Swiss Franc The Euro has fallen by 0.05% to 1.1028 CHF. EUR/CHF - Euro Swiss Franc, July 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies. The greenback’s gains have not been very impressive. Nor have they exceeded important technical levels. Short-term participants appear caught between the strong upside momentum by the major foreign currencies and concerns that a key driver,

Topics:

Marc Chandler considers the following as important: China Fixed Asset Investment, China Gross Domestic Product, China Industrial Production, China Retail Sales, ECB, EUR, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, newslettersent, U.S. NY Empire State Manufacturing Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.05% to 1.1028 CHF. |

EUR/CHF - Euro Swiss Franc, July 17(see more posts on EUR/CHF, ) |

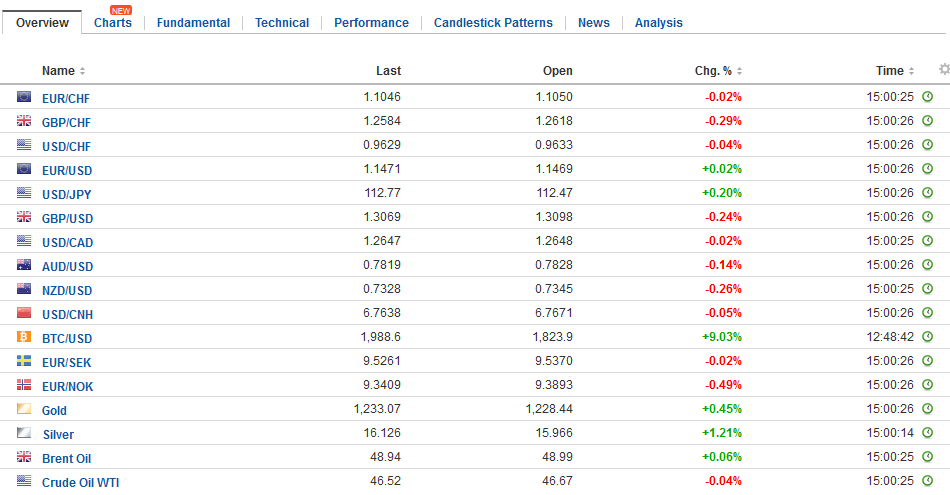

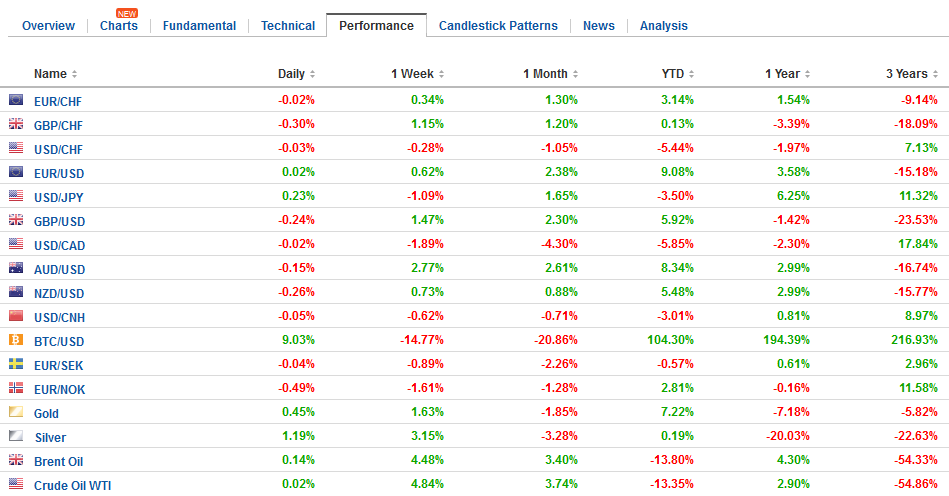

FX RatesAfter falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies. The greenback’s gains have not been very impressive. Nor have they exceeded important technical levels. Short-term participants appear caught between the strong upside momentum by the major foreign currencies and concerns that a key driver, the ECB may try to discourage the market from getting too far ahead of itself in tightening financial conditions. |

FX Daily Rates, July 17 |

| Notable option expires today include nearly 910 mln euro struck at $1.1450, $660 mln at JPY112.50 (and $506 mln at JPY113). Tomorrow there is a 1.1 bln euro option struck at GBP0.8764 expiring.

Elsewhere, we note that the MSCI Asia Pacific Index extended its advance for a sixth session today gaining almost 0.25%. The Chinese equity market was a notable exception to the regional advance. Despite the economic data, a concern that officials were going to increase the enforcement of regulations and that the PBOC was going to have more regulatory authority, according to reports, appeared to weigh particularly heavy on small cap shares. The Shenzhen Composite was off 4.3% while the large cap Shanghai was off 1.4%. European shares are mixed, with a heavier bias. The Dow Jones Stoxx 600 is off about 0.1%, with industrials, real estate and financials offsetting gains from energy and materials. |

FX Performance, July 17 |

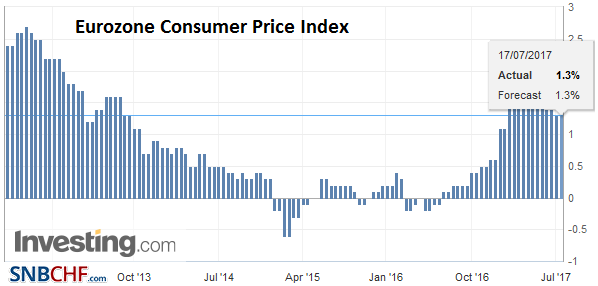

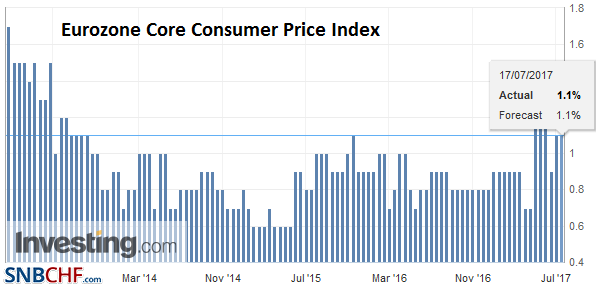

EurozoneDraghi can be expected to emphasize that the ECB extraordinary monetary policy is aimed at putting inflation on a sustainable and durable path toward its target (near but below 2%). It is using all the appropriate tools in its mandate to achieve its legal objective. As of last month, it judged that its goal was still not achieved and that the accommodative monetary policy would continue until its objective was reached. |

Eurozone Consumer Price Index (CPI) YoY, July 2017 (flash)(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| While many, like ourselves, expect the ECB to continue to buy bonds well into next year, there is some thought being given to the possibility that as it reduces its purchases, the ECB focuses on some particular asset classes, like corporate bonds and asset backed securities. Draghi’s press conference will be closely watched for clues, but the policy announcement is more likely to come in September than now. There is no urgency now, and there will be new staff forecasts available, which the ECB seems to like to link to policy changes.

The German 10-year bund yield rose from 23 bp on June 26 to nearly 62 bp last week. It is at 57.5 bp today. The 50 bp was an important hurdle on the way up, capping yields in January and against in March and May. This will be an important area to watch as yields pull back. In comparison, Italy’s 10-year yield rose from 1.87% to 2.35% in the same period. It is now at 2.25%. |

Eurozone Core Consumer Price Index (CPI) YoY, June 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

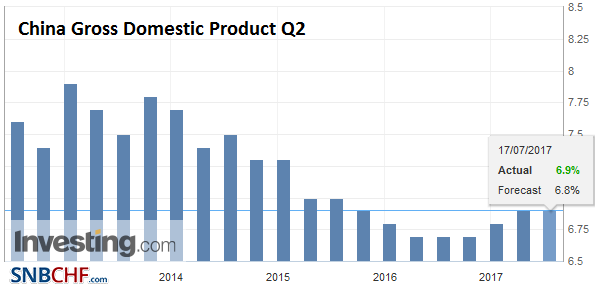

ChinaThat said, the news stream is subdued. China’s Q2 GDP of 6.9%, the same as Q1, was the main economic news. It was slightly above the Bloomberg median forecast, though the quarter-over-quarter rate of 1.7% was spot on expectations. |

China Gross Domestic Product (GDP), Q2 2017(see more posts on China Gross Domestic Product, ) Source: investing.com - Click to enlarge |

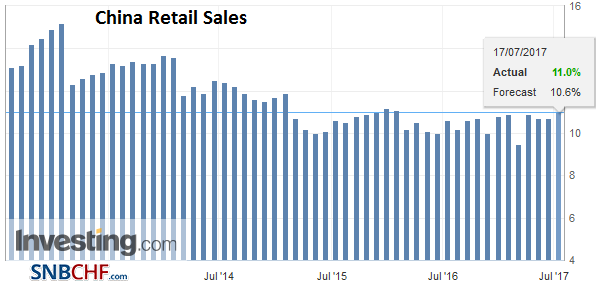

| The June monthly data suggest the economy finished the quarter with some momentum. Retail sales rose to 11.0% from 10.7% a year ago, which is the strongest pace since the end of 2015. |

China Retail Sales YoY, June 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

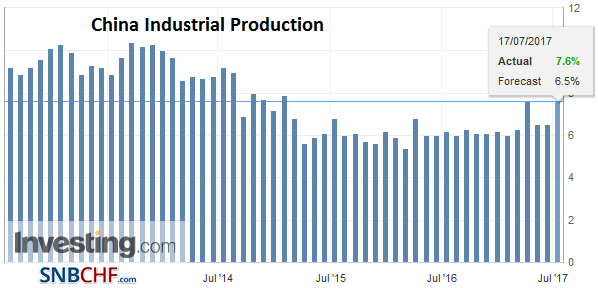

| Industrial output jumped to 7.6% year-over-year from a 6.5% pace in April and May. It matches March’s high, which itself was the strongest pace since the end of 2014. |

China Industrial Production YoY, June 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

| The robust data from China may have helped underpin commodity prices. Iron ore rose 2.5% in China, and copper is up around 1%. Aluminum is up 0.5%, while Brent is extending its advancing streak into a six consecutive session, though WTI is flat. Gold briefly traded above its 20-day moving average (~$1233) for the first time in a little more than a month but is struggling to sustain the move in the European morning. |

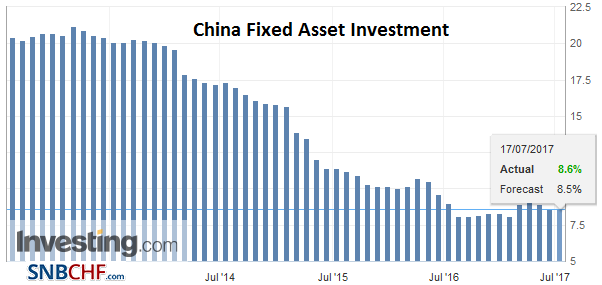

China Fixed Asset Investment YoY, June 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

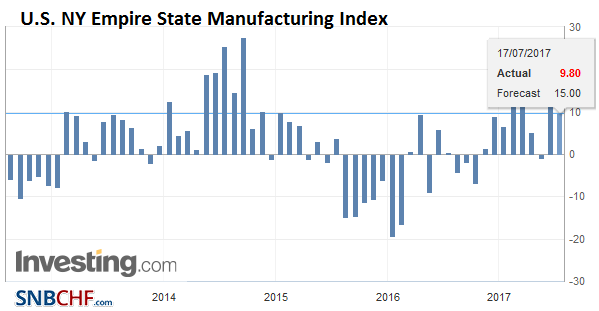

United StatesThe market is still digesting the implication of last week’s disappointing US data. The only data of note today will be the Empire manufacturing report for July, one of the first peaks into the Q3 economy, and after surging to its best level since 2014 in May, which seems to overstate the case, a modest pullback is expected. Meanwhile, the corporate earnings season continues. Among today’s highlights are Blackrock and Netflix. The Senate vote on a health care bill is unlikely to happen this week, and the CBO evaluation will be delayed. Some last minute compromises may still be possible, as there is little margin for error, with two Senators already dissenting. |

U.S. NY Empire State Manufacturing Index, July 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports international securities transactions for May. Foreign demand for Canadian securities is running near last year’s pace. In the first four months of 2016, net foreign demand averaged CAD17 bln a month. This year’s average is CAD17.8 bln. Canada also reports June existing home sales. They have fallen for the past two months.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,China Fixed Asset Investment,China Gross Domestic Product,China Industrial Production,China Retail Sales,ECB,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,newslettersent,U.S. NY Empire State Manufacturing Index