Better-than-expected Flash PMI numbers in September mean that the quarter is ending on a strong note, with some upside risks ahead.Flash PMI surveys for the euro area ended the third quarter on a strong note. The composite flash PMI increased to 56.7 in September from 55.7 in August against consensus expectations for a stable print (55.6).The breakdown by sub-indices showed pretty strong signals in most forward-looking components, with the sole weak spot manufacturing new export orders....

Read More »Euro area cyclical inflation is on the rise

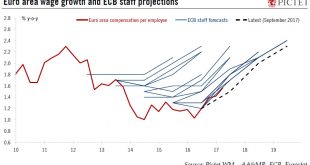

Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s...

Read More »Euro area, revisiting the past once again

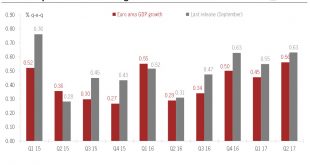

GDP figures have been considerably revised in the euro area and in Switzerland in the wake of Q2 data, leading to mechanical changes in our growth forecasts for this year.Revisions to GDP figures have been massive in the euro area and in Switzerland following the publication of Q2 GDP data. The resultant changes in our forecasts are mechanical, and do not reflect a change in our growth profile for H2 2017 and beyond.Recent data released by Eurostat have resulted in a further upward revision...

Read More »QE put to bed, the focus shifts to rate hikes

In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying...

Read More »High equity valuations leave no room for disappointment

Our updated core scenario for global equities foresees earnings growth as the primary driver of returns over the next 18 months. We expect current high valuations to persist.Our core scenario for global equities for the next 18 months is built on three active risk factors (drivers): earnings growth, valuations and currency fluctuations. Of the three, earnings growth will be the most significant for return generation.After two strong quarterly reporting seasons, the positive base effect that...

Read More »Trump more focused on trade deficit than budget deficit

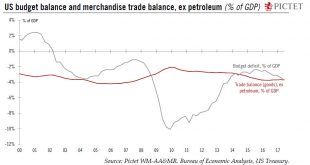

The Trump administration is noticeably more focused on trade issues than on the ongoing deterioration in public finances.Second-quarter current account data from the US Bureau of Economic Analysis showed once again a sizeable trade deficit, particularly in merchandise trade excluding energy. The energy boom driven by shale gas and light oil has reduced the US’s dependency on energy imports, in turn improving the headline current-account reading. But the US is still a net petroleum importer...

Read More »Moderate deceleration underway in China

The latest data releases seem to confirm our view that Chinese growth is decelerating, but our GDP forecast of 6.8% growth for 2017 remains unchanged.The latest data on China’s economic activity point to a slowdown in China’s growth momentum in the third quarter, after the positive surprise of the first half of the year. We expect growth to continue to moderate for the rest of 2017 and into 2018, but the pace of deceleration may be fairly modest. We have thus decided to keep our GDP forecast...

Read More »Fed may open door for December rate increase

As it prepares to announce a partial shrinkage of its balance sheet this week, the question is how firmly the Fed signals the next rate hike.The Fed is widely expected to announce a partial shrinkage of its balance sheet at its 20 September meeting, in line with the guidance it provided in June.We also expect Yellen to point to the possibility of another rate hike soon (while remaining vague about the exact timing), dependent on further improvements in inflation. This should be backed by the...

Read More »Scenarios for QExit

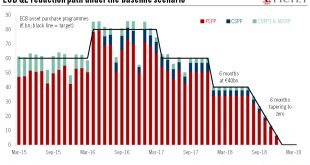

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

Read More »Euro area wage growth suggests the Phillips curve is not dead

The latest signs that wages are picking up together with drops in unemployment should help push the ECB along the road of policy normalisation.Wage growth is an important input in the ECB’s reaction function, and so far it has failed to respond to the narrowing of the output gap. It could be the normal behaviour of a lagging indicator, especially as labour market slack is likely to be larger than what the drop in headline unemployment would suggest. Or, it could be that “the slope of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org