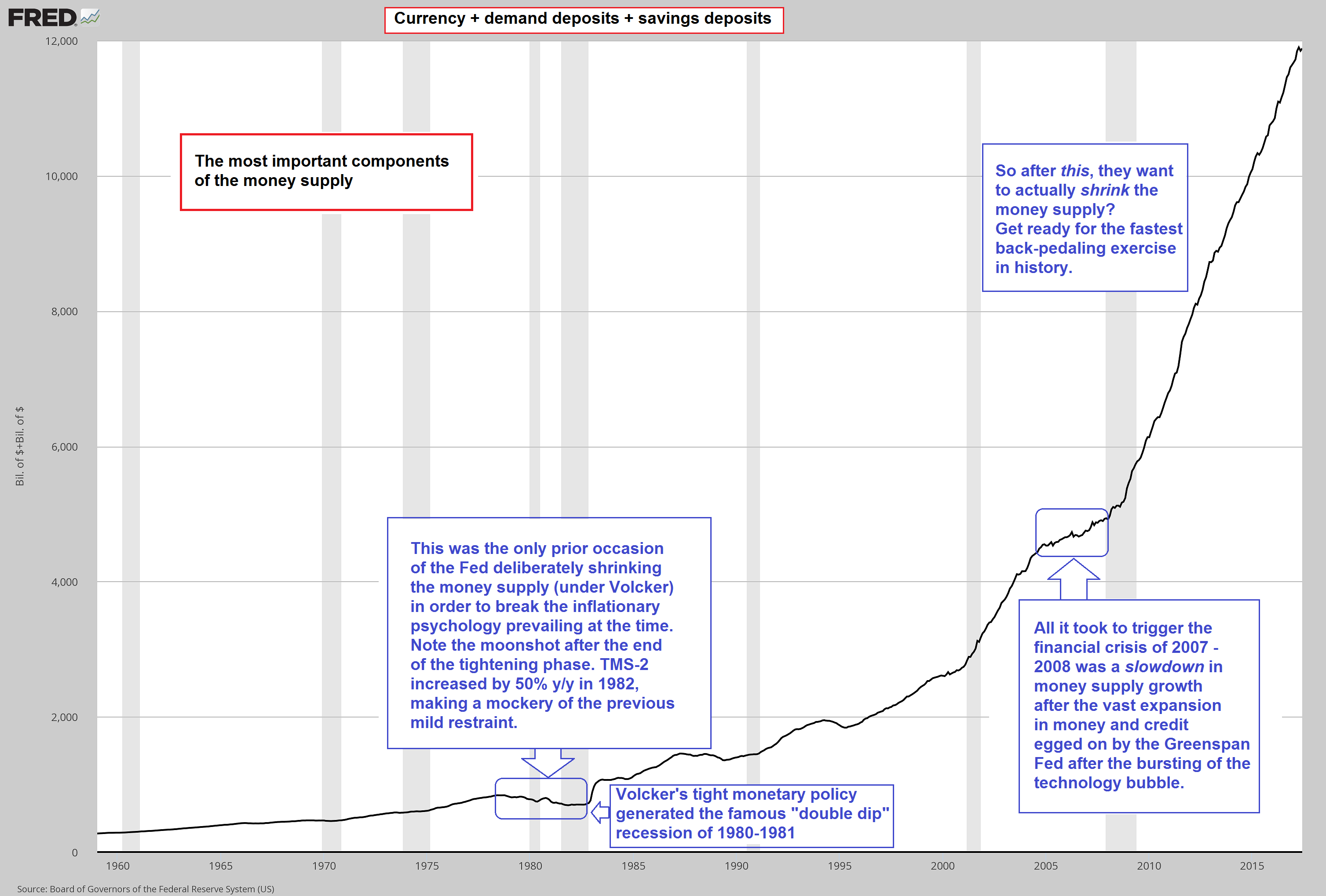

Currency plus Demand Deposits plus Savings Deposits, 1960 - 2017(see more posts on Currency, ) We have added up the three most important (and largest) money supply components to construct this chart, as there are several smaller TMS-2 components for which the data go back to 1986. This is a good enough proxy representation of the broad money supply though. - Click to enlarge We want to direct your attention to the two specific time periods marked by blue rectangles above: first, the only time in its entire history when the Fed deliberately reduced the money supply in order to break the public’s inflationary psychology, at the “cost” of two severe recessions (you can see that the plan was to shrink the money supply only temporarily, as it jumped by 50% y/y right after the tightening exercise ended) – and secondly, the mere slowdown in money supply growth that followed on the heels of the madcap credit expansion bonanza egged on by the Greenspan-Bernanke Fed after the Nasdaq crash. This slowdown in monetary pumping unmasked the capital consumption of the housing bubble in rather spectacular fashion. And now contemplate the breathtaking expansion of the money supply under the “QE” regime. Money supply growth rates have recently already slowed down quite dramatically. Should they turn negative, interesting times are bound to be experienced. It should be noted though that there is not much of a choice anyway – the sooner credit expansion is abandoned voluntarily, the better. The later it happens, the bigger the price that will have to be paid. We just don’t believe that today’s Fed will actually be willing to countenance the liquidation of malinvested capital it suddenly seems to eager to set into motion.[PT] |

| Here, in the spirit of modest contemplation, we offer several hunches, inklings, conjectures, and guesses as to what quantitative tightening might mean. These are not predictions. They’re merely a starting point from which you can extend out your own visions into the future…

Interest rates will rise. Asset prices, including bonds, stocks, and real estate, will fall. Credit will contract, yanking the thin rug the economy is resting upon right out from under it. GDP will decrease. Unemployment will increase in the face of declining labor participation. Cash in hand will be king (at first), as several too big to fail banks will, in fact, fail. Numerous cities and several states will also go bankrupt. Hartford and Illinois are leading the pack in their respective category. More will follow. The Fed will be forced to reverse course. However, efforts to push interest rates below zero through massive balance sheet expansion will have a negligible effect on stemming the economy’s collapse. Thus, the Fed will inject fiat money – not credit – directly into the economy via “helicopter drops”. This may take the form of direct delivery of monthly electronic tax rebate cards to taxpayers and non-taxpayers alike. |

Maybe we will get Boeing money? Arguably, QE was already a form of “helicopter money”, but a case for additional differentiation can certainly be made (see also the detailed discussion of helicopter money in the 2016 In Gold We Trust Report, starting on p. 63). - Click to enlarge It should be noted that the thwarting of economic contractions is not merely a matter of printing money. If money printing were actually a net positive for the economy, we should be doing as much as possible of it all the time. Whether the Potemkin village effect of an artificial boom can be triggered depends entirely on the state of the economy’s pool of real funding. One could also say, as long as more genuine wealth is created than is consumed, illusory prosperity can still be conjured up by the printing press. But with every boom, more scarce capital is consumed; economic recoveries become weaker and more erratic. Governments feel the urge to increase economic intervention, adding to regulations, boosting subsidies and fiscal spending in general, all of which weakens the economy even further on a structural level. At some point, we will cross a point of no return, when the choice will be between accepting an extremely grueling economic downturn or opting for an even more dubious flight forward toward hyper-inflation. Japan has seemingly achieved the Nirvana of permanent stagnation, but we think an unpleasant resolution was merely postponed there. On the other hand, even a severely hampered market economy is very powerful in terms of its wealth creation ability – but we fear that way too much is taken for granted these days. [PT] |

| This will trigger an earnest free-fall in the value of the dollar and of all paper currencies, as other central banks will be executing similar programs. Simultaneously, grocery stores will be cleared out and the shelves will remain empty.

Gold and silver prices, in fiat money terms, will launch into the stratosphere. This will be met with direct government confiscation. After that, things will really get ugly. Alternatively, it could all go off without a hitch. For as Yellen told Kustoff, “I expect, and certainly hope, that this will go smoothly and it will be a gradual and orderly process.” Don’t hold your breath. |

Charts by: ShareLynx, St. Louis Fed

Chart and image captions by PT

MN Gordon is President and Founder of Direct Expressions LLC, an independent publishing company. He is the Editorial Director and Publisher of the Economic Prism – an E-Newsletter that tries to bring clarity to the muddy waters of economic policy and discusses interesting investment opportunities.

Tags: central banks,Featured,newslettersent